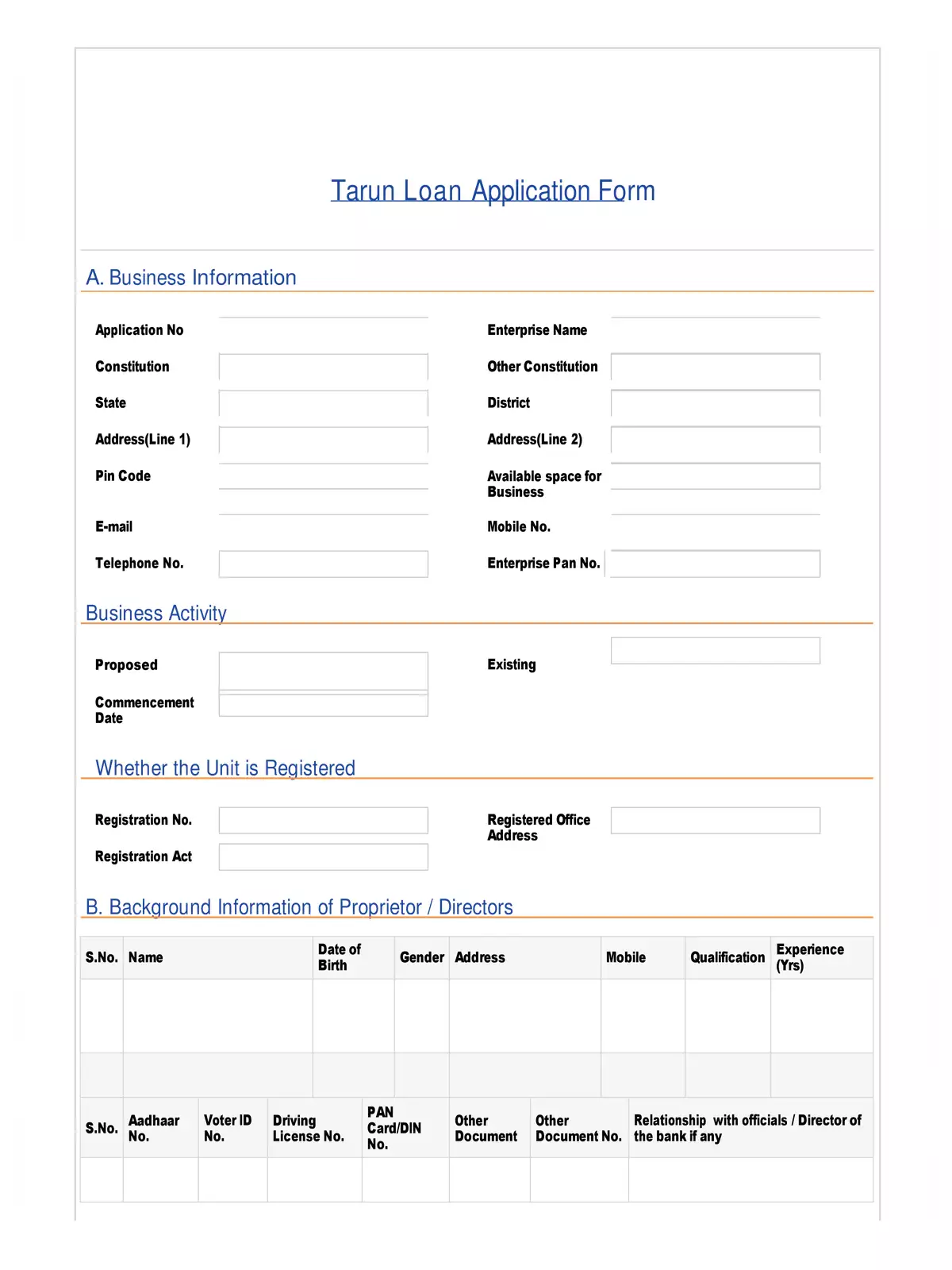

Tarun Loan Application Form - Summary

CHECKLIST: (This checklist for the Tarun Loan Application Form is a helpful guide but not complete. Depending on local needs, you may need to add more documents.)

- Proof of identity – Self-certified copy of Voter’s ID card, Driving License, PAN Card, Aadhar Card, or Passport.

- Proof of Residence – Recent telephone bill, electricity bill, property tax receipt (not older than 2 months), Voter’s ID card, Aadhar Card, or Passport of Proprietor/Partners/Directors.

- Proof of SC/ST/OBC/Minority.

- Proof of Identity/Address of the Business Enterprise – Copies of necessary licenses, registration certificates, or other documents that show ownership and address of the business unit.

- The applicant must not be a defaulter in any bank or financial institution.

- Statement of accounts for the last six months from your existing banker, if any.

- Last two years’ balance sheets of the units, along with income tax and sales tax returns (Required for all cases from ₹2 Lacs and above).

- Projected balance sheets for one year for working capital limits and for the loan period in case of a term loan (Applicable for all cases from ₹2 Lacs and above).

- Sales achieved during the current financial year up to the date of submitting the application.

- Project report for the proposed project containing details of technical and economic viability.

- Memorandum and articles of association of the company or Partnership Deed of Partners.

- In absence of a third-party guarantee, an Asset and Liability statement from the borrower including Directors and Partners may be required to know the net worth.

- Photos (two copies) of Proprietor/Partners/Directors.

Download the Tarun Loan Application Form PDF

You can easily download the Tarun Loan Application Form in PDF format from the link below. Make sure to gather all the necessary documents to help speed up your application process. This checklist is created to support you in taking necessary steps for a smooth loan application experience.

Why You Should Use This Checklist

Using this checklist ensures you are fully ready before sending your loan application. Being organized and having the right documents can greatly improve your chances of getting your loan approved quickly.

Don’t forget to download the PDF and keep it handy during your application process! 📝