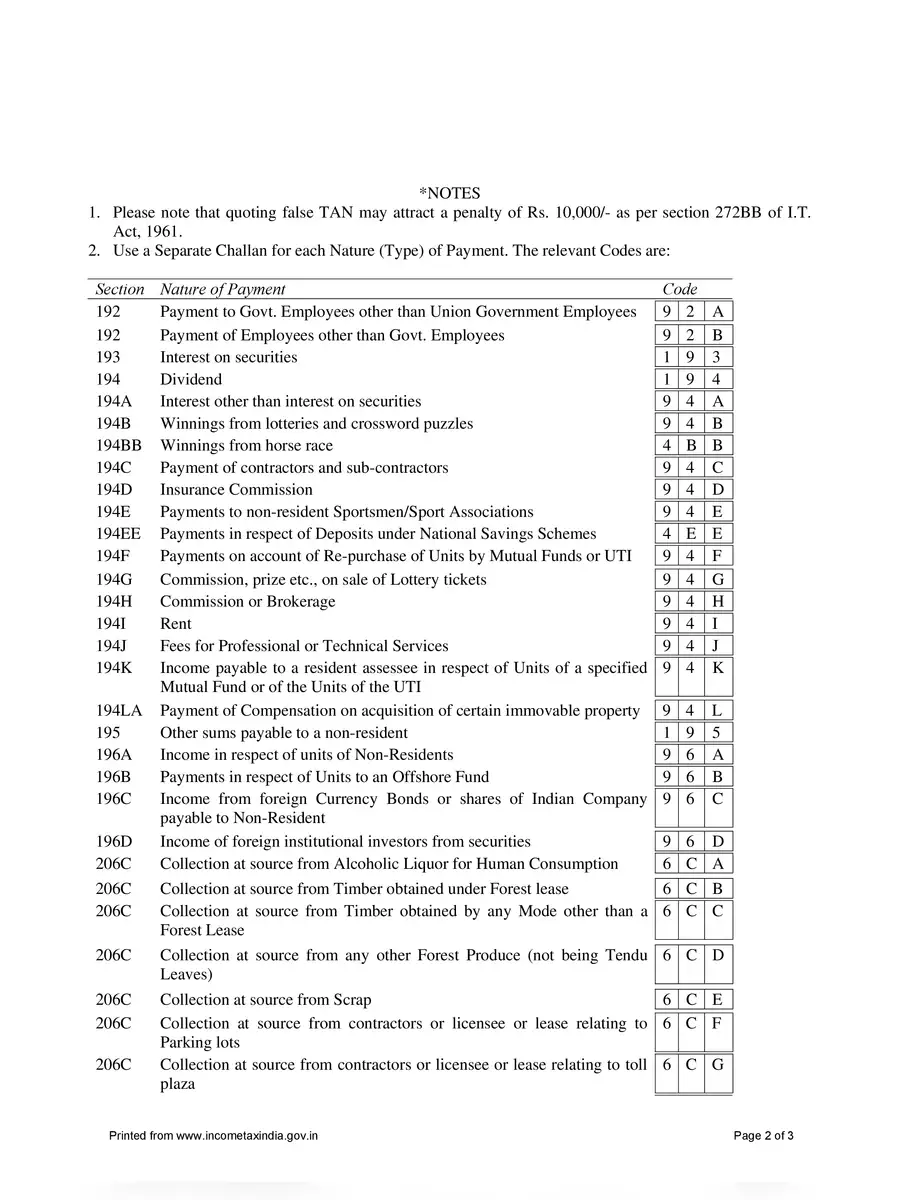

TDS/TCS Tax Challan Form 281

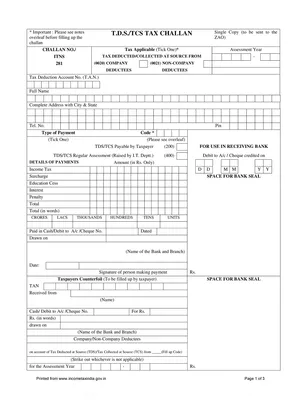

Download the TDS/TCS Tax Challan Form 281 in PDF format here. TDS or Tax Deducted at Source is a mechanism introduced by the Government in which the person (deductor) before making the payment of specified nature (such as salary, rent, etc.) to the payee (deductee) shall deduct tax at specified percentage from such amount payable and deposit it to the Income Tax Department.

TCS or Tax Collected at Source is the tax collected by the seller from the buyer at the time of sale of specified goods. This challan is used for depositing TDS and TCS by corporate as well as non-corporate entities.

TDS/TCS Tax Challan Form 281 Download

Following are the three types of challans introduced by the Income Tax Department:

- Challan No. ITNS 280 – This form is used for the payment of Income Tax; such payment can be in the form of Self-Assessment Tax, Advance tax, tax on regular assessment, tax on distributed profits, or income. Tax can be paid online or through cheque, DD, etc. at various bank branches. Irrespective of the mode of payment, Challan ITNS 280 shall be used.

- Challan No. ITNS 281 – This Challan is used for depositing Tax Deducted at Source (TDS) or Tax Collected at Source (TCS).

- Challan No. ITNS 282 – This is to be used in case of payment of Gift Tax, Wealth Tax, Expenditure Tax, Estate Duty, Securities Transaction Tax, and Other Direct Taxes.

Due date for payment in case of government assessee:

- Tax Deposited without challan – Same day

- Tax deposited with challan – 7th of the next month. For example, if the TDS is to be deposited for the month of May 2017, the due date shall be June 7, 2017

Download the TDS/TCS Tax Challan Form 281 in PDF format using the link given below.