PSB RuPay Kisan Credit Card Form - Summary

PSB RuPay Kisan Credit Card Form – Download PDF

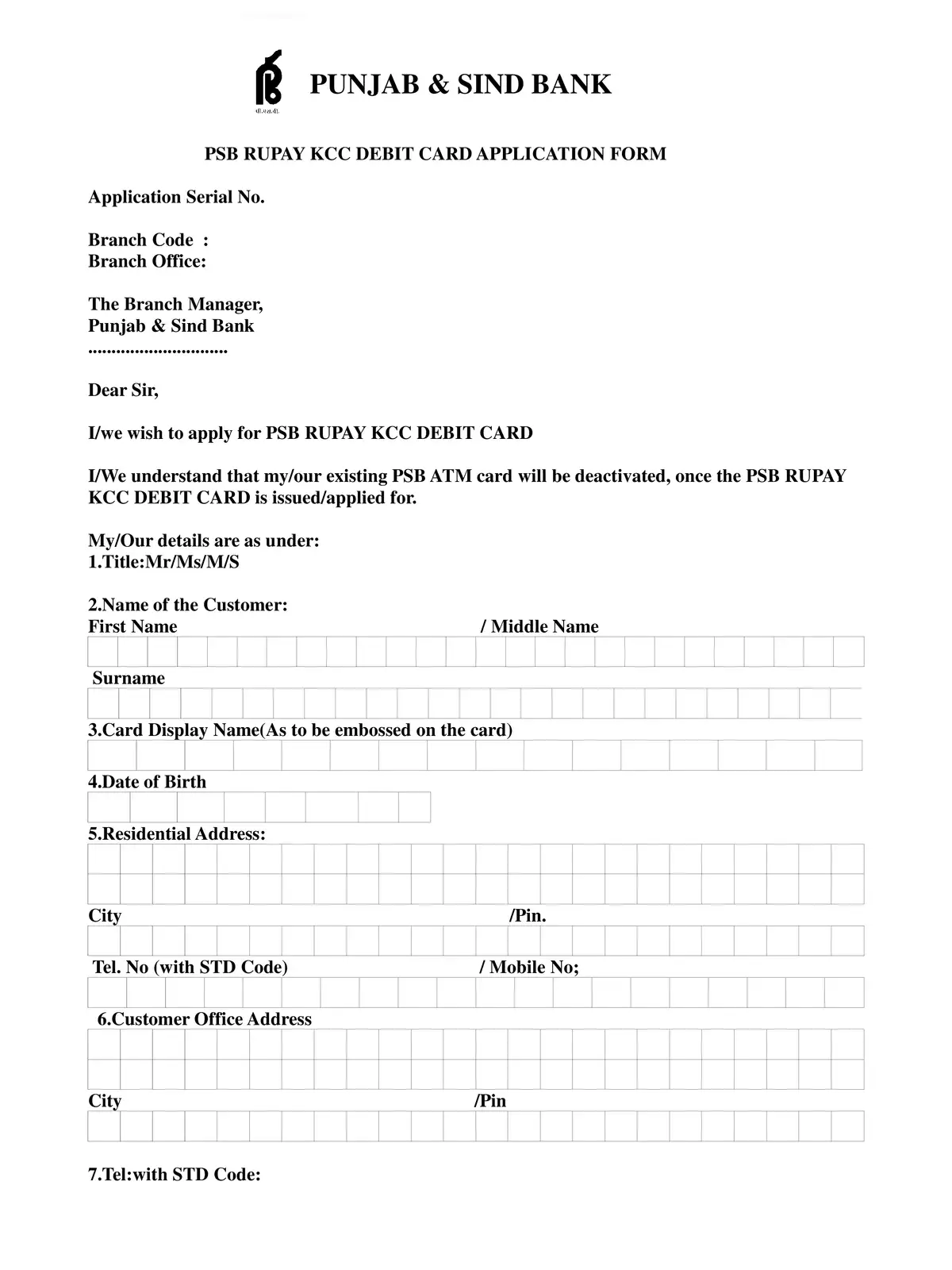

The PSB RuPay Kisan Credit Card Form is a vital document for farmers looking to secure credit support. This form helps farmers to get timely and sufficient financial assistance they need for farming and related activities. For your ease, you can easily download the PDF of this form.

Benefits of the RuPay Kisan Debit Card

- This initiative by the Ministry of Agriculture is aimed at fulfilling the credit needs of the agriculture sector.

- The Kisan Credit Card Scheme offers timely and need-based credit support to farmers for both cultivation activities and non-farm needs in a cost-effective manner.

- Farmers who are part of this scheme receive a RuPay Kisan Card, which is linked directly to their bank accounts.

- These cards can be conveniently used at ATMs and POS machines all over the country.

The Kisan Credit Card Scheme is designed to provide adequate and timely credit support through the banking system under a single-window approach. This system helps farmers with their cultivation needs and various other activities. Some of the key purposes are:

- To fulfill short-term credit needs for crop cultivation.

- To cover post-harvest expenses.

- To obtain marketing loans for agricultural products.

- For the household consumption needs of farming families.

- To provide working capital for maintaining farm assets and engaging in agricultural activities like dairy farming and inland fisheries.

- For investment credit in agricultural and allied activities, such as purchasing pump sets, sprayers, or dairy animals.

All farmers—including individual borrowers, joint borrowers, tenant farmers, oral lessees, sharecroppers, Self-Help Groups (SHGs), and Joint Liability Groups—are eligible for the Kisan Credit Card. The credit limit is usually set based on the size of their operational land, cropping patterns, and the agricultural needs throughout the year. For those who grow multiple crops, the limit is determined based on their intended cropping pattern.

The credit limit is assessed based on the cultivated area, allowing for a fair evaluation by the appraiser or sanctioning authority. The actual limits are determined on a case-by-case basis, with separate rules for irrigated and un-irrigated lands. Importantly, there is no upper loan limit under the KCC scheme, making it accessible to all kinds of farmers.

To make it easier for you, you can access the PDF of the PSB RuPay Kisan Credit Card Form through the link below for a quick download.