HSN Code List 2025 - Summary

GST taxpayers having a turnover of more than Rs 5 crore in the preceding financial year, to furnish 6 digit HSN Code (Harmonised System of Nomenclature Code). This comes into effect from April 1. This is applicable for SAC (Service Accounting Code) on the invoices issued for supplies of taxable goods and services.

A taxpayer having a turnover of up to Rs 5 crore in the preceding financial year is required to furnish 4 digit HSN code on B2B invoices. Earlier, the requirement was 4 digits and 2 digits respectively. HSN Code List 2022 PDF can be downloaded from the link given at the bottom of this page.

HSN Code List 2025 How to Download

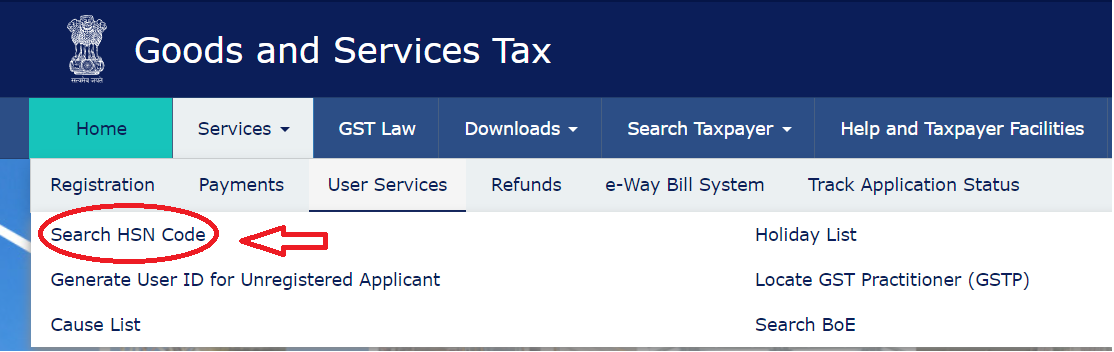

Step 1:- Firstly visit the official website GST Website https://www.gst.gov.in/

Step 2:- At the home page click on “Service” and then click on “User Service” After that “Search HSN Code” link will appear as the image shown below.

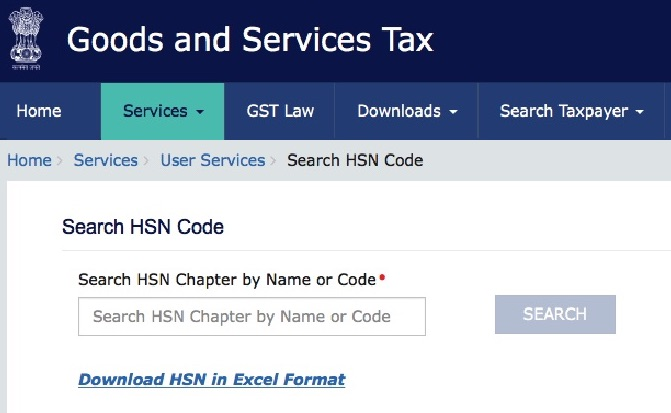

Step 3 :- Now after clicking on “Search HSN Code” a new window is open in which you can search the HSN Code by Digit as image shown below.

