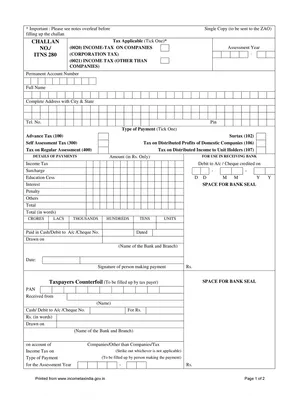

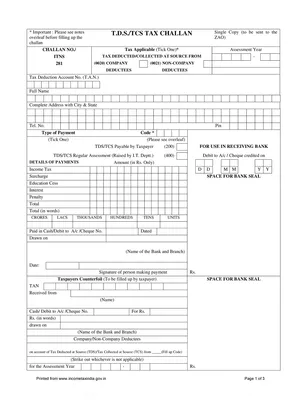

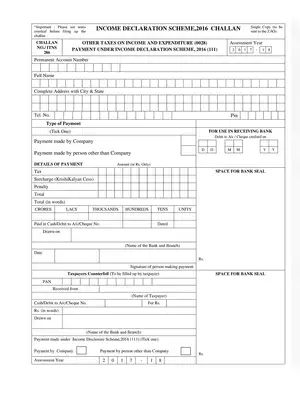

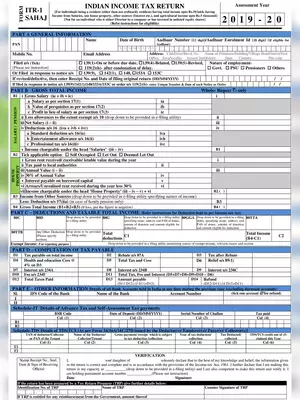

Income Tax Forms 2020-21

CBDT has notified the new ITR forms for FY 2019-20/ AY 2020-21 in line with the amendments made by the Finance Act, 2019.

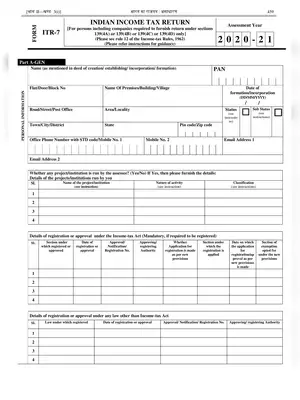

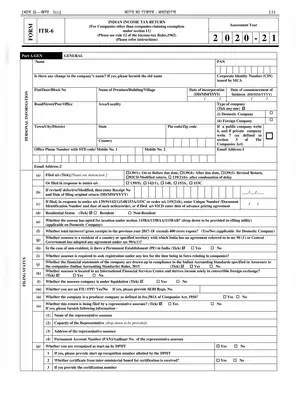

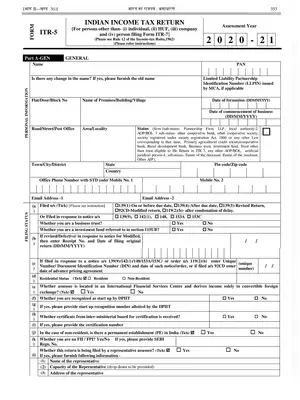

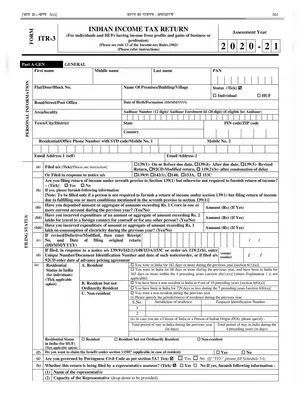

The Central Board of Direct Taxes (CBDT) has notified the new Income Tax Return (ITR) forms for FY 2019-20/ AY 2020-21 (i.e. ITR 1 Sahaj, 2, 3, 4 Sugam, 5, 6, 7 and ITR-V), vide Income-Tax (12th Amendment) Rules, 2020, in line with the amendments made by the Finance Act, 2019.

