Form GSTR -9C - Summary

If you are a taxpayer with an annual turnover exceeding Rs 2 crore, filing GSTR-9C is a must along with your GSTR-9. GSTR-9C is crucial as it reconciles the GST reported in your GSTR-9 (the annual GST return) with the GST from your audited financial accounts. Remember, GSTR-9 must be filed for each GSTIN associated with your business.

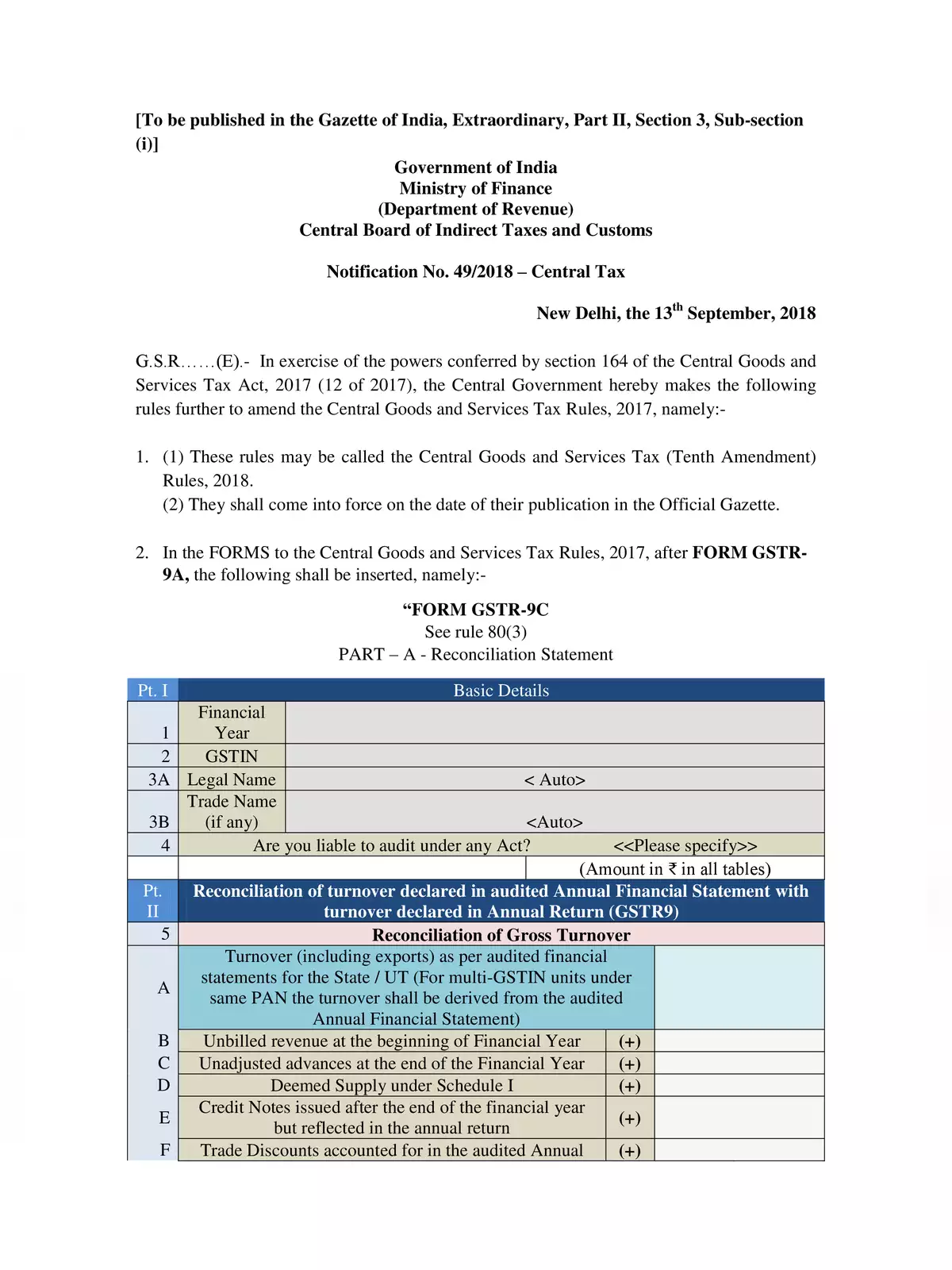

Understanding GSTR-9C

Filing GSTR-9C may seem challenging, but it’s a simple task once you get the hang of it. This form helps ensure that your GST returns align with your financial accounts, which is key for staying compliant with tax rules.

Why is GSTR-9C Important?

GSTR-9C is vital in the overall taxation process. It serves as a link between the taxes you report and the actual taxes according to your financial records. Accurately filing this form can help taxpayers avoid penalties and interest caused by discrepancies.

For detailed guidance on filing GSTR-9C, you can download the relevant PDF below. Ensure you gather all necessary documents to make your filing process smoother. Remember, accurate filing not only meets your legal obligations but also helps you build a strong reputation in the business community. 📄