GST Return Filing Due Date - Summary

Understanding GST Return Filing Due Dates

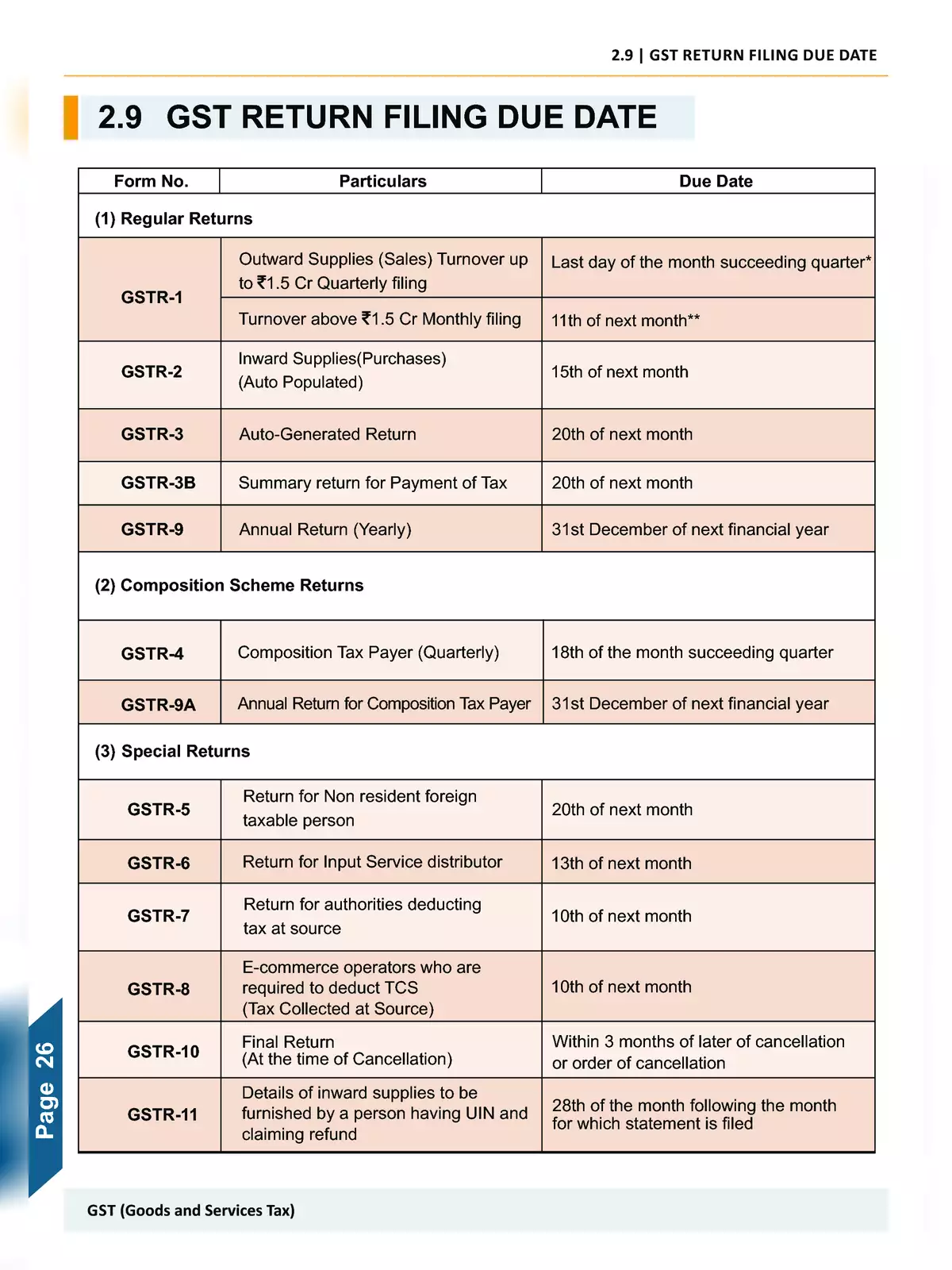

The GST Return Filing Due Date is an important aspect of the Goods and Services Tax system in India. Different returns such as GSTR 1, GSTR 2, GSTR 3B, GSTR 4, and others are filed under the GST Regime. Each of these returns has different due dates for filing, which you must keep in mind to ensure compliance and avoid any penalties.

Types of GST Returns

Let’s discuss the common types of GST returns: GSTR 1, GSTR 2, GSTR 3B, and GSTR 4. Each return serves a specific purpose and caters to different types of taxpayers.

GSTR 1 is a monthly or quarterly return that contains details of outward supplies made by the taxpayer. It is essential for maintaining the flow of input tax credit to the recipient. The due date for GSTR 1 varies based on the turnover, but it is usually filed on the 11th of the next month for monthly filers and on the 13th for quarterly filers.

GSTR 2 is the return that contains the details of inward supplies. However, it was made inactive, and taxpayers are advised to reconcile these details through GSTR 3B. For your business, GSTR 3B is crucial as it summarizes all the sales and purchases. The due date for GSTR 3B is generally the 20th of the following month, which means you need to file it promptly.

GSTR 4 is meant for taxpayers who are under the composition scheme. This scheme is for small taxpayers, making compliance simpler. The due date for GSTR 4 is usually the 18th of the month following the quarter.

Missing the due dates for filing these returns can lead to penalties and interest. Thus, it is advisable to keep a track of these important dates and ensure timely compliance. You can refer to more detailed information about each return in our PDF document, which is available for download below.

Staying updated with these due dates not only helps you in avoiding penalties but also ensures that you are in good standing with the tax authorities.

If you want to simplify your GST return filing process, make sure to download our comprehensive PDF guide, which provides detailed insights on due dates and filing procedures. This guide is designed to help you navigate the complexities of the GST system easily.