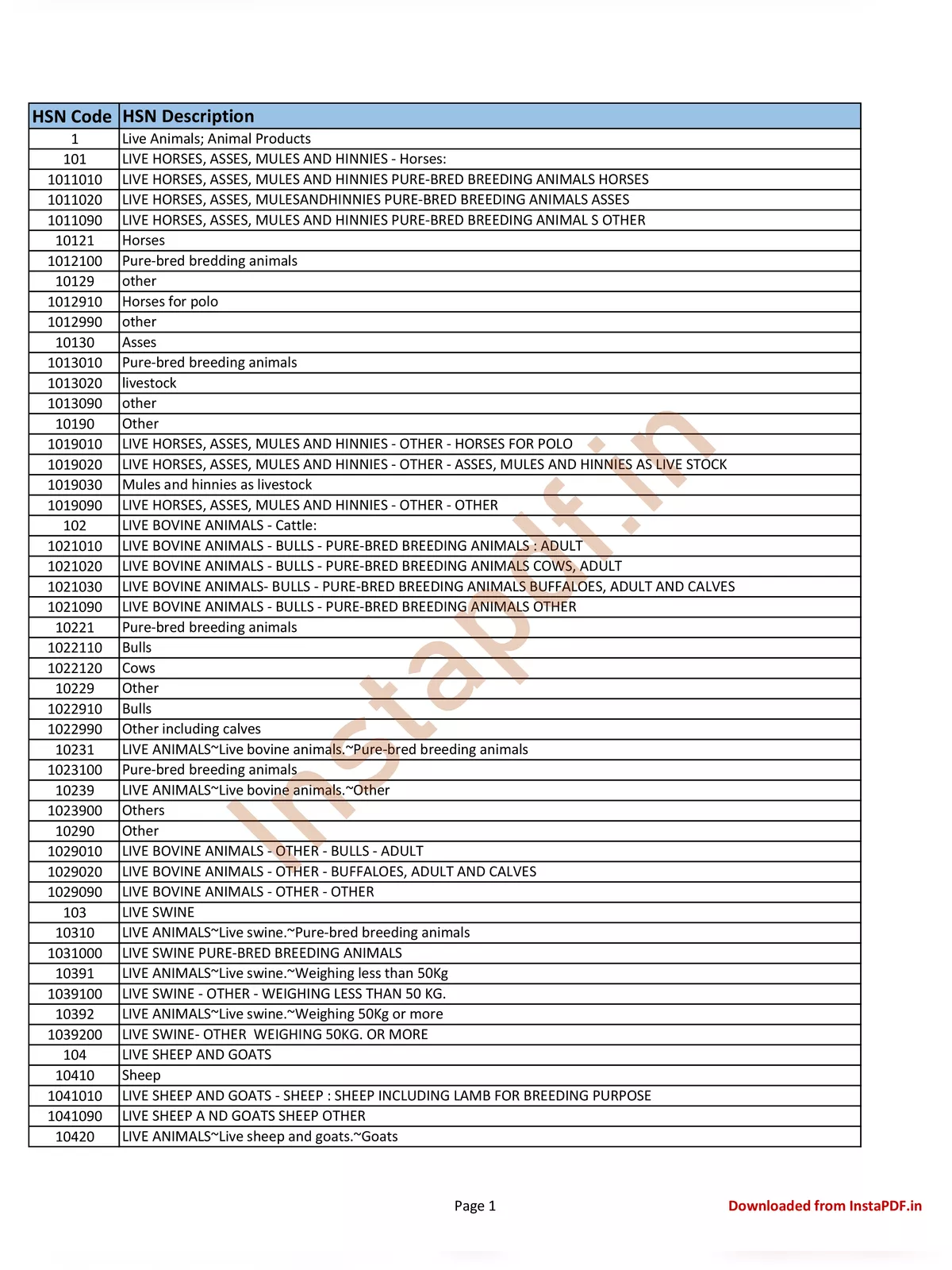

HSN Code Description

The use of HSN codes are mainly for dealers and trades. They must adopt 2 digits, 4 digits, and 8 digits HSN codes depending upon the following criteria.

- If the business turnover is less than Rs.1.5 crores then there is no need of adopting the HSN codes.

- If the business turnover is between Rs.1.5 Crs to Rs. 5 Crs then, they must adopt 2-digit HSN codes for the business trades.

- If the business turnover is above Rs.5 Crs then, they must adopt 4-digit HSN codes for the business.

In the case of Import and export dealings and international trades, one must adopt 8-digit HSN codes for business trades.

