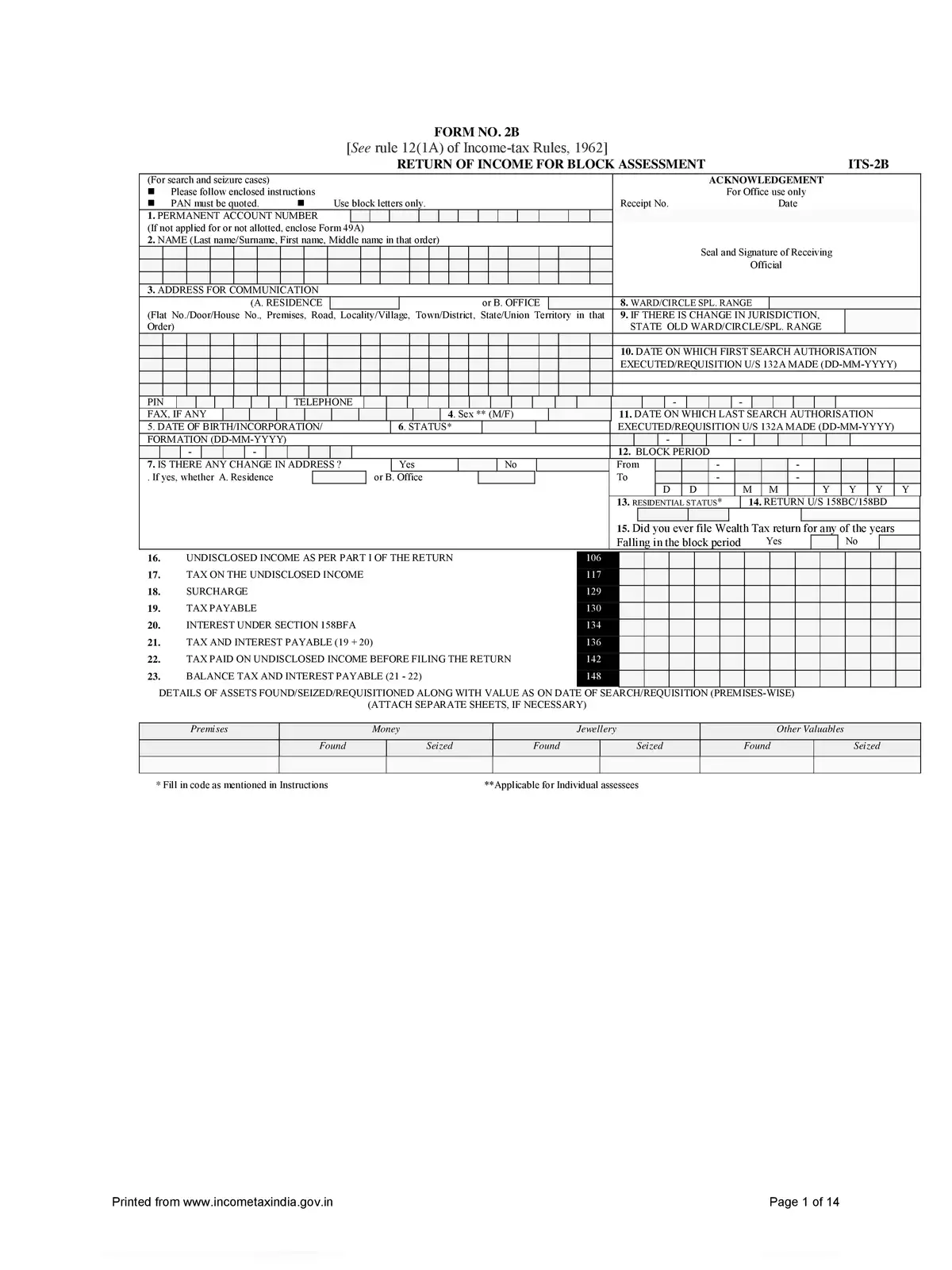

Block Assessment Income Return Form 2B - Summary

The Block Assessment Income Return Form 2B is a crucial document for anyone dealing with block assessments in India. According to the law, the assessee is given a minimum of 15 days and a maximum of 45 days from the date of notice to submit their return under Section 158 BC. If the return is not filed within this time frame, the Assessing Officer (AO) will proceed to determine the undisclosed income for the block period.

Understanding Block Assessments

Block assessments happen when the tax department suspects undisclosed income. This important process aids tax authorities in ensuring that all income is reported and taxed appropriately. The time allowed for filing the return is critical because it gives the assessee the chance to prepare their documents accurately.

The Importance of Timely Filing

Filing the Block Assessment Income Return Form 2B on time is very important. If you delay, the AO may decide on your undisclosed income without hearing your side of the story. Therefore, it is vital to collect all necessary documents and information within the specified period to avoid penalties or complications later on.

For more detailed information, you can download the PDF on Block Assessment Income Return Form 2B and understand more about the filing process and requirements.

Act promptly and ensure your return is submitted within the allowed time frame to comply with the law and avoid any issues. Remember, staying informed is the key! 📄