Income Tax Challan Form 282 - Summary

Understanding Income Tax Challan Form 282

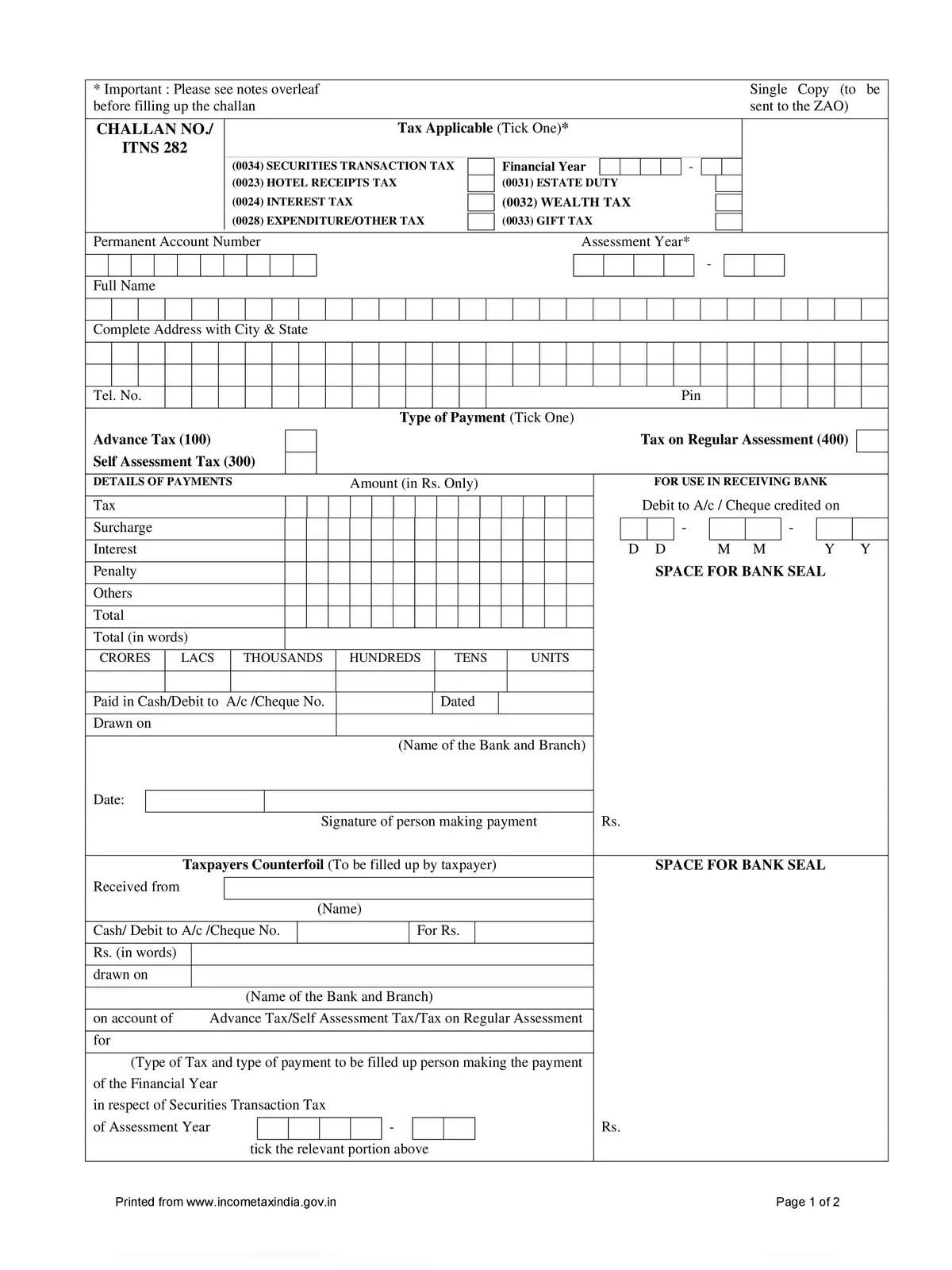

The Income Tax Challan Form 282 is an important document for individuals and businesses in India. It is specifically used for the payment of various direct taxes, including Gift Tax, Wealth Tax, Expenditure Tax, Estate Duty, and Securities Transaction Tax. Knowing about this form is crucial for anyone wanting to ensure their tax payments are made correctly.

Importance of Income Tax Challan Form 282

Filing taxes can seem complicated at times, but understanding the purpose of different forms makes the process easier. The Income Tax Challan Form 282 plays a vital role in helping taxpayers meet their obligations. By using this form, you can ensure your payments are processed properly.

When it’s time to pay taxes, filling out the correct form is essential. Using the right form helps avoid any delays or issues in the payment process.

You can easily find and download the Income Tax Challan Form 282 online in PDF format. This makes it convenient for taxpayers to access the form on their devices anytime they need it.

Additionally, you can complete the form digitally, which saves time and makes payments smoother. Remember to keep a copy of the completed form for your records; this will assist you with any future inquiries about your tax payments.

Stay informed about the latest tax updates and ensure compliance with the help of the Income Tax Challan Form 282. Timely tax payments are important to avoid penalties and to ensure your contribution to the country’s economy.

In summary, the Income Tax Challan Form 282 is a vital document for making tax payments in India. By using this form accurately, you can have a hassle-free tax payment experience. Make sure to download the latest version of the form as a PDF and follow the necessary guidelines for filling it out, ensuring you stay on track with your tax responsibilities. 😊