Form 15H HDFC Bank - Summary

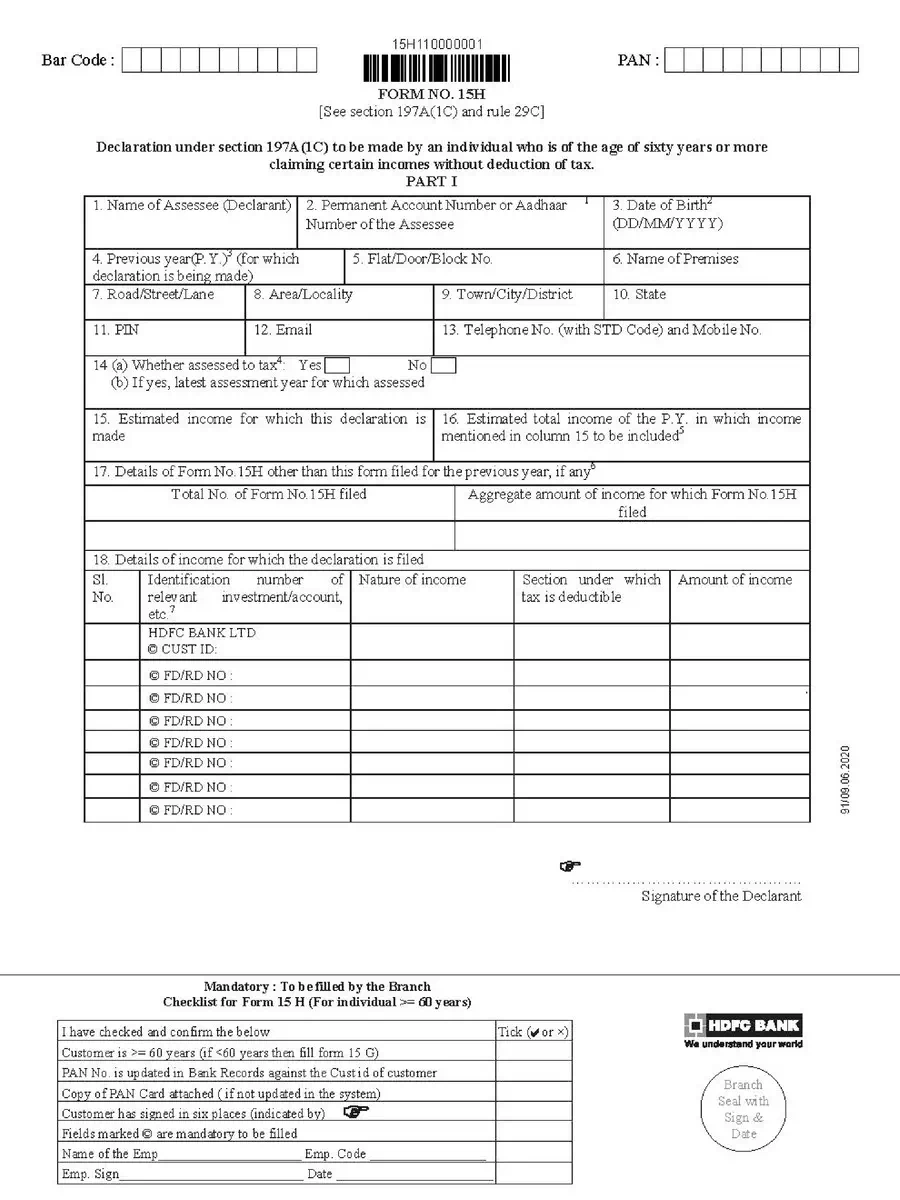

Form 15H HDFC Bank is a significant self-declaration form that helps individuals aged 60 and above to save on Tax Deducted at Source (TDS) for the interest income earned from fixed deposits. To prevent unnecessary deductions, the taxpayer needs to submit this declaration form to their banker.

Understanding Form 15H

Form 15H must be submitted at the start of each financial year to the relevant financial institution, such as HDFC Bank. By doing this, fixed deposit holders can avoid TDS on the interest they earn.

It is very important for taxpayers to submit Form 15H within the specified time to qualify for TDS exemption. For example, Form 15H can be submitted in the first week of July 2020. Any forms submitted for the financial year 2021-22 will serve as valid proof for non-deduction of TDS from 1st April 2021 to 30th June 2021.

How to Download Form 15H

You can easily download the HDFC Bank Form 15H in PDF format online from the official website link given below.