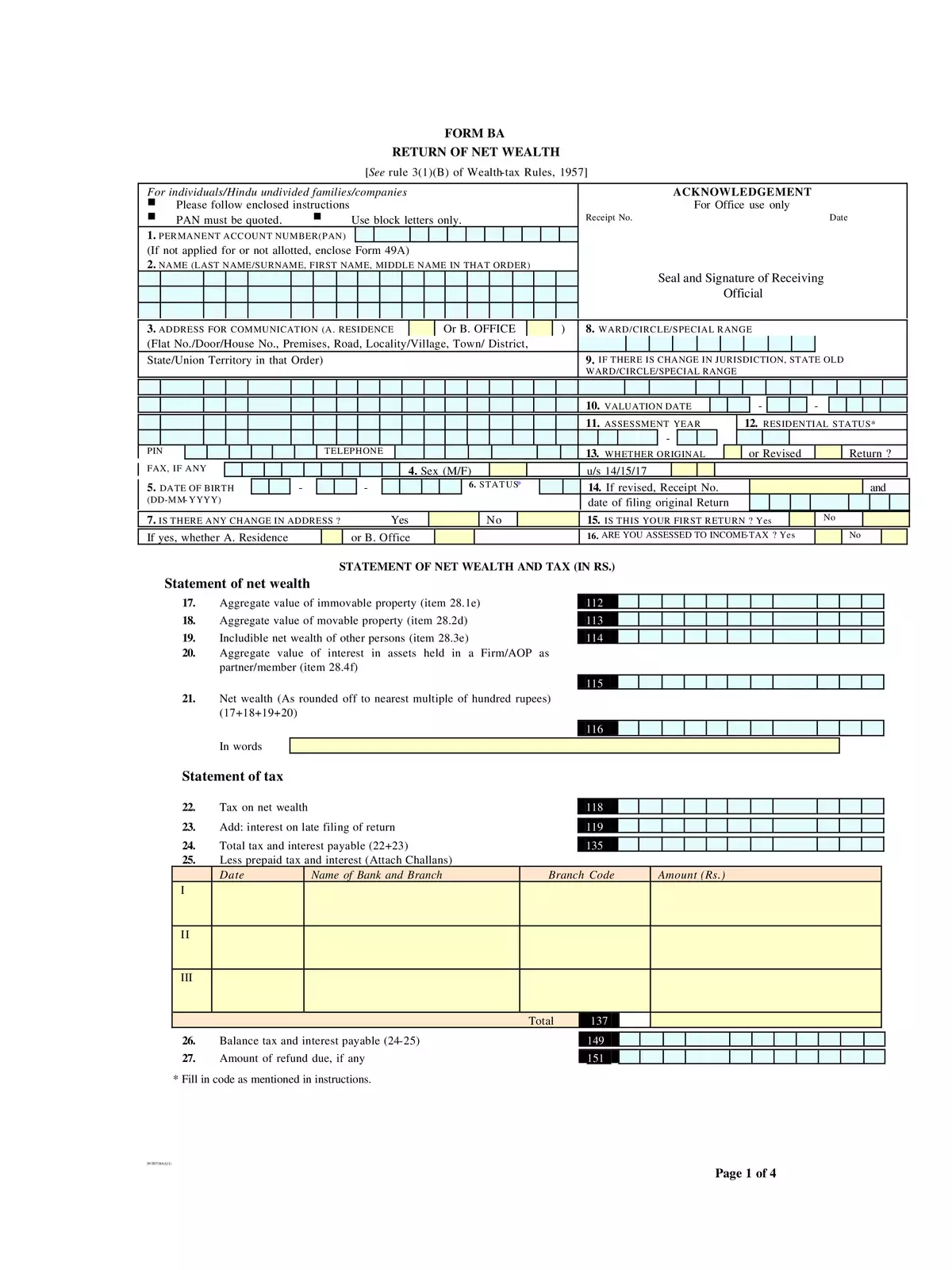

Return of Net Worth – From BA - Summary

Net worth is the value the assets a person or corporation owns, minus the liabilities they owe. It is an important metric to gauge a company’s health and it provides a snapshot of the firm’s current financial position.

You can download Form BA- Return of Net Worth in PDF format from the official website by visiting the alternate link or click direct link provided below.