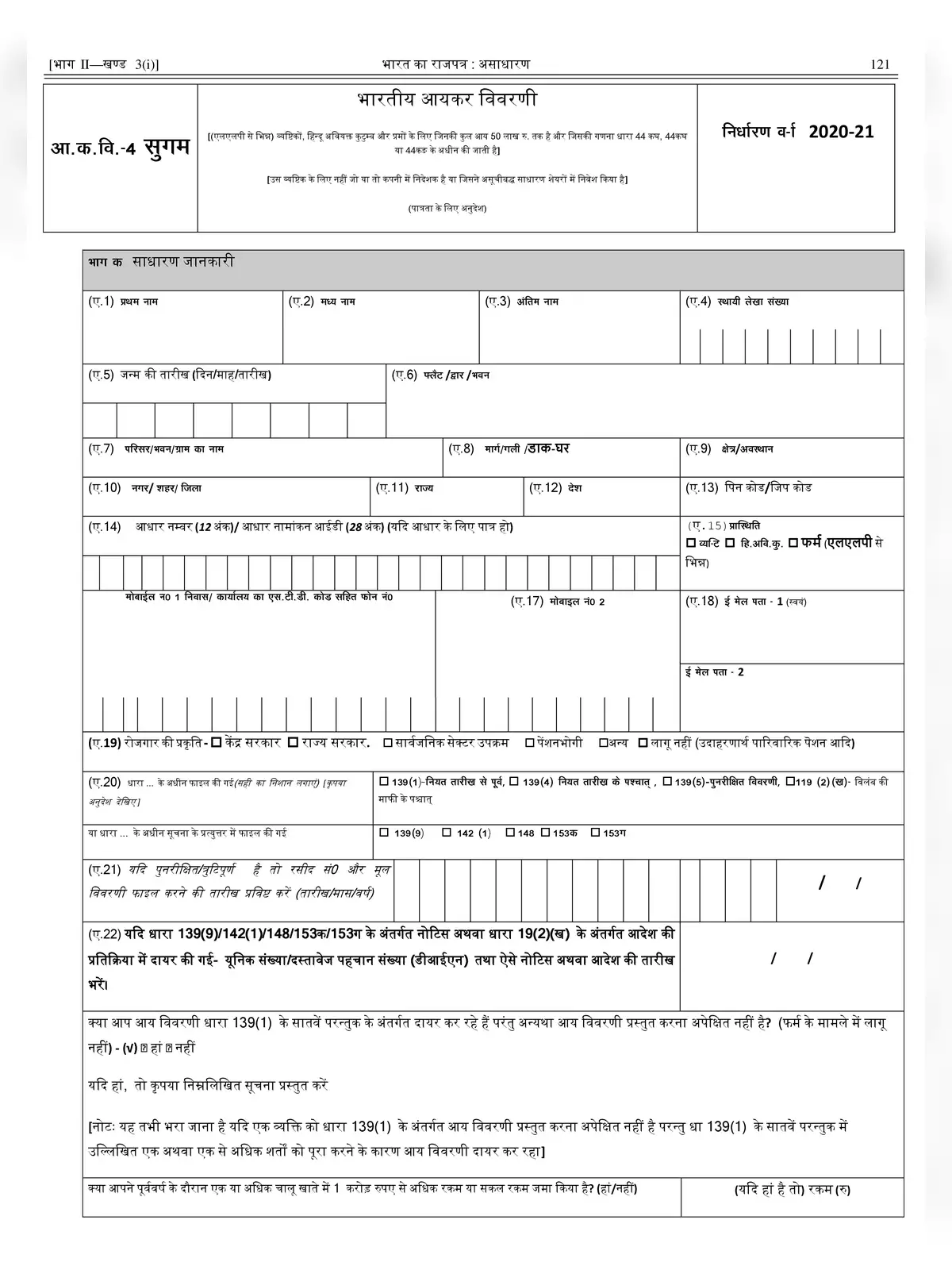

ITR 4 Form 2020-21 - Summary

ITR-4 Sugam Form for Individuals, HUFs, and Firms (other than LLP) being a resident having total income up to Rs.50 lakh, one house property (single ownership), having income from business and profession which is computed under sections 44AD, 44ADA, or 44AE or Interest Income, Family pension, etc. and agricultural income up to Rs.5 thousand.

Eligible Person for file ITR 4-Sugam Return:-

ITR 4-Sugam is for Individuals, HUFs, and Firms (other than LLP) being a resident having total income up to Rs.50 lakh, one house property (single ownership), having income from business and profession which is computed under sections 44AD, 44ADA, or 44AE or Interest Income, Family pension, etc. and agricultural income up to Rs.5,000.

Offline Mode:

The ITR form can be filed offline only in any of the following case:

- The individual is of the age of 80 years or more.

- The income of the individual is less than Rs 5 lakhs and who do not have to claim a refund in the income tax return The return can be filed offline:

- By furnishing a return in a physical paper form b. By furnishing a bar-coded return The Income Tax Department will issue you an acknowledgment at the time of submission of your physical paper return.

5 new disclosures that the Income Tax Department is seeking in this form are:

1. House ownership: Individual taxpayers who are joint owners of house property cannot file ITR4.

2. Passport: One needs to disclose the Passport number if held by the taxpayer. This is to be furnished both in ITR 1-Sahaj and ITR 4-Sugam. Hopefully, it will be made mandatory in other ITR Forms as and when they are notified.

3. Cash deposit: For those filing ITR 4-Sugam, it has been made compulsory to declare the amount deposited as cash in a bank account, if such amount exceeds Rs 1 crore during the FY.

4. Foreign travel: If you have spent more than Rs 2 lakh on traveling abroad during the FY, you need to disclose the actual amount spent.

5. Electricity consumption: If your electricity bills have been more than Rs 1 lakh in aggregate during the FY, you need to disclose the actual amount.

You can download the ITR-4 Sugam Form (AY 2020-21) in PDF format online from the link given below or alternative link.

Also, Check