Advance Tax Income Tax Challan Form 280 - Summary

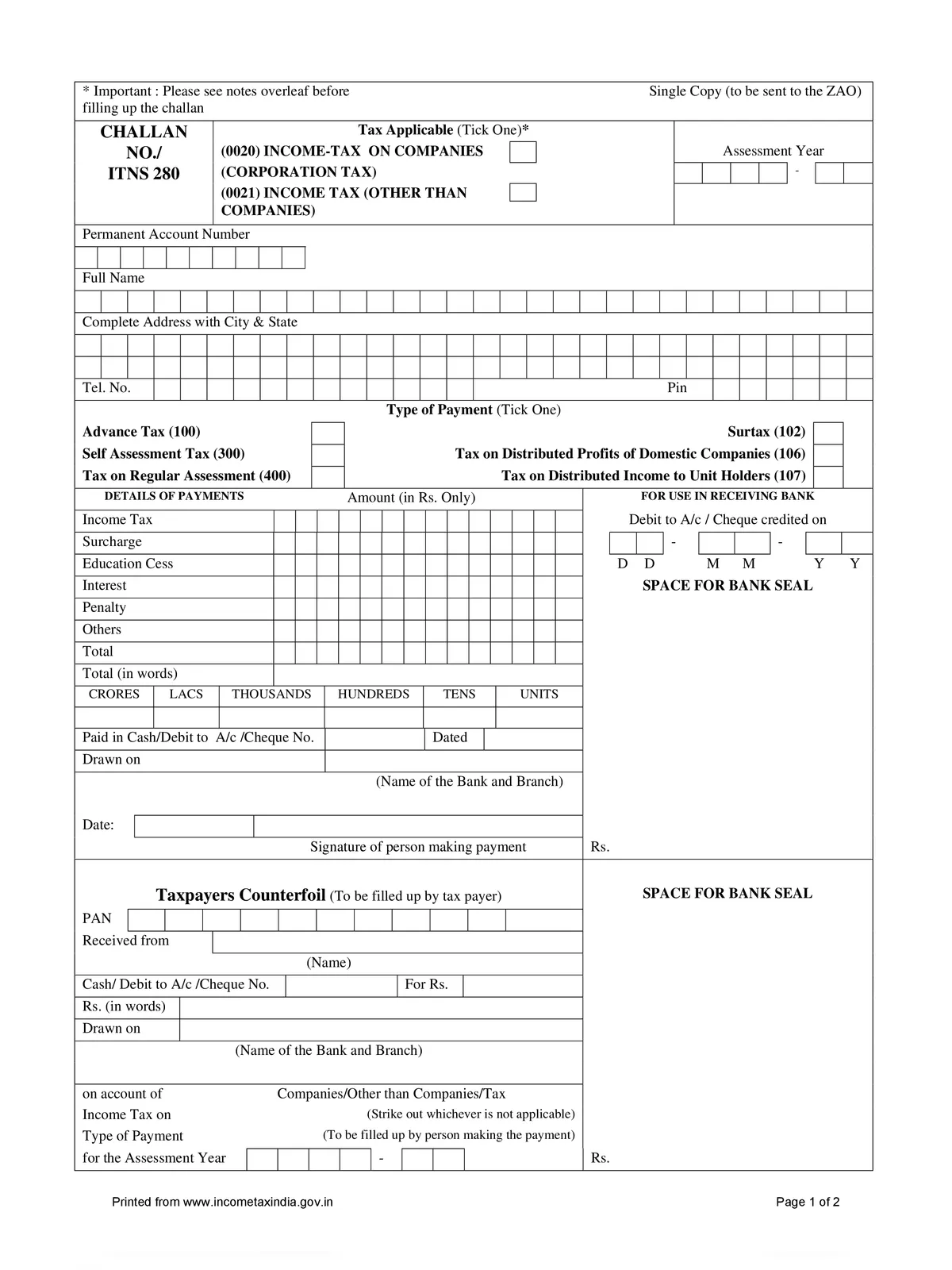

This is an Advance Tax Challan Form 280 PDF issued by the Income Tax of India and this form can be downloaded from the official website of the Income Tax Department i.e. www.incometaxindia.gov.in, or it can directly download from the link given below in PDF format.

Challan 280 is a form available on the official website of Income Tax India. This challan can be used to make online payments of income tax. The challan can be filed online or can be submitted offline as well to pay the tax. Using challan 280 you can now pay your income tax online on the income tax website.

Advance Tax Challan Form 280 (Required Details)

- Assessment Year

- PAN

- Full Name & Address

- Type of Payment

- Details of Payments

- Taxpayers Counterfoil

- And any other details

Advance Tax Chalan Form 280 – Documents Required

- Form 280

- Cheque Leaf if payment through cheque

- And any other documents

Advance Tax Payment Due Date

| Due Date | Advance Tax Payable |

|---|---|

| On or before 15th June | 15% |

| On or before 15th September | 45% |

| On or before 15th December | 75% |

| On or before 15th March | 100% |

Income Tax Online with Challan 280

Step 1: Visit the official website of NSDL at https://www.tin-nsdl.com/

Step 2: On the main page, click on the ‘Services’ tab to get the drop-down list.

Step 3: Select the ‘e-payment: Pay Taxes Online’ option from the drop-down menu.

Step 4: You will be directed to the ‘e-Payment of Taxes’ page. Alternatively, you can go to the ‘Pay Taxes Online’ box present on the right side of the main page of the website and choose ‘Click to pay tax online to directly access the ‘e-Payment of Taxes’ page.

Step 5: Choose ‘Challan No./ITNS 280’ from the options and click on the ‘Proceed’ button.

Step 6: In the next page, you can view the challan which is required to be filled up with details such as applicable tax, the Permanent Account Number (PAN), the assessment year, and so on.

Step 7: Select ‘(0021) Income Tax (Other than Companies)’ option for paying income tax. The other option ‘(0020) Corporation Tax (Companies)’ will be applicable to companies for paying corporation tax.

Step 8: Next, select the correct ‘Type of Payment’ from the given options including – (100) Advance Tax, (102) Surtax, (106) Tax on Distributed Profit, (107) Tax on Distributed Income., (300) Self-Assessment Tax, and (400) Tax on Regular Assessment.

Step 9: Then, choose the mode of payment. The payment can either be made using ‘Net Banking’ or through ‘Debit Card’. Once you select the convenient option, click the bank name from the drop-down menu next to the selected option.

Step 10: Next, enter your PAN details and the relevant Assessment Year from the drop-down box. Note that the relevant assessment year for the period of 1 April 2018 – 31 March 2019 is 2019-20.

Step 11: In the next step, you will be required to fill up the details related to your address, district, state, pin code, e-mail ID, and mobile phone number.

Step 12: Then enter the ‘Captcha Code’ appearing on the screen in the field provided.

Step 13: Click on the ‘Proceed’ option and this will lead you to the ‘e-Payment page’ where you can make the payment of the income tax that you are liable to.

You can download Form 280 in PDF format using the link given below.