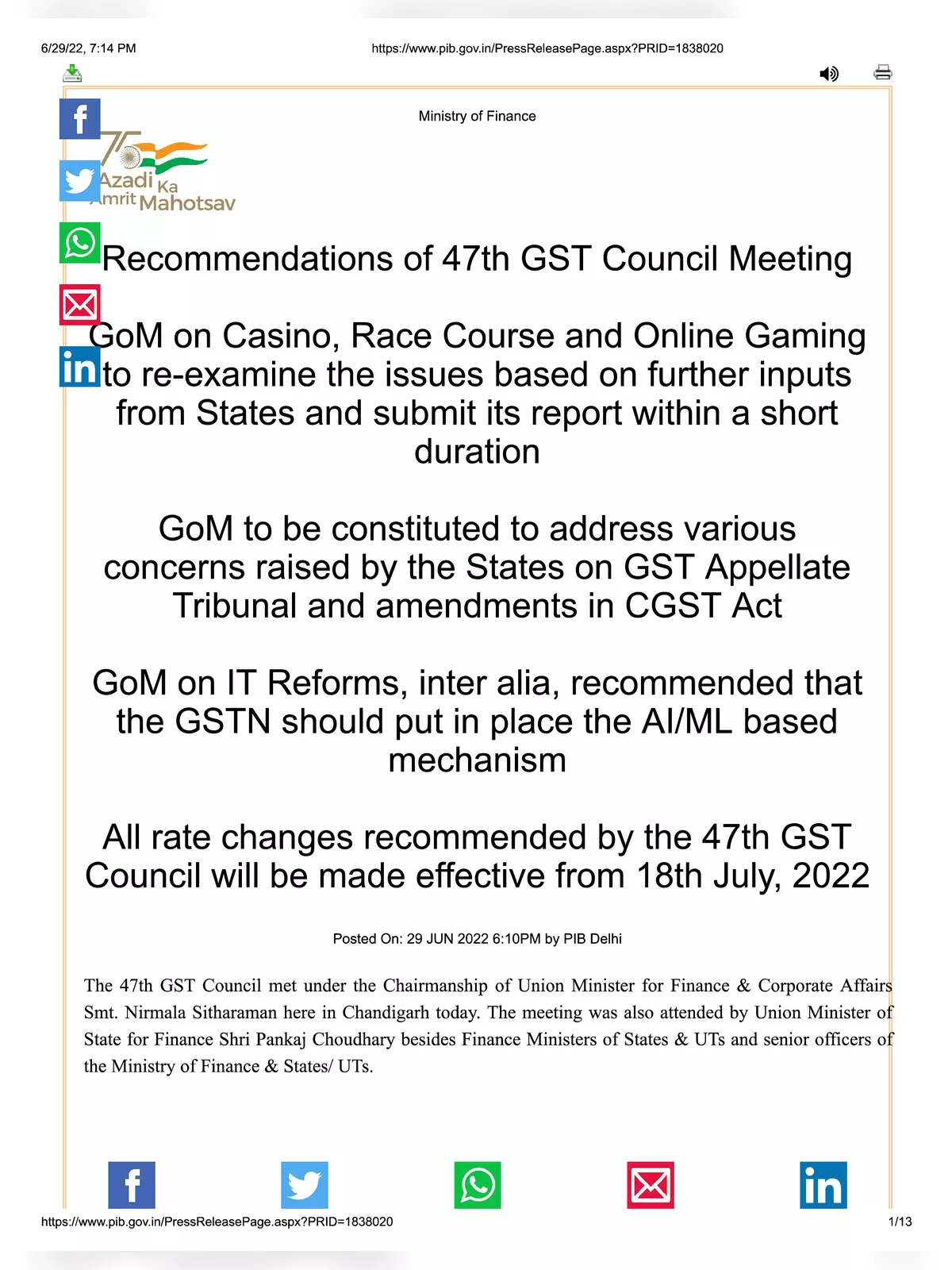

47th GST Council Meeting Notification - Summary

The Central Board of Indirect Taxes and Customs (CBIC) issued six new CGST notifications on 5th July 2022. Most of these are to implement the decisions taken at the 47th GST Council meeting. The Central Tax Notification number 14/2022 has altered some parts of the form GSTR-3B (monthly/quarterly summary return for regular taxpayers).

As per the 47th GST Council Meeting Notification PDF, taxpayers can find new table 3.1.1 to separately report e-commerce sales classified under Section 9(5). E-commerce operators must furnish details in Clause (i) for sales made through them on which they pay taxes. At the same time, Clause (ii) must be reported by the e-commerce supplier or e-tailer. Corresponding changes are made in Table 3.2 and the instructions for accommodating the above new table.

47th GST Council Meeting Notification – GST Rate 2022

| S. No. | Description | Existing Rate | New Rate |

|---|---|---|---|

| 1. | Printing, writing or drawing ink | 12% | 18% |

| 2. | Knives with cutting blades, Paper knives, Pencil sharpeners and blades, therefor, Spoons, forks, ladles, skimmers, cake-servers etc., | 12% | 18% |

| 3. | Power driven pumps primary designed for handling water such as centrifugal pumps, deep tube-well turbine pumps , submersible pumps, Bicycle pumps, | 12% | 18% |

| 4 | Machines for cleaning, sorting or grading, seed, grain pulses, Machinery used in milling industry or for the working of cereals etc., Pawan Chakki that is Air Based Atta Chakki, Wet grinder. | 5% | 18% |

| 5. | Machines for cleaning, sorting or grading eggs, fruit or other agricultural produce and its part ,, Milking machines and dairy machinery. | 12% | 18% |

| 6. | LED Lamps, lights and fixture, their metal printed circuits board, | 12% | 18% |

| 7. | Drawing and Marking out instruments. | 12% | 18% |

| 8. | Solar Water Heater and System. | 5% | 12% |

| 9. | Prepared/ finished leather/chamois /composition leathers, | 5% | 12% |

| 10. | Refund of accumulated ITC not to be allowed on following goods: (i). Edible oils, | —– | —- |

With regards to Supply of Services

| S.No. | Description | Existing Rate | New Rate |

|---|---|---|---|

| 1. | Services supplied by foreman to chit fund. | 12% | 18% |

| 2. | Job work in relation to processing of hides, skins and leather | 5% | 12% |

| 3. | Job work in relation to manufacturing of leather goods and footwear. | 5% | 12% |

| 4. | Job work in relation to manufacturing of clay bricks. | 5% | 12% |

| 5. | Works contract for roads, bridges, railways, metro, effluent treatment plant, crematorium etc., | 12% | 18% |

| 6. | Works contract supplied to Central and State Government, Local authorities for historical monuments , canals, pipelines, plant for water supply, educational institutions, hospitals etc., & sub-contractor thereof | 12% | 18% |

| 7. | Works contract supplied to Central and State Government, Union territories and Local authorities involving predominantly earthwork and sub-contract thereof | 5% | 12% |

For more details download the 47th GST Council Meeting Notification PDF using the link given below.