Post Office NPS Partial Withdrawal Form - Summary

The National Pension Scheme (NPS) is an excellent way to secure a comfortable future in India after retirement. For many, starting an NPS plan is simpler than exiting one. With the NPS, subscribers have several options for withdrawing their funds. By following a few simple guidelines, you can make the process of withdrawing from your NPS account as effortless as the relaxed life you dream of after retiring.

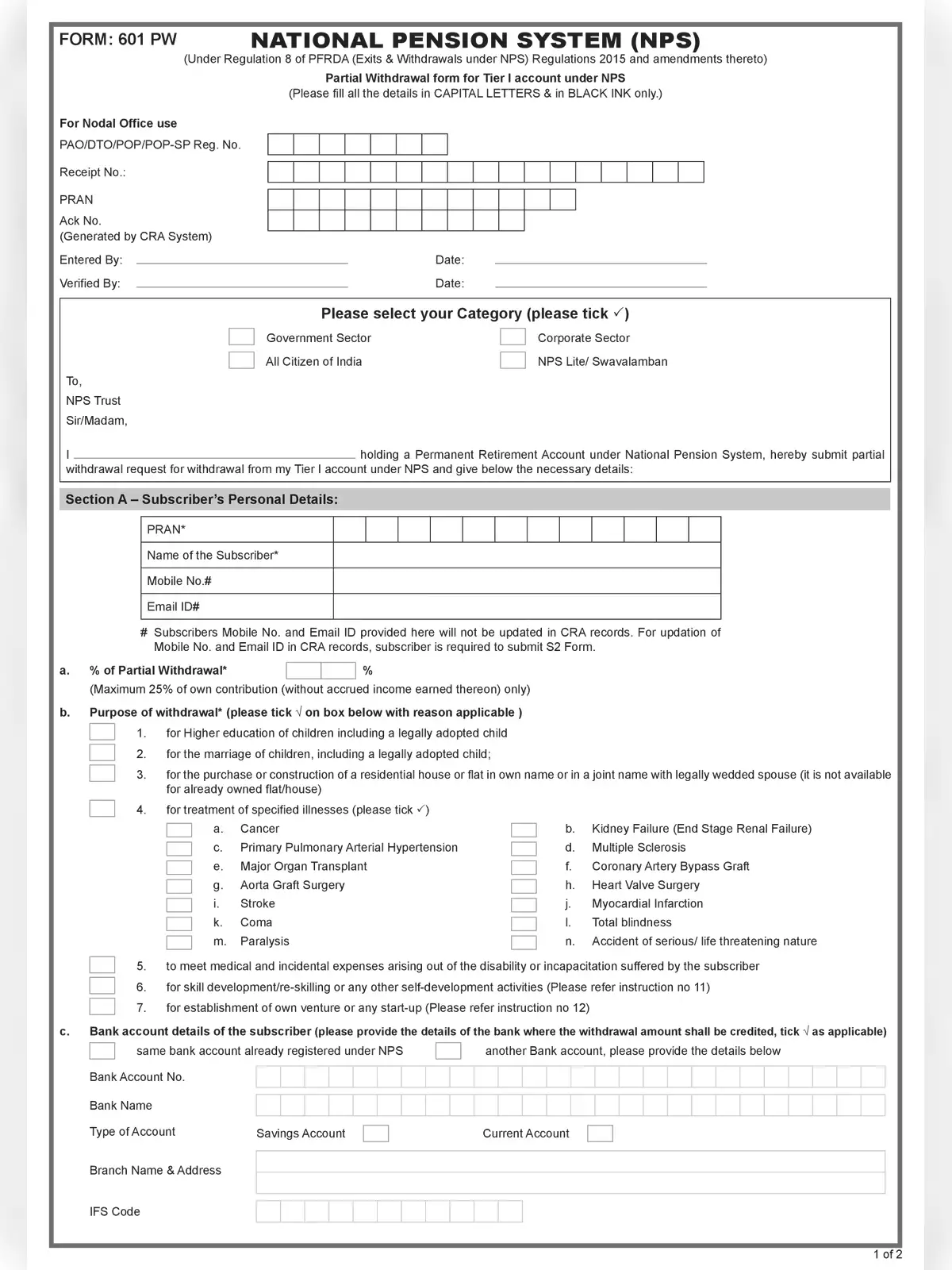

Withdrawal Rules for NPS

- Throughout the duration of your subscription, you can only make three withdrawals.

- There must be a minimum gap of 5 years between any two withdrawals for a subscription, but this can be shortened in case of medical emergencies.

- You can withdraw up to 25% of your own contributions to the NPS plan.

- To qualify for a partial withdrawal, you must have been a member of the scheme for at least three years.

- Partial withdrawals are allowed only in special cases, such as for children’s education, wedding expenses, house construction, or medical emergencies.

Amount Allowed for Partial Withdrawal

Initially, partial withdrawals from the NPS were not permitted. However, thanks to updated regulations, contributors can now withdraw up to 25% of their total contributions. It’s important to remember that only the principal amount can be withdrawn partially, while the interest earned on the account stays in the account. So, only 25% of the amount you have contributed can be taken out, not the total value of your NPS account.

Feel free to download the PDF for more information on the Post Office NPS Partial Withdrawal Form. Just click the link below to access and download it! 📄