Assam Gramin Vikash Bank Asomi Grihasree Loan Form - Summary

Welcome to the Asomi Grihasree Loan Scheme—an excellent housing loan option from Assam Gramin Vikash Bank (AGVB). This loan is tailored for customers, particularly Government of Assam employees. The details regarding this housing loan scheme were first shared through Head Office circular no. AGVB/CR/HLS/17/OM-009/06 dated 27.03.06. If you are looking for the Asomi Grihasree Loan Form, you’ve come to the right place. You can download the PDF version now!

Eligibility and Application Process

Under the special agreement in the Memorandum of Understanding (MoU), housing loans are approved and provided to Government of Assam employees at various locations through any branch of AGVB in Assam, on meeting the bank’s terms and conditions under the Asomi Grihasree Loan Scheme.

Steps to Apply for the Asomi Grihasree Loan

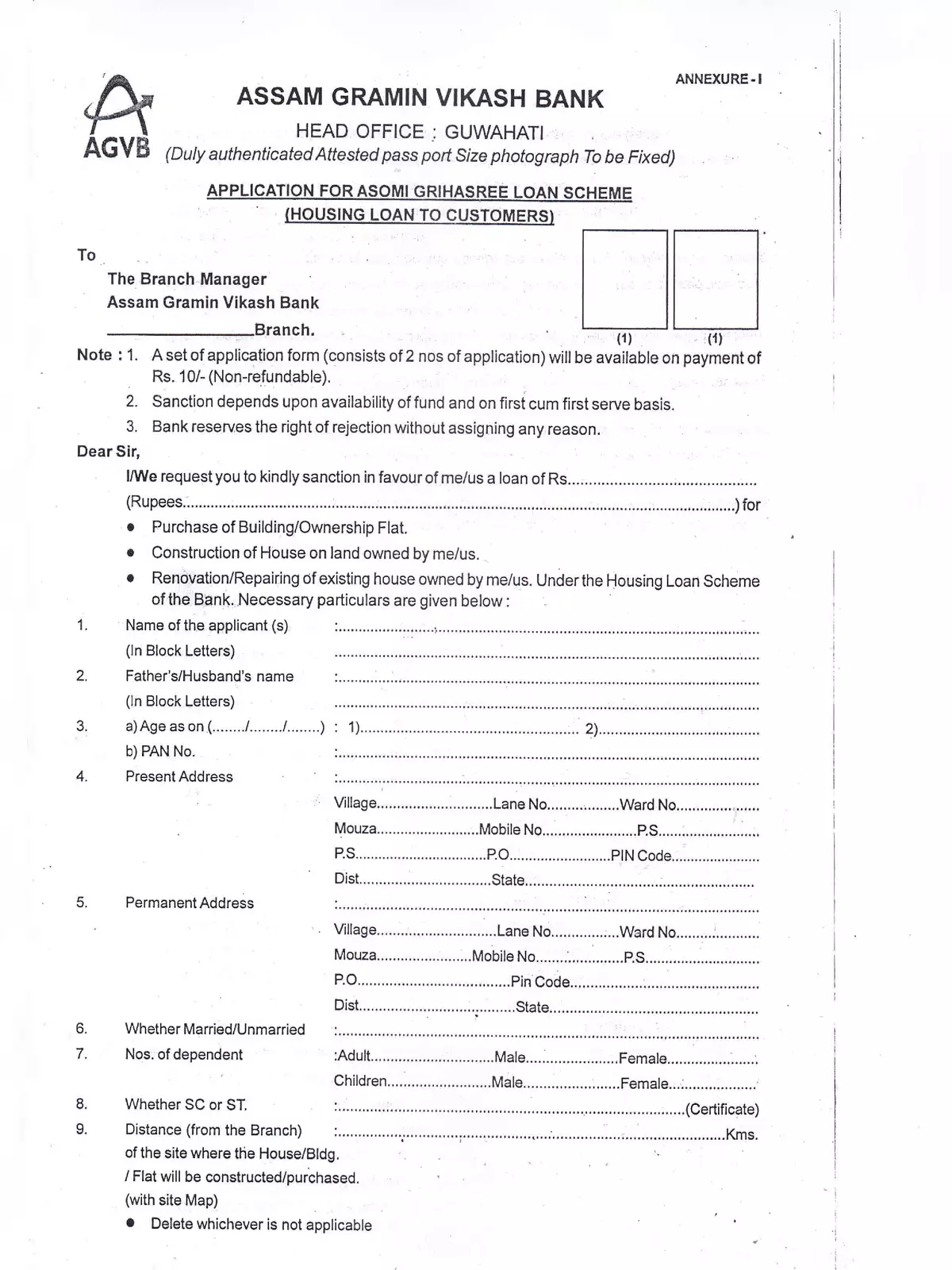

- The specially designed loan application form, along with Annexure I, II & III, is available at any AGVB branch in Assam. This form is for Government of Assam employees who have completed a minimum of three years in regular service and possess GPF Account Numbers.

- Employees should submit their completed loan applications along with the required documents to the branches where their salaries are credited for loan sanction and disbursement.

- Each loan application must be accompanied by the following documents:

- An Irrevocable Letter of Authority (Annexure I of the MoU) addressed to the respective Branch Manager, allowing for EMI deductions from the employee’s account at that branch until the loan and accrued interest are fully repaid.

- The Drawing and Disbursing Officer (DDO) is not permitted to transfer the employees’ salary accounts or credit salary to any other account without written consent from the branch where the loan was obtained. The DDO is also not allowed to pay salary in cash.

- A standard format letter from the concerned DDO to AGVB (Annexure II of the MoU), agreeing to credit the employee’s salary to the bank account until the loan and interest are fully paid, except in the event of the employee’s death.

- If the loan applicant is the DDO, a letter must be issued by the DDO (Annexure III of the MoU), along with the Irrevocable Letter of Authority (Annexure I), agreeing to credit his/her salary to their account until the loan is repaid.

- After receiving the application and documents, the respective AGVB branch will review and process the loan based on the bank’s established criteria, inviting eligible applicants to execute the necessary loan documents as per Assam’s regulations.

- The following terms and conditions in the MoU apply to Assam government employees:

- AGVB offers a lower interest rate than the standard rate based on AGVBCR for loans granted under this scheme.

- The current rate of interest for state government employees is as follows:

- Fixed Rate – Repayment up to 5 years – 10% p.a.; Above 5 years and up to 20 years – 10.50% p.a. with a reset clause every two years.

- Floating Rate – Repayment up to 5 years – (BPLR) – 3.25% i.e., 10%; Above 5 to 10 years – (BPLR) – 2.75% i.e., 10.50%; Above 10 years – (BPLR – 2.50%) i.e., 10.75%.

- AGVB will waive 75% of the processing fee from the date of the MoU execution. Depending on the total loan volume to government employees, a complete waiver may be considered later in the year. Currently, the processing fee is 0.25% of the loan amount.

Get your journey started today! For more information and to access the Asomi Grihasree Loan Form, you can download the PDF.