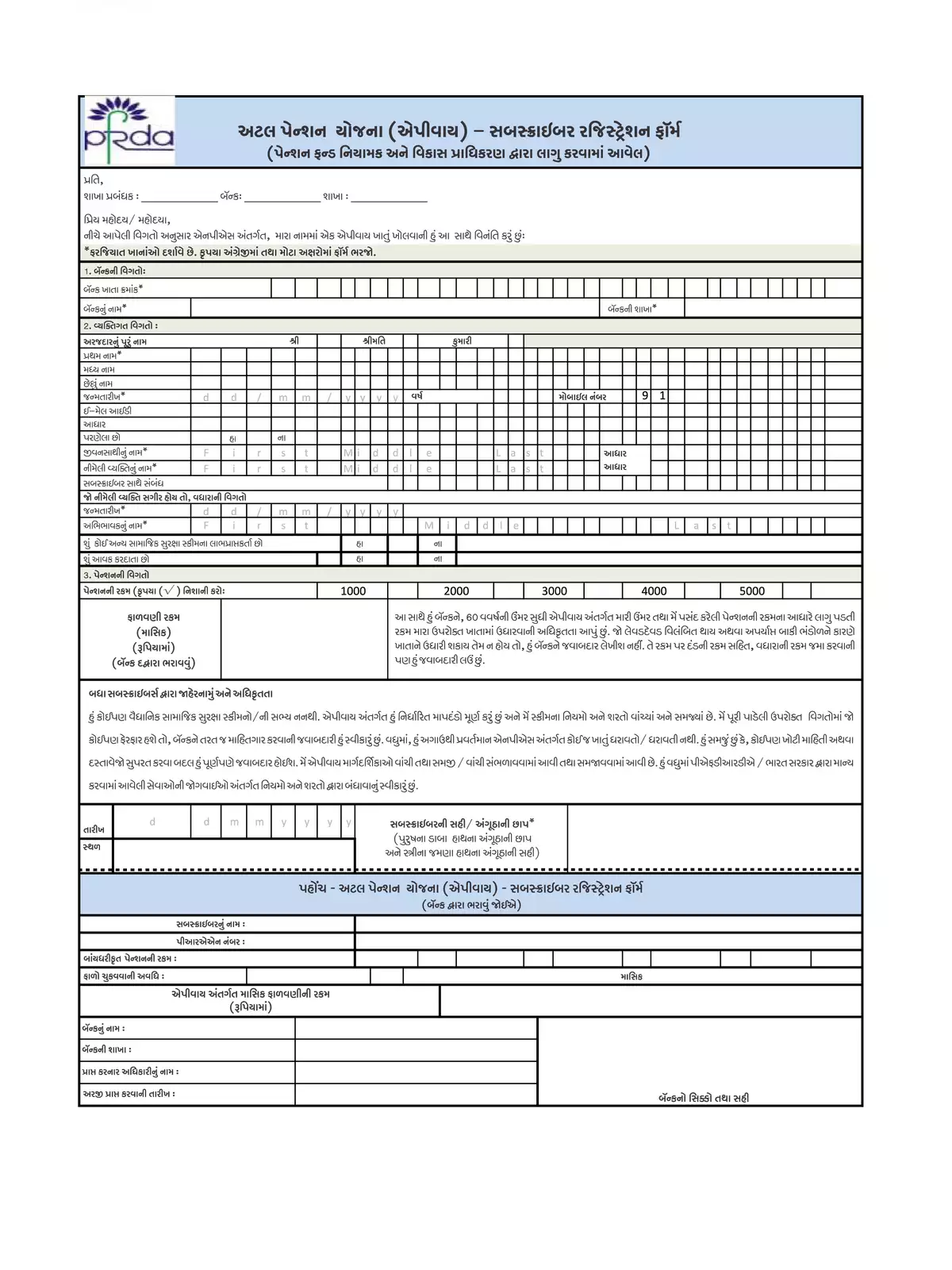

Atal Pension Yojana (APY) Application Form - Summary

Atal Pension Yojana (APY) is a popular periodic contribution-based pension plan that promises a fixed monthly pension of Rs 1,000, Rs 2,000, Rs 3,000, Rs 4,000, or Rs 5,000. Your monthly contribution depends on the pension amount you wish to receive and the age at which you start. Contributions stop, and the pension begins at 60 years of age. So, if you join APY at 40 years, you need to contribute for at least 20 years to receive your pension. Check out the table below for details on monthly contributions based on your age and chosen pension plan.

Eligibility for Atal Pension Yojana

- Must be an Indian citizen

- Need to have a valid bank account

- Age should be between 18 and 40 years

Benefits of Atal Pension Yojana

APY offers a secure pension ranging from Rs 1,000 to Rs 5,000 (as mentioned above) to its subscribers. One of the great features of this scheme is that you can choose to decrease or increase your pension amount once a year during the accumulation phase.

In the unfortunate event of a subscriber’s death, the spouse will continue to receive the pension amount until their own death. After both subscribers and their spouses have passed away, the nominee will receive the accumulated pension money until the age of 60.

If a subscriber dies before reaching 60 years, the spouse can either exit the scheme and claim the accumulated amount or keep the account active under the subscriber’s name for the remaining years. In this latter case, the spouse will receive the same pension amount as the subscriber until their own death.

You can easily download the Atal Pension Yojana (APY) Application Form in PDF format using the link below. Make sure to grab your copy and start your journey towards a secure future!