ITR 3 Form 2020-21 - Summary

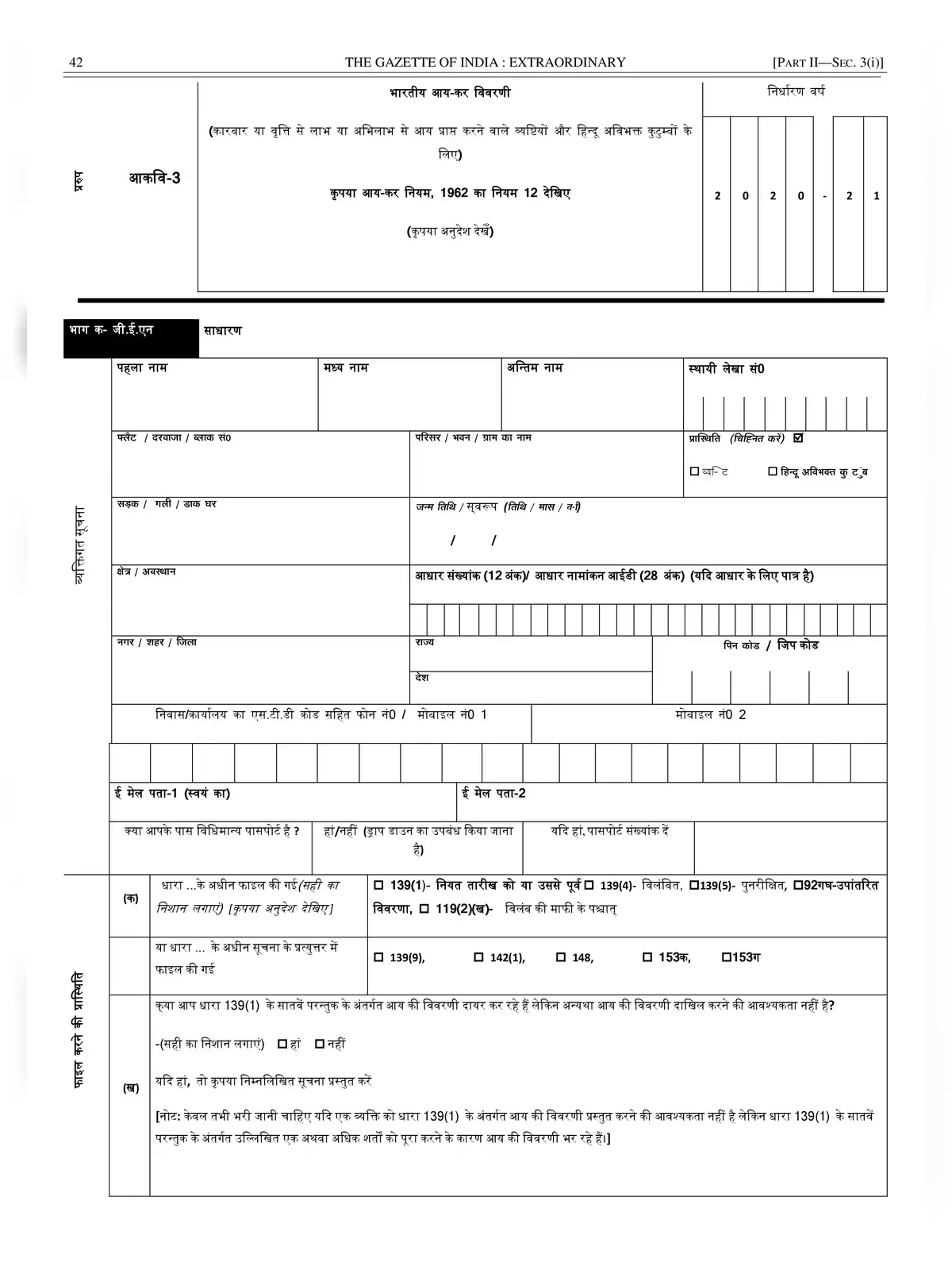

The Current ITR 3 Form is to be used by an individual or a Hindu Undivided Family who has income from a proprietary business or is carrying on profession. The persons having income from the following sources are eligible to file ITR 3.

The taxpayer has to disclose of name and PAN of partnership firms in which the individual taxpayer was a partner during the year, details of audit under any other statutory law. You have to also include the annual value of outward supplies as per the goods and services tax (GST) returns filed in Form ITR-3.

The persons having income from the following sources are eligible to file ITR 3 :

- Carrying on a business or profession

- If you are an Individual Director in a company

- If you have had investments in unlisted equity shares at any time during the financial year

- The return may include income from House property, Salary/Pension, and Income from other sources

- The income of a person as a partner in the firm

Major Changes in ITR 3 Form for AY 2020-21

- The taxpayer should disclose (a) the number of cash deposits above Rs 1 crore in the current accounts with a bank, (b) expenditure incurred above Rs 2 lakh on foreign travel (c) expenditure incurred above Rs 1 lakh on electricity.

- In case an individual is a director in a company or holds unlisted equity investments, the ‘type of company’ should also be disclosed.

- In case of short-term or long term capital gains from the sale of land or building or both, the details of the buyer(s) i.e. name, PAN, or Aadhaar, percentage share of ownership and address have to be given.

- A separate schedule 112A for the calculation of the long-term capital gains on the sale of equity shares or units of a business trust which are liable to STT.

- Under ‘income from other sources’, a taxpayer should provide the details of ‘any other income’.

- The details of the deductions against ‘income from other sources’ should be provided

- The ‘Schedule VI-A’ for tax deductions is amended to include deduction under section 80EEA and section 80EEB.

- In the case of a business trust or investment fund, the details of ‘capital gains’ income and ‘dividend’ income should be provided.

- The details of tax on secondary adjustments to transfer price under section 92CE(2A).

- The details of tax deduction claims for investments or payments or expenditure made between 1 April 2020 until 30 June 2020.

- While providing the details of bank accounts, if a taxpayer selects multiple bank accounts for credit of refund, the income tax department may choose any account for processing the refund.

You can download the ITR-3 Form in PDF format online from the link provided below or alternative link.

Also, Check