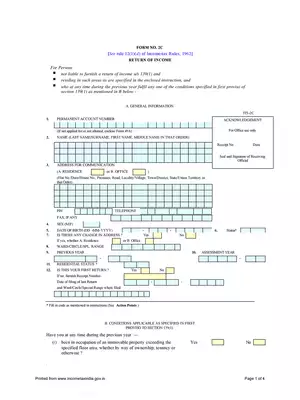

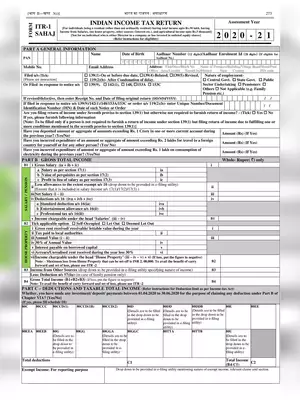

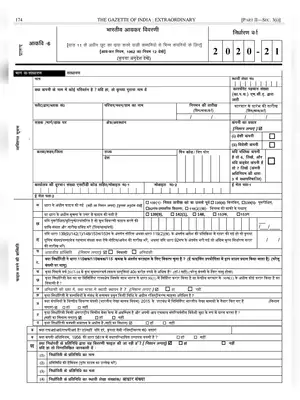

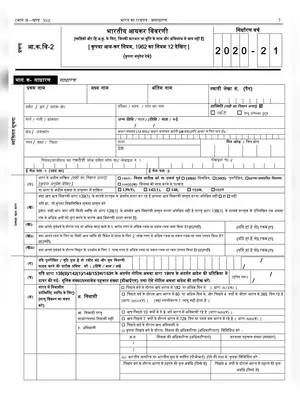

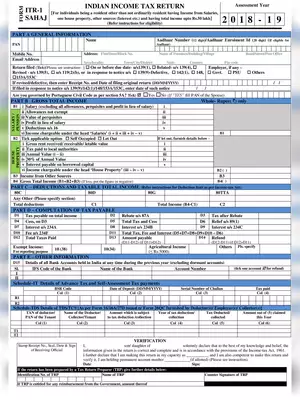

ITR 1 Sahaj: This form is for individuals being a resident (other than not ordinarily resident) having total income up to Rs 50 lakh.

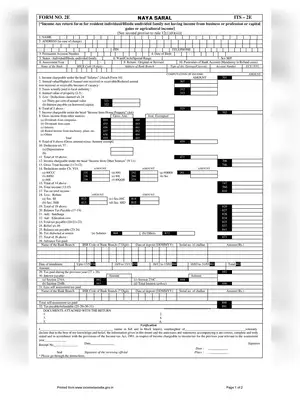

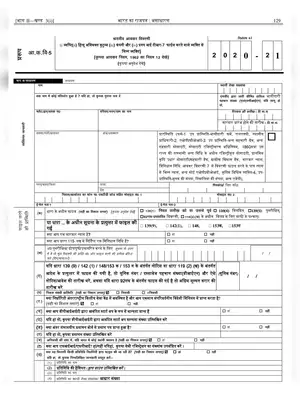

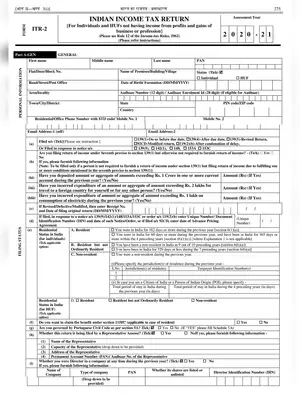

ITR 2: This form is for individuals and HUFs not having income from profits and gains of business or profession.

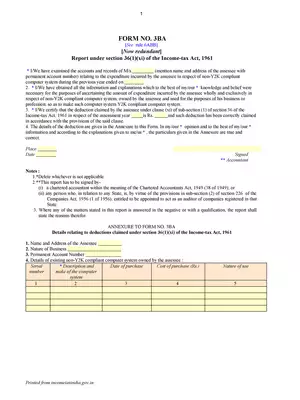

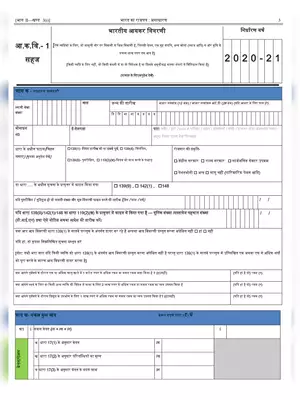

ITR 3: For individuals and HUFs having income from profits and gains of business or profession.

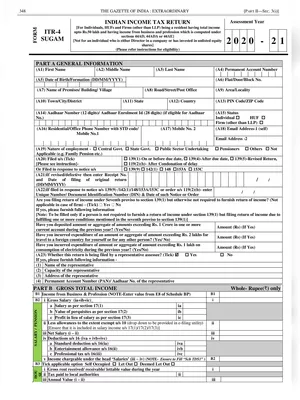

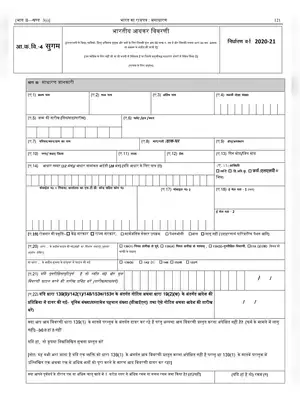

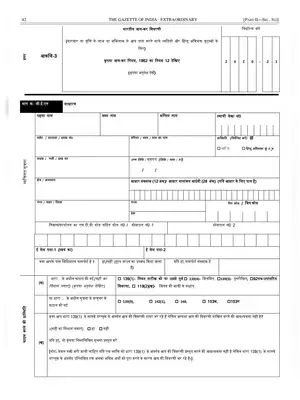

ITR 4 Sugam: For individuals, HUFs and Firms (other than LLP) being a resident having a total income up to Rs 50 lakh and having income from business and profession which is computed under sections 44AD, 44ADA or 44AE.

ITR 5: For persons other than (i) individual, (ii) HUF, (iii) company, and (iv) person filing Form ITR-7.

ITR 6: For Companies other than companies claiming exemption under section 11.