Form 49A – Application Form for PAN Card - Summary

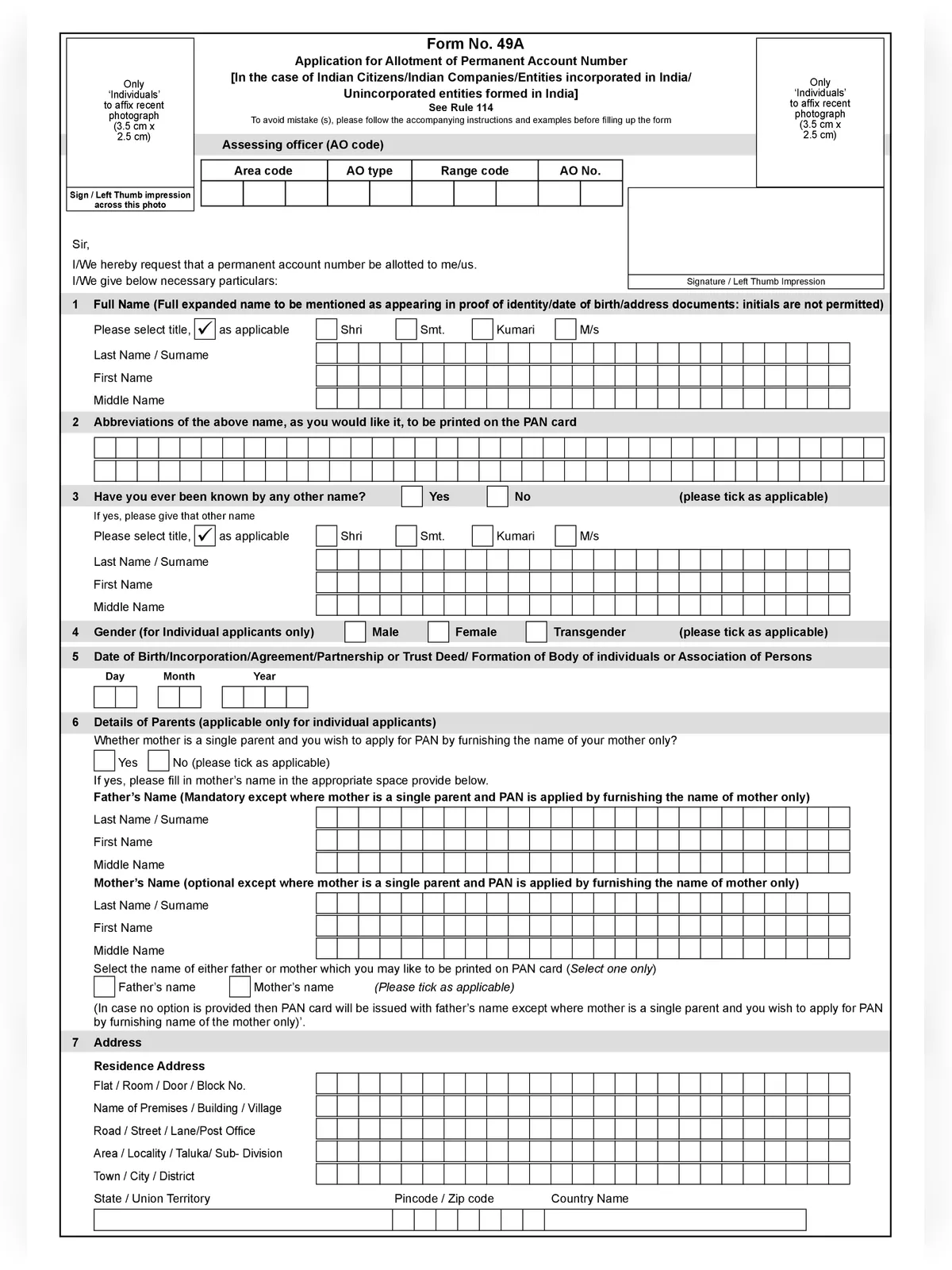

Form 49A PDF is an application form to apply for a new PAN card issued by the Income Tax Department for Indian residents and this form can be downloaded from the Income Tax official website i.e. https://www.incometaxindia.gov.in/, or it can be directly downloaded from the link given at the bottom of this page.

