HSN SAC Code List - Summary

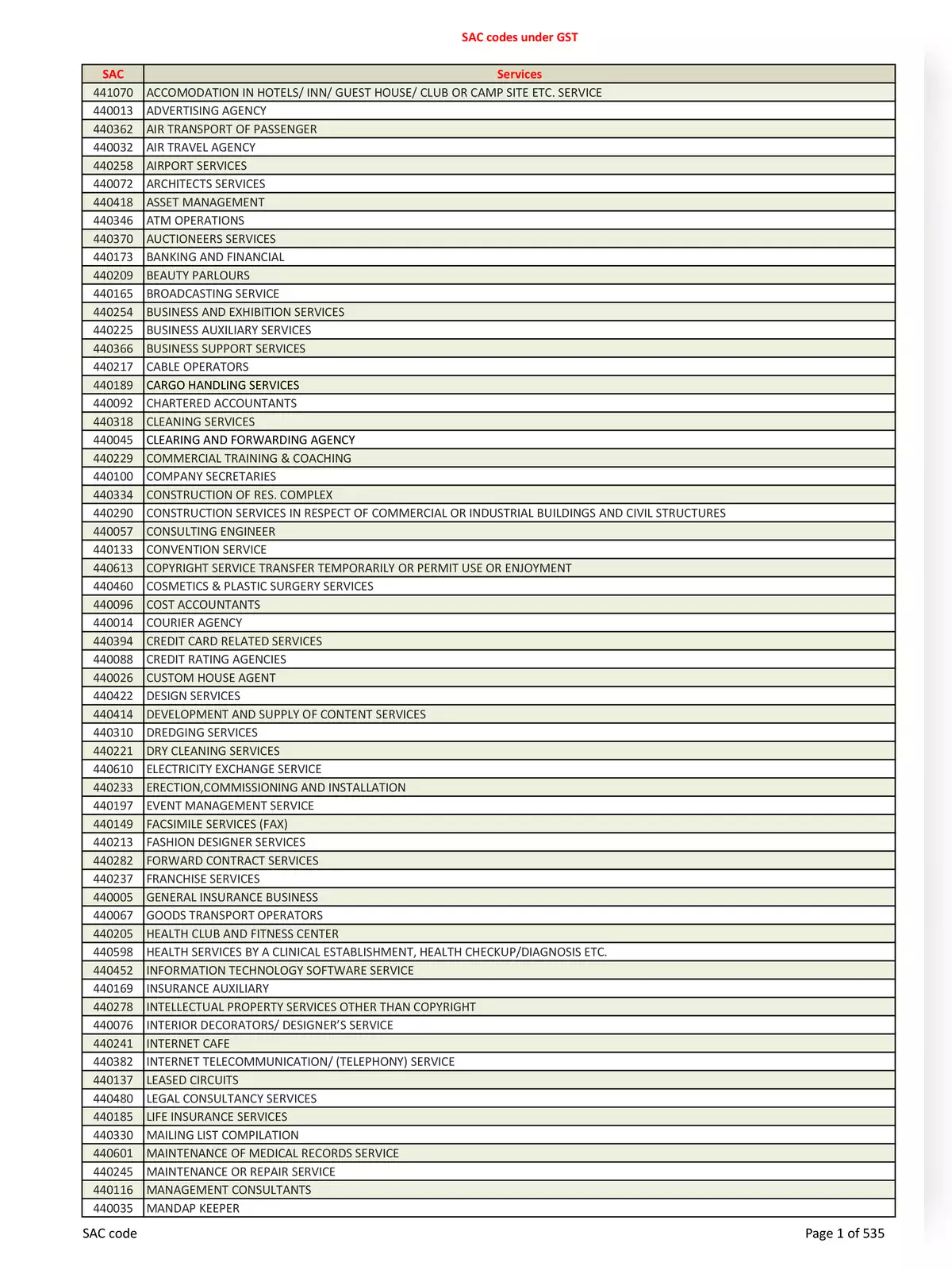

SAC codes (Services Accounting Code) are essential for classifying services under GST. These important codes are issued by the CBEC to provide a standard method of classifying all types of services. We have compiled the HSN code information from the master codes published in the NIC’s GST e-Invoice system. Please be aware that there may be changes over time due to updates from the government. The SAC code signifies the Services Accounting Code under which services are classified under GST.

Understanding SAC Codes for GST

SAC codes play a vital role in helping businesses and individuals understand how services are taxed under GST. By utilizing these codes, you can ensure that you’re complying with the law correctly and paying the correct amount of tax.

Latest HSN SAC Code Information

For the most accurate and up-to-date information, it is crucial to refer to official government sources. Keeping track of any changes in these codes will assist in avoiding compliance issues in the future.

You can download the HSN SAC Code List in PDF format using the link given below.