GSTR 1 Form - Summary

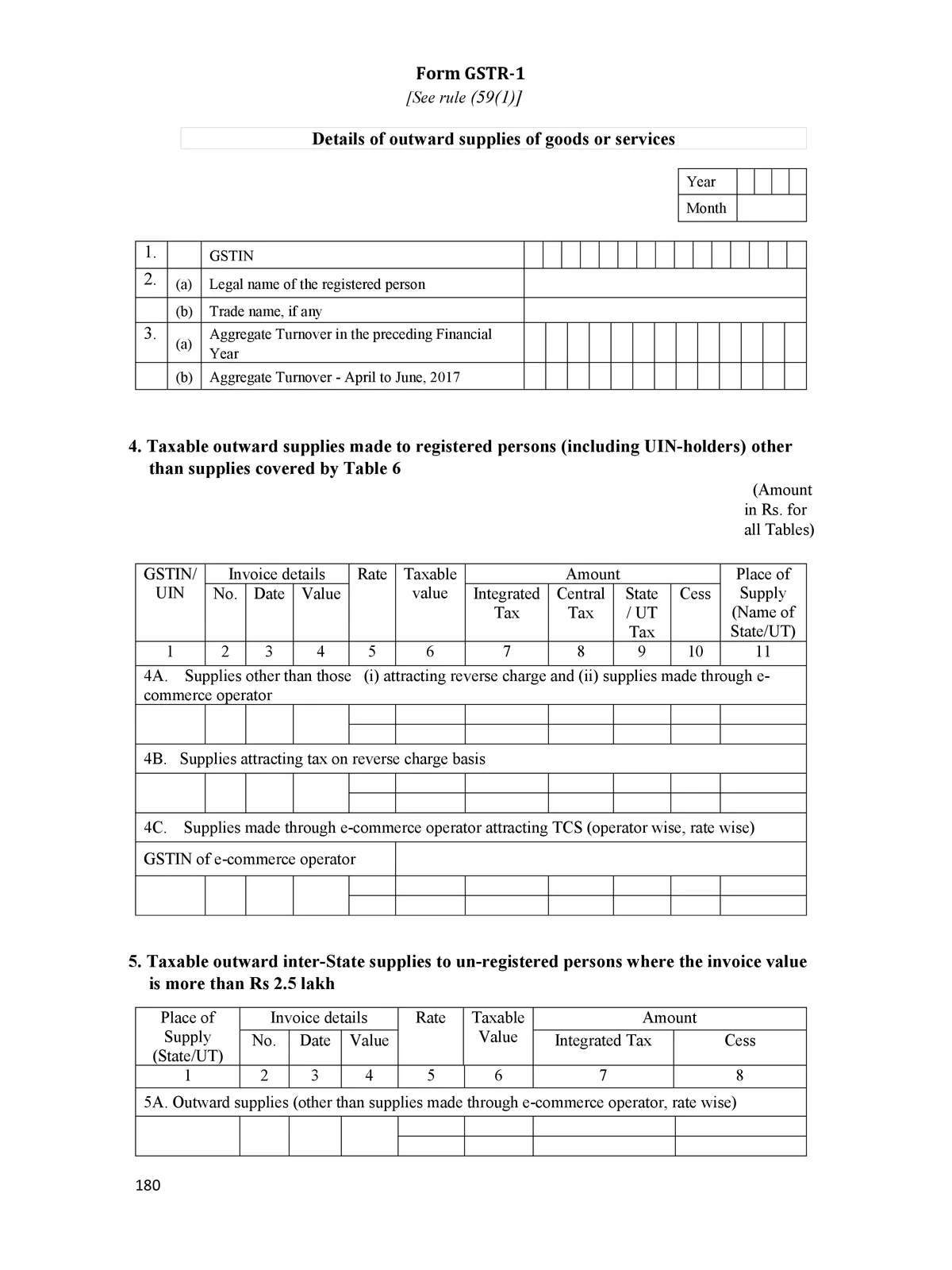

Hello, Friends! Today, we are excited to share the GSTR 1 Form PDF with you. The GSTR 1 Form is an essential document that details the outward supplies (i.e., sales of goods or provision of services) of goods or services or both. You can easily download the GSTR 1 Form PDF from the link provided at the bottom of this page.

Understanding the GSTR 1 Form

The GSTR-1 must be filed electronically by every registered person. This excludes Suppliers of Online Information and Database Access or Retrieval (OIDAR) services, Input Service Distributors, non-resident taxable persons, and others under special categories. Casual taxable persons are also required to file GSTR-1.

Information Required for the GSTR 1 Form

When filling out the GSTR 1 Form, you need to provide details about the outward supplies of goods or services or both. Here’s what to include in FORM GSTR-1:

Invoice-wise details of all:

- Inter-State and intra-State supplies made to registered persons;

- Inter-State supplies with an invoice value exceeding two and a half lakh rupees made to unregistered persons;

Consolidated details of all:

- Intra-State supplies made to unregistered persons for each tax rate;

- State-wise inter-State supplies with an invoice value up to two and a half lakh rupees made to unregistered persons for each tax rate;

- Any debit and credit notes issued during the month for previously issued invoices.

GSTR 1 Form Filing Timeline

The GSTR-1 return is to be filed for every tax period, even if no supplies of goods or services have been made during that time. Taxpayers can file this return directly through the common portal www.gst.gov.in or via a Facilitation Centre authorized by the Commissioner.

You can download the GSTR 1 Form PDF using the link given below.