Form No- 26QB Statement of Deduction of Tax - Summary

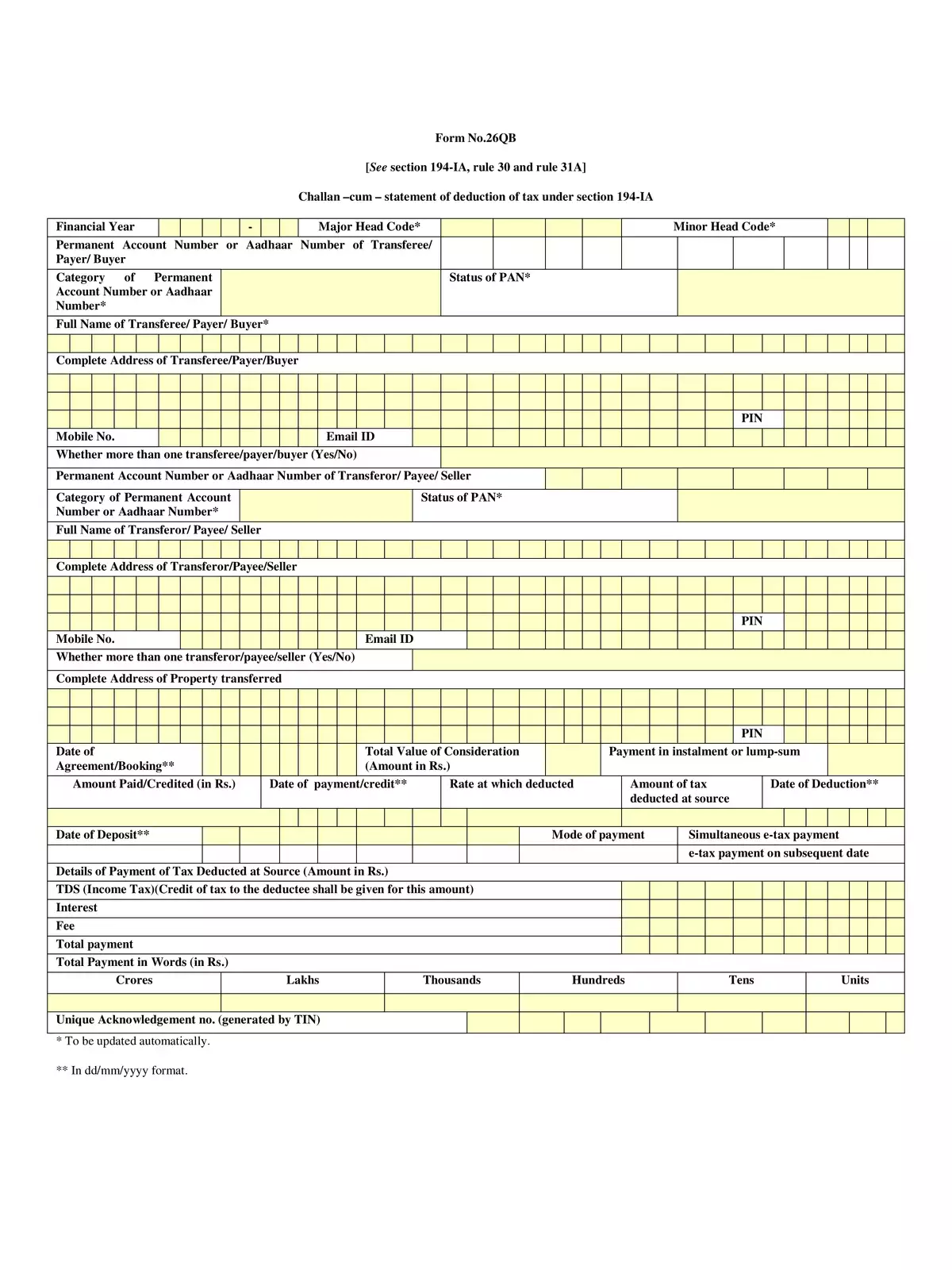

Download the Form No – 26QB Statement of Deduction of Tax in PDF format here. The Form 26QB is essential for the Statement of Deduction of Tax, which serves as a return cum challan for TDS payments to the government. Additionally, Form 16B is a certificate that the buyer issues to the seller for the TDS that has been deducted. Each buyer must fill out the Form 26QB challan for every unique buyer-seller combination concerning their respective share.

Understanding Form No- 26QB

Form No- 26QB plays a crucial role in the TDS procedure for property sales. It ensures that the tax deducted at source (TDS) is accurately recorded, making sure the government receives the tax payments due. Proper use of Form 26QB helps in maintaining transparency and compliance in real estate transactions.

Form No- 26QB Statement of Deduction of Tax (Procedure)

Steps to fill Form 26QB:

- Go to the TIN NSDL website ( www.tin-nsdl.com ).

- Under ‘TDS on sale of the property’, click on “Online form for furnishing TDS on property (Form 26QB)” or click here.

- Select the applicable challan as “TDS on Sale of Property”.

- Fill the complete form as required. (Be prepared with the following information while filling Form 26QB:

- PAN of the seller & buyer

- Contact details of seller & buyer

- Details of the property

- Amount paid/credited & details of tax deposit

- Submit the fully completed form to proceed. A confirmation screen will appear. After confirming, a new screen will show two buttons: “Print Form 26QB” and “Submit to the bank”. A unique acknowledgment number will also be generated on the screen, and it’s wise to save this number for future reference. Click on “Print Form 26QB” to print the form, then click on “Submit to the bank” to make your payment online using internet banking. You can choose from various bank’s internet banking options. For a list of authorized banks, please visit https://onlineservices.tin.egov-nsdl.com/etaxnew/Authorizedbanks.html.

- Once the payment is successful, a challan counterfoil will be displayed, which contains the CIN, payment details, and the bank name through which the e-payment was made. This counterfoil acts as proof of your payment.

You can easily download the Form No- 26QB Statement of Deduction of Tax in PDF format online from the link provided below. Don’t forget to download your PDF for your records! 📄