New Pan Card Form 49AA - Summary

This is an application for the allotment of a Permanent Account Number (PAN) for individuals who are not citizens of India, entities incorporated outside India, or unincorporated entities formed outside India. Applicants can obtain the PAN application form (Form 49AA) from any IT PAN Service Centers managed by UTIITSL, TIN Facilitation Centers (TIN-FCs) / PAN Centers managed by NSDL e-Gov, or any stationery vendor that provides such forms. You can also conveniently download the form in PDF format from the official websites of the Income Tax Department (www.incometaxindia.gov.in), UTIITSL (www.utiitsl.com), or NSDL e-Gov (www.tin-nsdl.com). Alternatively, you can use the download link provided below for easy access.

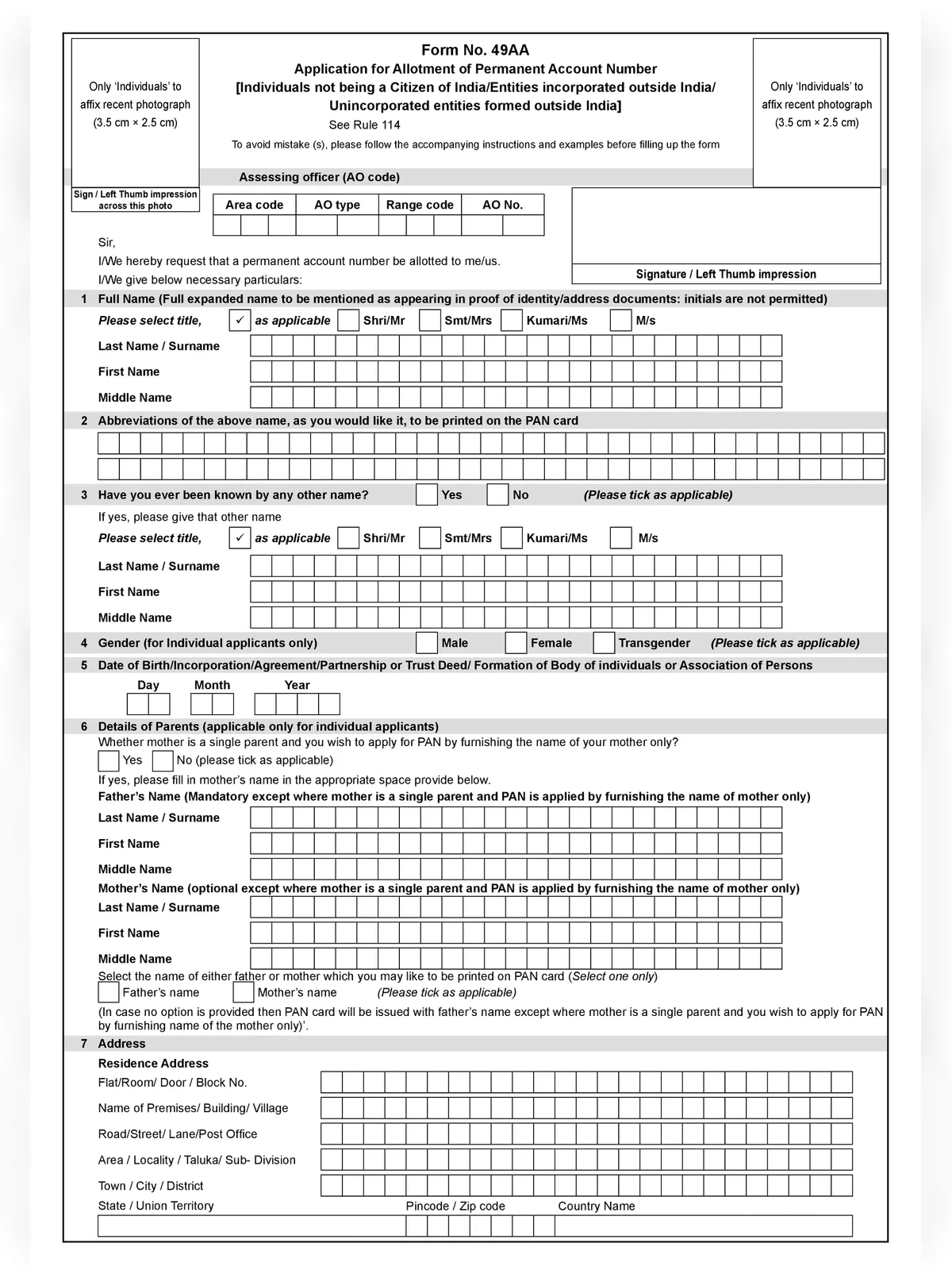

Details to Include in Form 49AA

Essential Information Required

- Full name of applicants and other personal details

- Permanent address

- Telephone number & email ID details

- Registration number (for companies, firms, etc.)

- Any other required details

Documents Required

- Proof of Identity – You can provide a copy of your passport, a copy of your Person of Indian Origin (PIO) card issued by the Government of India, a copy of your Overseas Citizen of India (OCI) card issued by the Government of India, or a copy of another national or citizenship identification number or taxpayer identification number duly attested by “Apostle” (for countries that are signatories to the Hague Convention of 1961), by the Indian Embassy, High Commission, or Consulate in your country, or authorized officials of overseas branches of Scheduled Banks registered in India.

- Proof of Address – You can provide a copy of your passport, a copy of your PIO card issued by the Government of India, or a copy of your OCI card issued by the Government of India.

The fee for processing the PAN application is as follows:

- If you require a physical PAN card, a fee of ₹107 (including goods & service tax) will need to be paid by the applicant. If the PAN card is to be dispatched outside India, an additional dispatch charge of ₹910 will also apply.

- If a physical PAN card is not needed, a fee of ₹72 (including goods & service tax) must be paid by the applicant. In such cases, applicants should clearly mention on the top of the application form, “Physical PAN Card not required.” Also, an email ID must be provided to receive the e-PAN card.

Application signatures are essential: it must be signed by (i) the applicant; (ii) Karta for HUF; (iii) Director of a Company; (iv) Authorized Signatory for AOP, body of individuals, local authority, and artificial juridical person; (v) Partner for Firm/LLP; (vi) Trustee; or (vii) Representative Assessor for a minor/deceased/idiot/lunatic/mentally retarded. Applications that are not signed correctly in the designated space are likely to be rejected.

For more information or to check your application status, you can contact:

Mode: Income-tax Department | NSDL e-Gov

Website: www.incometaxindia.gov.in | www.tin-nsdl.com

Call Center: 1800-180-1961 or 020-27218080

Email ID: [email protected]

You can download the New Pan Card Form 49AA in PDF format using the link below. Don’t forget to download it!