SBI PPF Withdrawal Form C - Summary

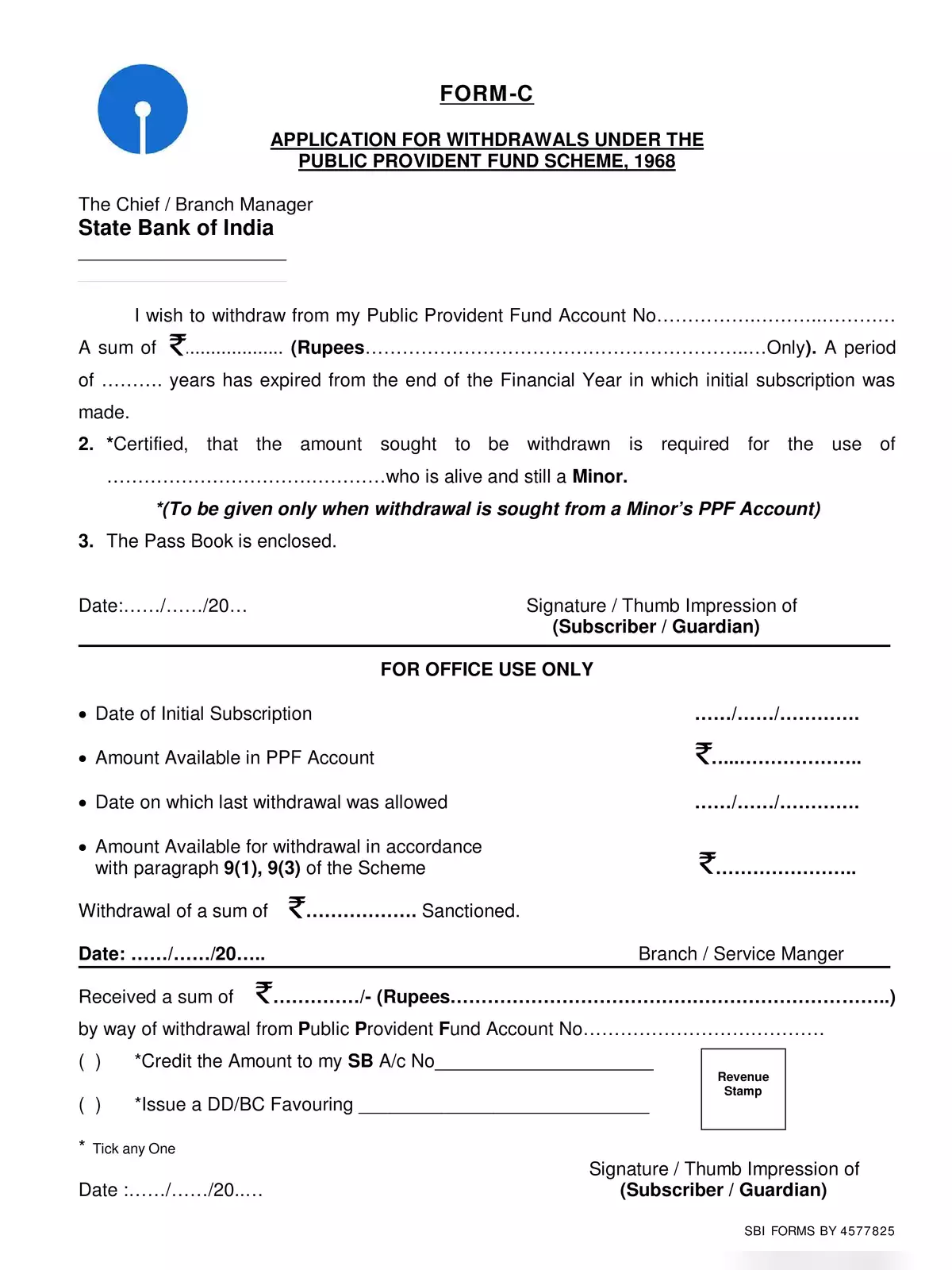

Understanding SBI PPF Withdrawal Form C

An account holder can withdraw prematurely, up to a maximum of 50 percent of the amount that is in the account at the end of the 4th year. This limit applies to the amount that is available at the end of the year preceding the withdrawal or at the end of the preceding year, whichever amount is lower.

Key Features of SBI PPF Withdrawal

The Public Provident Fund, or PPF, is a popular savings scheme backed by the Government of India, offering great interest rates along with tax benefits. With the SBI PPF withdrawal form C, you can access your funds in case of an emergency or urgent need.

While the PPF account aims to encourage long-term savings, it also gives you the flexibility to withdraw a portion of your savings after the completion of 5 years. Remember, the maximum amount you can withdraw is limited to 50 percent of the total balance at the end of the 4th financial year preceding your withdrawal.

Ensure you have all the necessary documents ready to fill the SBI PPF Withdrawal Form C correctly. This form will help you in making that important withdrawal request. The process is straightforward, but make sure to check all guidelines set by the State Bank of India to avoid any delays.

If you’re looking to learn more about the details of this process or want to keep these important points handy, you can easily find a comprehensive PDF that explains everything about the SBI PPF Withdrawal Form C. It’s a simple and efficient way to keep essential information at your fingertips and download it for future reference. 📄

With careful planning and understanding of your PPF options, you can manage your finances better. Remember to consider the implications of early withdrawals to make the most of your savings.