Return of Income Form 2C - Summary

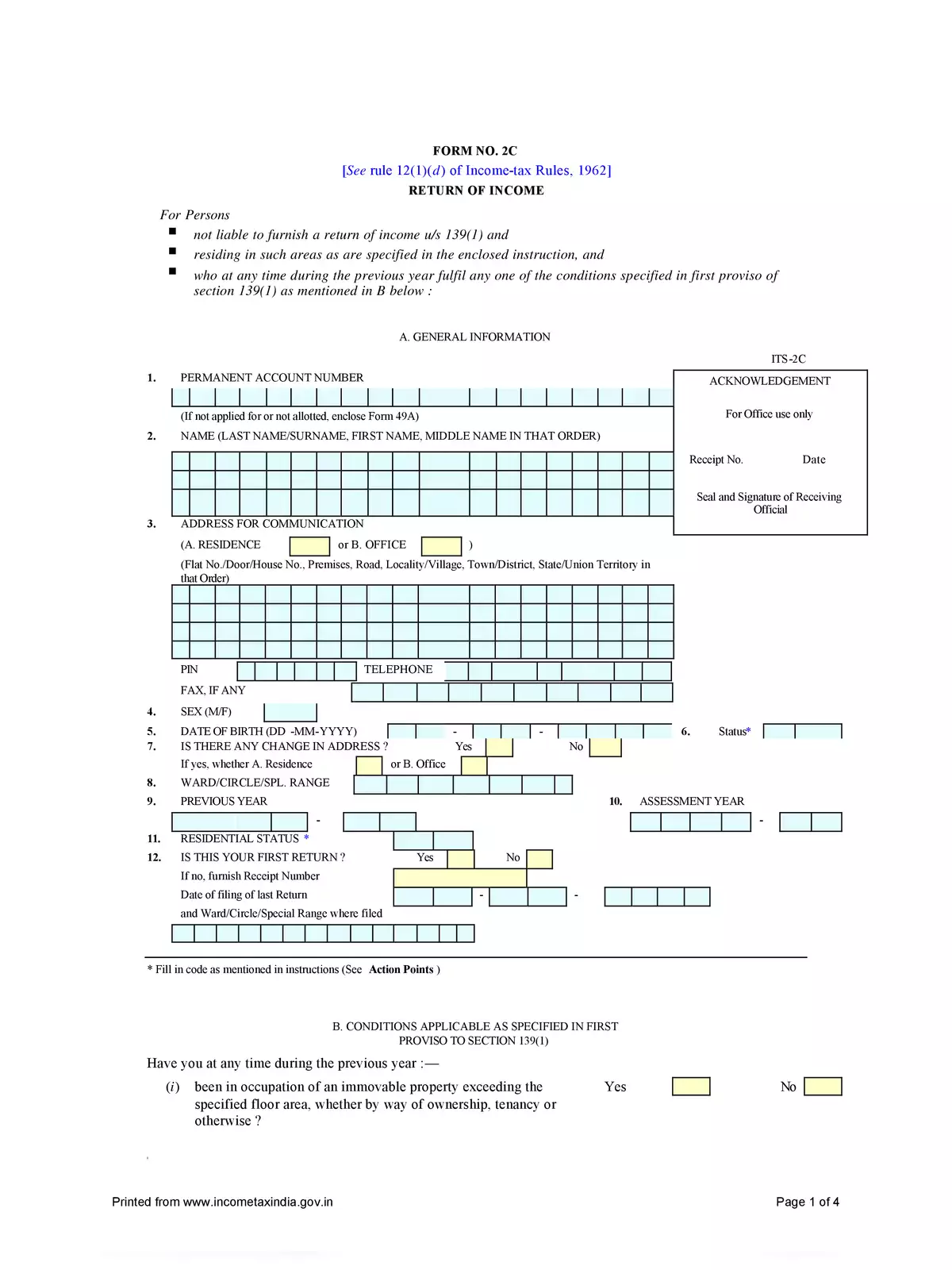

This Return of Income Form 2C must be submitted by individuals who are not required to file a return of income under section 139(1) and who live in specific areas mentioned in the enclosed instructions. If at any point during the previous year, they meet any one of the conditions outlined in the first proviso of section 139(1), then they are obligated to furnish this form.

Understanding Return Form 2C

Return Form 2C is crucial for those who do not fall under the usual income tax filing rules. It helps in declaring income for tax purposes. Completing this form correctly ensures compliance with the Income Tax Act. This is especially important for residents in certain areas where tax rules differ.

Who Needs to Fill Out Form 2C?

Individuals who do not have to file a regular income tax return but meet specific criteria during the previous year are required to fill out Form 2C. This includes those who may have income, even if it is below the taxable limit. By downloading the PDF version of this form, users can easily access the necessary instructions and guidelines for filling it out properly. Make sure to download the PDF for detailed information and assistance.

Remember, submitting your Return Form 2C on time is essential to stay compliant with tax regulations. If you need further assistance, the instructions included will guide you through the process.