A permanent Account Number (PAN) is a ten-digit alphanumeric number, issued in the form of a laminated card, by the Income Tax Department, to any “person” who applies for it or to whom the department allots the number without an application.

Form 49A (PAN Card Form 2025) – Highlights

| Name of Form | 49A Form PDF (PAN Card Form) |

| Use of Form | New PAN Card Application for Indian Citizens |

| PAN Card Form Official website | https://www.tin-nsdl.com/ |

| Who Can Apply | Anyone above 18 years of age |

| Department | Income Tax Department |

| Official Website of Department | https://incometaxindia.gov.in |

| Application Modes | Online and Offline |

| Application Fee | Rs. 107 for Physical Card, Rs. 72 without a physical card requirement |

| Document Required | Identity Proof, Address Proof & Date of Birth Proof |

| Application Processing Duration | 15 Days to 1 Month |

| Form 49A PDF Download Link | Download PDF |

How to Fill 49A Form (PAN Card Form)

Applicants may obtain the application form for PAN (Form 49A) from any IT PAN Service Centers (managed by UTIITSL) or TIN-Facilitation Centers (TIN-FCs) / PAN Centers (managed by NSDL e-Gov). This form can also be obtained from any nearby stationery vendor or downloaded from the Income Tax Department website (www.incometaxindia.gov.in) / UTIITSL website (www.utiitsl.com) / NSDL e-Gov website (www.tin-nsdl.com).

- Assessing Officer Code: The AO Code along with the details such as the Area Code, Range Code, AO Type, and AO number has to be filled for the PAN Card application

- Full Name: You need to fill up your full name. Make sure there is no use of abbreviations when filling your name

- Abbreviations of the Full Name to be Printed on the PAN card: If you wish to mention the abbreviations of your full name on your PAN Card. Do note that only the first and middle name can be abbreviated and not the last name.

- Other Name: In this third section of the form, ‘Have you ever been known by any other name’, you need to tick as applicable i.e. yes or no. You will have to submit all the details of the other name with no abbreviations.

- Gender: You will have to fill in your gender (for individual applicants only)

- Date of Birth: Fill up your date of birth/Agreement/Incorporation/Partnership or Trust Deed/Formation of Body of Individuals or Association of Persons in the format i.e. DDMMYYYY

- Information about Parents: In this section of the form, details of the parents is required to be filled:

- Tick mark as applicable if you have a single mother and want to apply PAN Card furnishing her name only

- Name of the father (mandatory except where mother is a single parent)

- Name of the mother (optional)

- If you have filled up your father’s as well as your mother’s name, and no option is selected, your father’s name will be printed on the PAN card by default

- Address: This is a mandatory section to fill up your residential address and office address in Form 49A with complete details like the name of premises, state, district, town, PIN Code, etc.

- Address for Communication: You need to tick mark if the address for communication is residence or office

- Email ID and Telephone Number: You need to share your email id and telephone number so that the PAN authorities can get in touch with you and inform you about your PAN Card application through SMS or email or if there are any discrepancies in your application form. Make sure that the telephone number has the ISD (country code) and the STD code

- Status of Applicant: It is mandatory to fill up the status of the applicant i.e.

- Individual/Hindu Undivided Family/Company/Partnership Firm/Trusts/Body of Individuals/Local Authority/Government/Association of Persons/Artificial Judicial Persons/Limited Liability Partnerships

- Registration Number: The registration number field to be filled by companies, firms, and LLPs applying for a PAN Card and since it does not apply to individuals and HUFs

- Aadhaar number: As per the new rules, it is mandatory to link a PAN Card with an Aadhaar Card. If you have an Aadhaar Card you are required to quote the Aadhaar number otherwise the Enrolment ID of the Aadhaar application form according to section 139 AA in this form

- Source of Income: You must mention your source of income in Form 49A out of the following options given:

- Salary/Income from Business or Profession/Income from House Property/Capital Gains/Income from other Sources/No Income

- Make sure you mention the Business or Profession Code if you have selected the Income from Business or Profession as the source of income.

