Income Tax Forms 2019-20

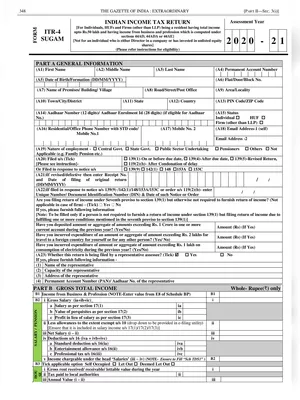

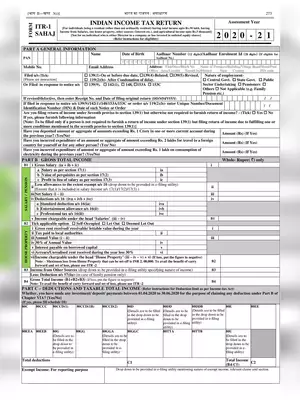

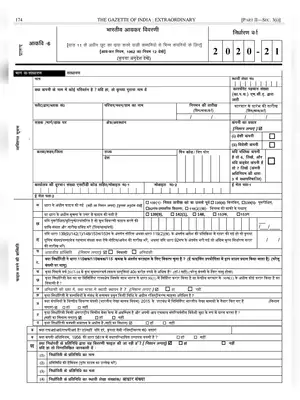

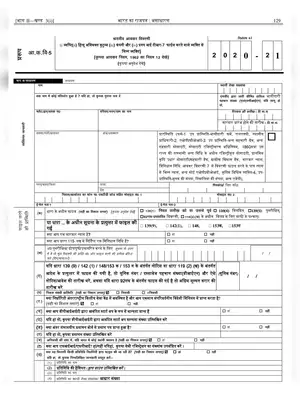

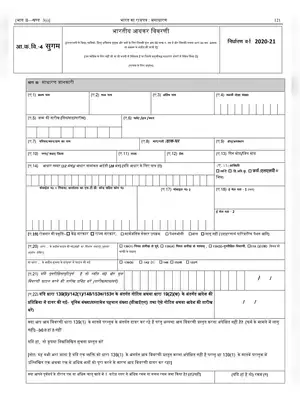

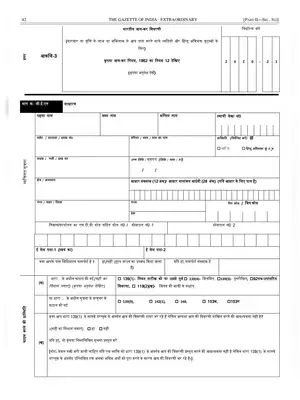

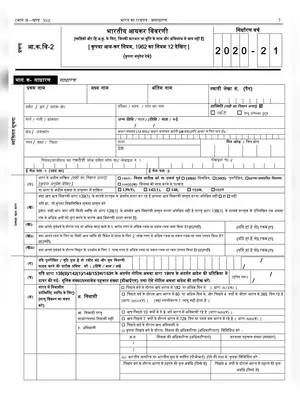

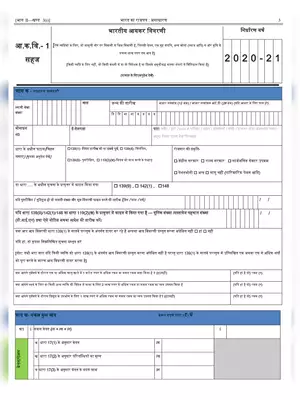

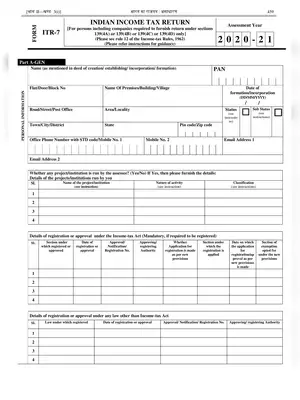

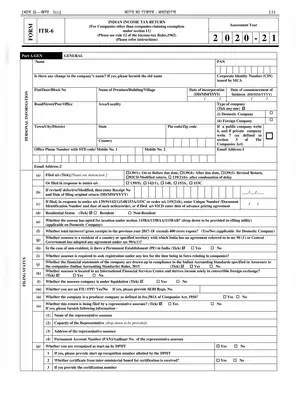

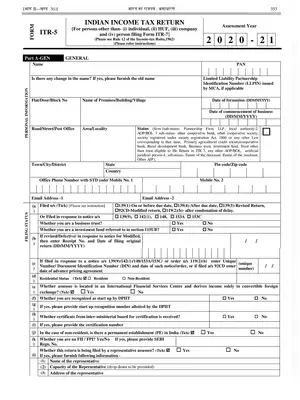

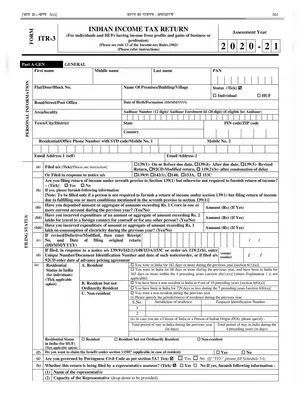

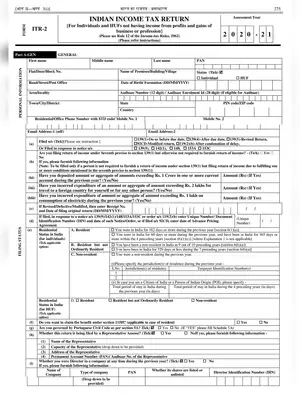

The Central Board of Direct Taxes (CBDT) on May 30 notified Sahaj (ITR-1), Form ITR-2, Form ITR-3, Form Sugam (ITR-4), Form ITR-5, Form ITR-6, Form ITR-7 and Form ITR-V for the assessment year 2020-21 (income earned between April 1, 2019, to March 31, 2020).

The new ITR forms require taxpayers to furnish details of specified high-spend transactions, such as deposit of Rs 1 crore or more in a current account, the expenditure of Rs 2 lakh or more on foreign travel or spending of Rs 1 lakh or more on the consumption of electricity, in case such persons are otherwise not required to income tax returns.