Latest HSN Code in Excel Format

HSN Code List Chapter Wise

| Serial No / Chapter No’s | Description |

| Chapter 1 | Live Animals and poultry |

| Chapter 2 | Animal Meat and edible offals |

| Chapter 3 | Fish, fillets and other aquatic animals meat |

| Chapter 4 | Honey, Eggs and Dairy Products |

| Chapter 5 | Inedible animal products (unspecified) |

| Chapter 6 | Flowers, Live trees and plants |

| Chapter 7 | Vegetables |

| Chapter 8 | Fruits |

| Chapter 9 | Tea, coffee, spices |

| Chapter 10 | Cereals and Grains |

| Chapter 11 | Milling Industry Products |

| Chapter 12 | Medicinal Plants, seeds and fruits |

| Chapter 13 | Lac, Gums, Resins, vegetable SAP and other extracts |

| Chapter 14 | Vegetable products and materials (unspecified) |

| Chapter 15 | Oils, Fats, Vegetable and Animal products |

| Chapter 16 | Fish and aquatic vertebrates meat (Prepared/Preserved) |

| Chapter 17 | Sugar, sugar confectionery and bubble gums |

| Chapter 18 | Cocoa and Cocoa products |

| Chapter 19 | Pastry, pizza, bread, waffles |

| Chapter 20 | Fruits, Juices, Jams and Jellies |

| Chapter 21 | Tea, coffee and other edible preparations |

| Chapter 22 | Non-alcoholic beverages, Spirit and Vinegar |

| Chapter 23 | Residual starch products, meals, and pellets |

| Chapter 24 | Tobacco and tobacco products |

| Chapter 25 | Salts and Marbles |

| Chapter 26 | Mineral ores and concentrates |

| Chapter 27 | Coal, Petroleum and other fossil fuels |

| Chapter 28 | Gases and Inorganic Chemicals |

| Chapter 29 | Hydrocarbons |

| Chapter 30 | Blood and Pharma products |

| Chapter 31 | Fertilizers and unspecified products |

| Chapter 32 | Colouring and Tanning products |

| Chapter 33 | Cosmetics and oils |

| Chapter 34 | Soaps and waxes |

| Chapter 35 | Glues and Enzymes |

| Chapter 36 | Industrial explosives and fireworks |

| Chapter 37 | Photographic and cinematographic goods |

| Chapter 38 | Chemicals and clinical wastes |

| Chapter 39 | Plastic products |

| Chapter 40 | Rubber and rubber products |

| Chapter 41 | Skins and rawhides |

| Chapter 42 | Leather products: Bags, wallets, and handbags |

| Chapter 43 | Raw and artificial fur products |

| Chapter 44 | Wood products and Wood charcoal |

| Chapter 45 | Natural and Shuttlecock Cork |

| Chapter 46 | Basketware, of esparto or of other plaiting materials; wickerwork and manufacturers of Straw |

| Chapter 47 | Wood Pulp |

| Chapter 48 | Paper, Paperboard, Newsprint |

| Chapter 49 | Printed Books, Newspapers and Postal goods |

| Chapter 50 | Silk |

| Chapter 51 | Fine, woolor coarse animal hair; woven fabric and horsehair yarn |

| Chapter 52 | Cotton |

| Chapter 53 | paper yarn and woven fabrics of paper yarn and Other vegetable textile fibres |

| Chapter 54 | Man-made filaments |

| Chapter 55 | Man-made staple fibres |

| Chapter 56 | Cables, ropes, felt and nonwovens, cordage, wadding; special yarns; twine and articles thereof |

| Chapter 57 | Carpets and other textile floor coverings |

| Chapter 58 | Fabrics of tufted textile, lace; tapestries,trimmings; embroidery |

| Chapter 59 | Coated and laminated textile fabrics, special woven fabrics, |

| Chapter 60 | Knitted or crocheted fabrics |

| Chapter 61 | Accessories of clothing knitted or crocheted and articles of apparel |

| Chapter 62 | Clothing accessories not knitted or crocheted articles of apparel |

| Chapter 63 | Other textile articles, sets, worn clothing and rags, worn textile articles |

| Chapter 64 | Footwear, gaiters, and parts of such articles |

| Chapter 65 | Headgear parts thereof |

| Chapter 66 | Umbrellas, walking stick and accessories |

| Chapter 67 | Wigs, artificial flowers, false beards |

| Chapter 68 | Cement, Plaster, mica and construction materials |

| Chapter 69 | Bricks and ceramic products |

| Chapter 70 | Glass and glassware products |

| Chapter 71 | Gold, silver, diamond, pearls and other precious metals |

| Chapter 72 | Iron, steel, Iron rods and non-alloy products |

| Chapter 73 | Railway tracks, iron tube, Containers, nails, needles and sanitary wares |

| Chapter 74 | Copper and copper alloy products |

| Chapter 75 | Nickel and nickel alloy products |

| Chapter 76 | Aluminium and aluminium products |

| Chapter 77 | (Reserved for possible future use) |

| Chapter 78 | Lead, lead foils and sheets |

| Chapter 79 | Zinc bars,Zinc dust and sheets |

| Chapter 80 | Tin, tin bars and profiles |

| Chapter 81 | Cobalt, Magnesium, Bismuth and other base metals |

| Chapter 82 | Agricultural tools, cutlery, razors and knives |

| Chapter 83 | Padlocks, bells, safe deposit lockers and base metal products |

| Chapter 84 | Industrial tools and machinery |

| Chapter 85 | Electrical and electronic products |

| Chapter 86 | Railway machinery and locomotives |

| Chapter 87 | Motor vehicles |

| Chapter 88 | Aircraft, satellites, parachutes |

| Chapter 89 | Boats, ships, cargo vessels |

| Chapter 90 | Artificial organs, Medical equipment, monitoring systems, photographic, cinematographic accessories, lens and optical fibres |

| Chapter 91 | Watches and clocks |

| Chapter 92 | All Musical Instruments |

| Chapter 93 | Arms and Military weapons |

| Chapter 94 | Lighting, furniture and household products |

| Chapter 95 | Electronic toys, sports goods and gaming consoles |

| Chapter 96 | Pens, pencils, educational equipment and smoking pipes |

| Chapter 97 | Arts and Antiques |

| Chapter 98 | Passenger baggage, laboratory chemical and project imports |

| Chapter 99 | Services |

HSN Code List

You can download the GST HSN Code List PDF format online from the link given below.