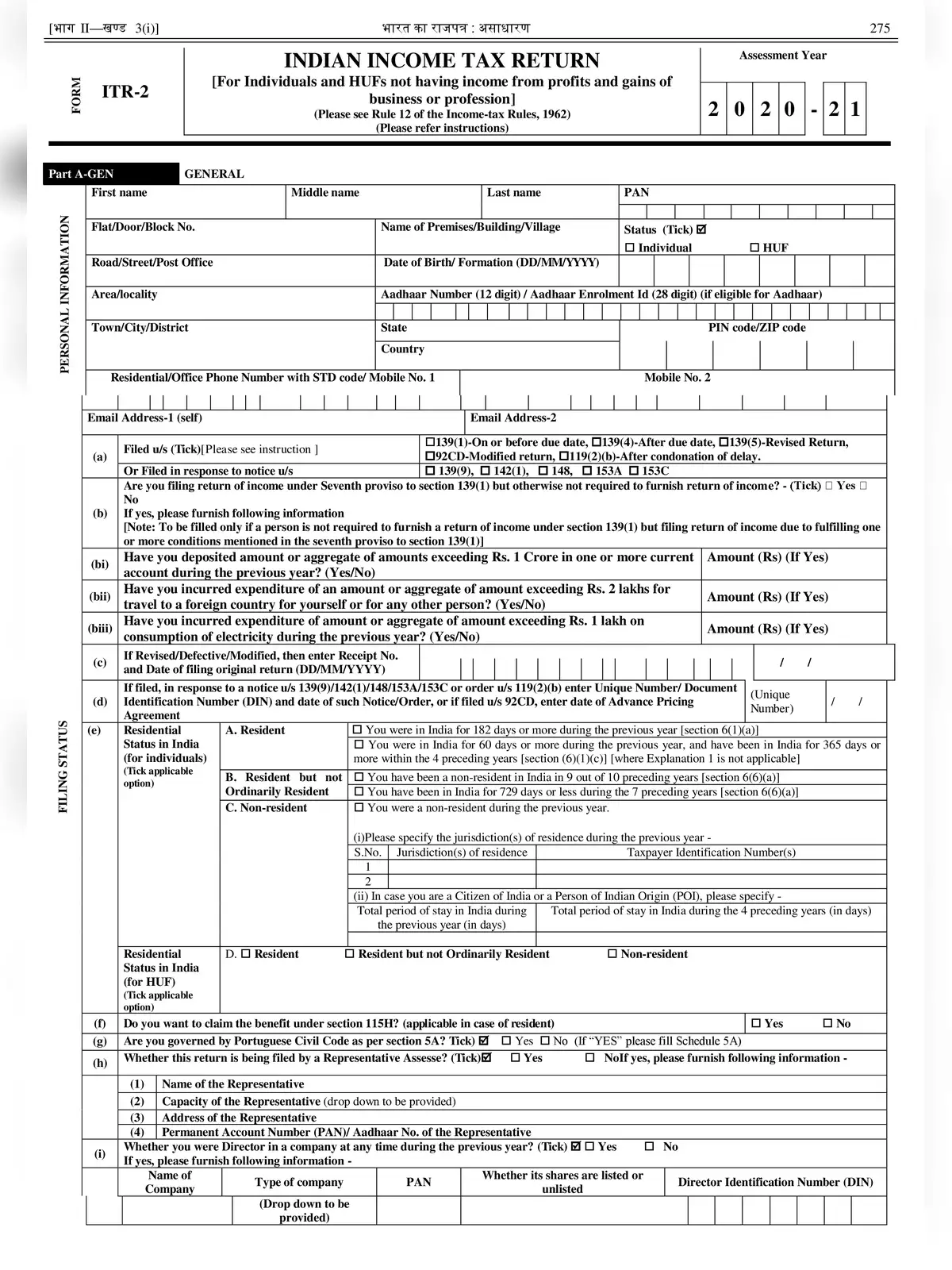

ITR-2 Form 2020-21 - Summary

ITR-2 Form (AY 2020-21) :- This form is for individuals and HUFs not having income from profits and gains of business or profession. It is to be used by individuals having capital gains or more than one house property but not by those individuals having income from business and profession. All the allowances received by salaried individuals have to be filled separately.

ITR-2 Income From:-

- Every Income from ITR-1 >50lakhs

- Capital Gain

- More than one house property

- Foreign Income/Foreign Agent

- Holding directorship in a company

- Holding unlisted equity share

You can download the ITR-2 Form in PDF format online form the link provided below or alternative link.