- Representative Assessee (RA):Fill up the name, and address of the Representative Assessee (individual), who is assessable under Section 160 of the Income Tax Act, 1961. It is worth mentioning that this field can only be filled in by a representative assessee such as a manager or guardian of a minor, a non-resident’s agent, etc.

- Documents Required: Here you need to mention the documents that you attach as Proof of Address (POA), Proof of Identity (POI) as well as Proof of Date of Birth with PAN Card Form 49A

After carefully filling out this form and attaching the necessary documents, sent it to the following address via speed post or normal post: Income Tax PAN Services Unit, NSDL e-Governance Infrastructure Limited, 5th Floor, Mantri Sterling, Plot No. 341, Survey No. 997/8, Model Colony, Near Deep Bungalow Chowk, Pune – 411 016.

The application must be signed by (i) the applicant or (ii) Karta in case of HUF or (iii) Director of a Company or (iv) Authorized Signatory in case of AOP, Body of Individuals, Local Authority and Artificial Juridical Person or (v) Partner in case of Firm/LLP or (vi) Trustee or (vii) Representative Assessee in case of Minor/deceased/idiot/lunatic/mentally retarded. Applications not signed in the given manner and in the space provided are liable to be rejected.

Applicants will get the acknowledgment slip which can be used to track the status of the application. The application process will take about 15 days to complete, and you will receive your PAN card copy at the provided address.

49A Form PAN Card Apply Online Procedure

Applicants must visit the NSDL official website i.e. https://www.onlineservices.nsdl.com/, or they can directly click this link.

Documents Required for New PAN Card

Following are the Documents Required for applying for Pan Card Form : (Individual)

| Proof of Identity | Proof of Address | Proof of date of birth |

|---|---|---|

| (i) Copy of the following documents bearing the name of the applicant as mentioned in the application:- | (i) Copy of the following documents bearing the address mentioned in the application:- | Copy of the following documents bearing the name, date, month, and year of birth of the applicant as mentioned in the application:- |

| a. Aadhaar Card issued by the Unique Identification Authority of India; or | a. Aadhaar Card issued by the Unique Identification Authority of India; or | a. Aadhaar card issued by the Unique Identification Authority of India; or |

| b. Elector’s photo identity card; or | b. Elector’s photo identity card; or | b. Elector’s photo identity card; or |

| c. Driving License; or | c. Driving License; or | c. Driving License; or |

| d. Passport | d. Passport | d. Passport |

| e. Ration card having a photograph of the applicant; or | e. Passport of the spouse; or | e. Matriculation certificate or Mark sheet of the recognized board; or |

For Categories other than Individuals & HUF i.e. Firm, BOI, AOP, AOP (Trust), Local Authority, Company, Limited Liability Partnership, Artificial Juridical Person

| Type of Applicant | Document to be submitted |

|---|---|

| Company | Copy of certificate of registration issued by Registrar of Companies. |

| Partnership Firm | Copy of certificate of registration issued by Registrar of Firms or Copy of Partnership Deed. |

| Limited Liability Partnership | Copy of Certificate of Registration issued by the Registrar of LLPs |

| Association of Persons (Trust) | Copy of trust deed or copy of the certificate of registration number issued by Charity Commissioner. |

| Association of Person, Body of Individuals, Local Authority, or Artificial Juridical Person | Copy of Agreement or copy of the certificate of registration number issued by charity commissioner or registrar of cooperative society or any other competent authority or any other document originating from any Central or State Government Department establishing identity and address of such person. |

You can download the PAN Card Application form in PDF format online from the official website at the link provided below.