GST Exempted Goods List - Summary

What is GST Exemption

GST, which stands for Goods and Services Tax, is a special tax that people and businesses have to pay when they buy or sell things. But, not everything gets this special tax. Some things are so important or necessary that the government decides not to charge this tax on them to make them more affordable.

So, when we talk about GST exemption in India, it means that certain things, like important stuff we need every day and some services, don’t have to pay this special tax. This helps people afford things they really need, like food and basic services, and it also helps certain parts of our economy. Just remember, the rules about what doesn’t have to pay GST can change, so it’s important to check with adults or experts to know which things are exempt from GST right now.

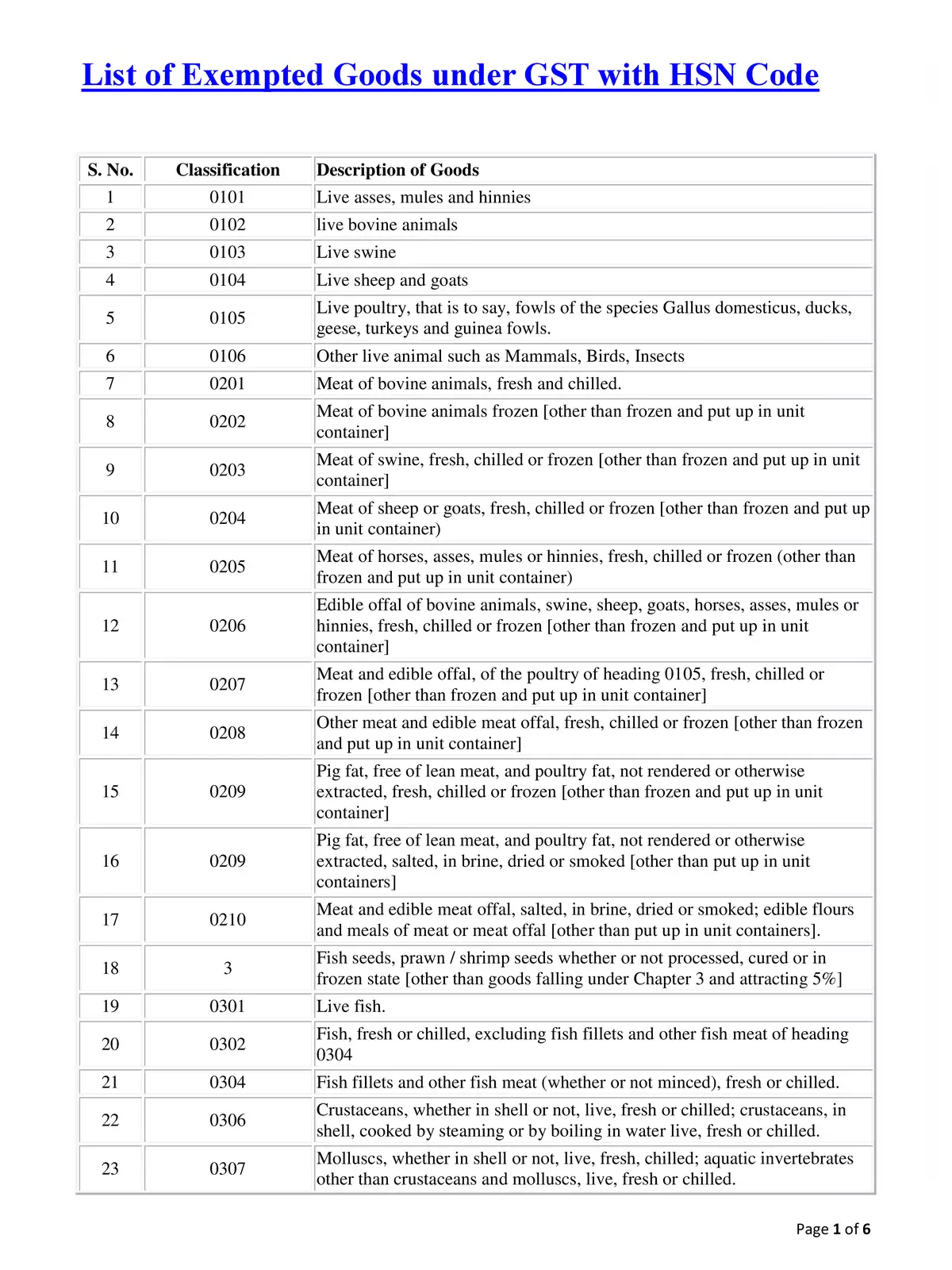

List of GST Exempted Goods

Below is the complete list of Exempted Goods Under GST with HSN code download in PDF format.

| Types of goods | Examples |

|---|---|

| Fossil fuels | Coal, oil, natural gas |

| Grains | Wheat, rice, oats, barley, etc. |

| Fish | Fresh or frozen fish |

| Fruits | Bananas, grapes, apples, etc. |

| Vegetables | Tomatoes, potatoes, onions, etc. |

| Meat | Fresh and frozen meat of sheep, cows, goats, pigs, horses, etc. |

| Dry fruits | Cashew nuts, walnuts, etc. |

| Natural products | Honey, fresh and pasteurized milk, cheese, eggs, etc. |

| Live animals | Asses, cows, sheep, goats, poultry, etc. |

| Live trees and plants | Bulbs, roots, flowers, foliage, etc. |

| Seeds | Flower seeds, oil seeds, cereal husks, etc. |

| Products of the milling industry | Flours of different types |

| Tea, coffee and spices | Coffee beans, tea leaves, turmeric, ginger, etc. |

| Sugar | Sugar, jaggery, etc. |

| Water | Mineral water, tender coconut water, etc. |

| Baked goods | Bread, pizza base, puffed rice, etc. |

| Drugs and pharmaceuticals | Medicines, human blood, contraceptives, etc. |

| Fertilizers | Chemical fertilizers, organic manure |

| Beauty products | Bindi, kajal, kumkum, etc. |

| Waste | Sewage sludge, municipal waste, etc. |

| Ornaments | Plastic and glass bangles, etc. |

| Newsprint | Judicial stamp paper, envelopes, rupee notes, etc. |

| Printed items | Printed books, newspapers, maps, etc. |

| Fabrics | Raw silk, silkworm cocoon, khadi, etc. |

| Hand tools | Spade, hammer, etc. |

| Pottery | Earthen pots, clay lamps, etc. |

The examples above are not the actual GST exempted goods, so, please check the latest GST Goods rate list for clarification.