Form 15H For PF Withdrawal - Summary

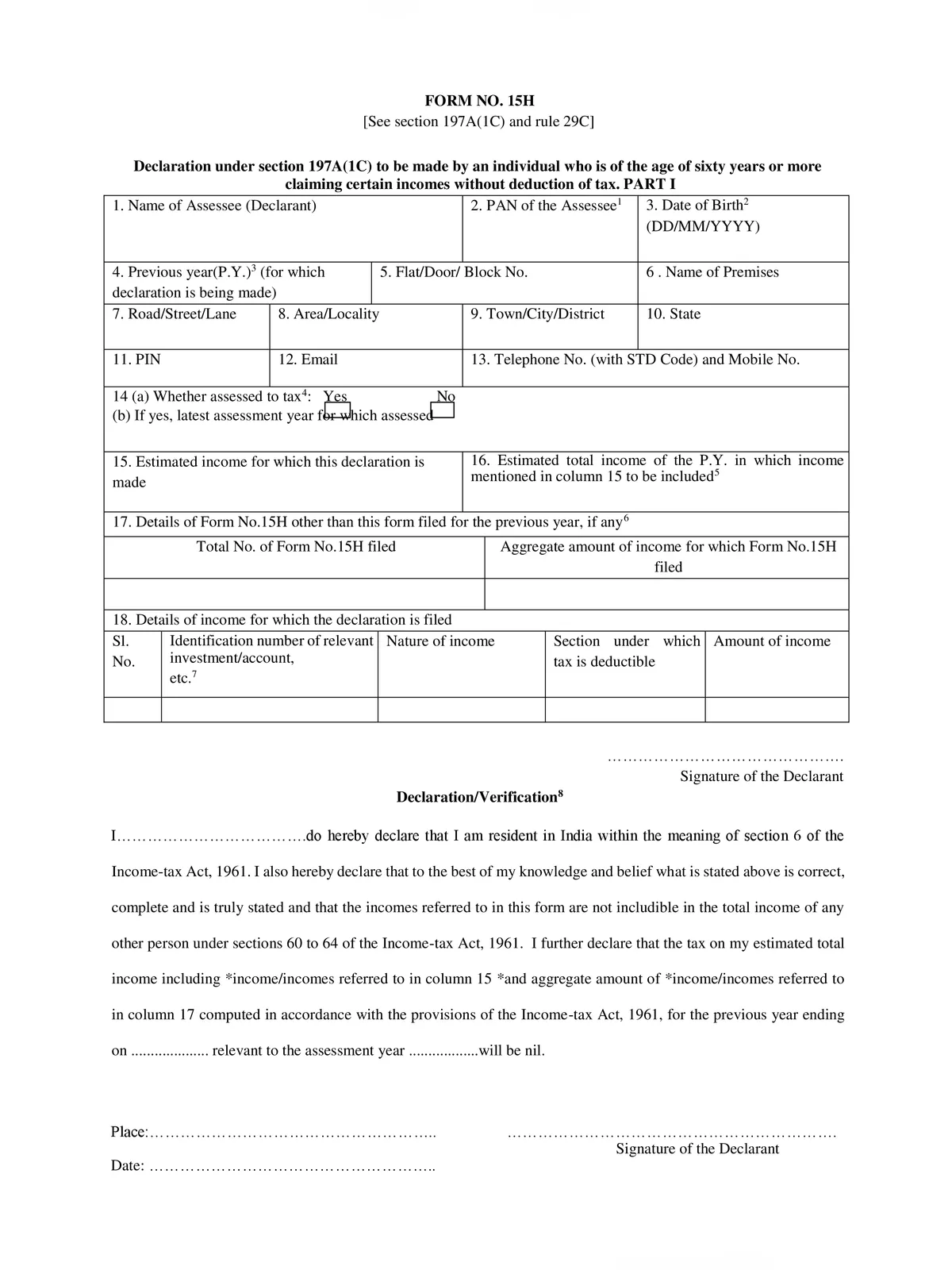

Form 15H Declaration under section 197A (1) and section 197A(1A) to be made by an individual or a person (not being a company or firm) claiming certain incomes without deduction of tax for PF Withdrawal.

As per the income tax rules, it’s mandatory for banks to deduct tax at source (TDS) in case the interest earned on your fixed deposit, recurring deposit, etc. It is more than Rs. 10,000 in a financial year. However, in the case of Form 15G or 15H is submitted by the member, then TDS is not deducted. These forms are to declare that their income would not be taxable after receiving payment of their PF accumulations from retirement fund body EPFO.

Form 15G for PF Withdrawal

- Login to EPFO UAN Unified Portal for members.

- Click on the ONLINE SERVICES option – Claim (Form 31, 19, 10C).

- Verify the last 4 digits of your bank account

- Below the option, ‘I want to apply for’, click on Upload form 15G as depicted in the image

Form 15G has two sections. The first part is meant for individuals who want to claim no-deduction of TDS on certain incomes. The following are the fields you need to fill out in the first segment of Form 15G:

Field (1) Name of the Assessee (Declarant) – Name as mentioned on your PAN Card

Field (2) PAN of the Assessee: Valid PAN card is mandatory to file Form 15G. If you don’t have valid PAN details, your declaration will be treated as invalid. Declaration in Form 15G can be provided by an individual but not by any firm or company.

Field (3) Status: Your income tax status which can be Individual/ Hindu Undivided Family(HUF)/ AOP, whatever is applicable to you

Field (4) Previous Year: You have to select the previous year as the financial year for which you are claiming the non-deduction of TDS.

Field (5) Residential Status: Mention your residential status as a resident individual because NRI is not allowed to submit Form 15G.

Fields (6-12) Address: Mention your communication address correctly along with PIN code.

Fields (13-14) Email id and phone number: Provide valid email ID and contact number for further communications.

Field 15 (a) Whether assessed to tax under the Income-tax Act, 1961: Tick mark ‘’Yes’’ if you were assessed to tax under the provisions of Income Tax Act, 1961 for any of the previous assessment years.

(b) If yes, latest assessment year for which assessed: Mention the latest assessment year for which the returns were assessed.

Field (16) Estimated income for which this declaration is made: In this field, the estimated income for which you are making declaration needs to be mentioned

Field (17) Estimated total income of the P.Y. in which income mentioned in column 16 to be included: Total estimated income for the financial year (which includes all the income)

Field (18) Details of Form No. 15G other than this form filed during the previous year, if any: If you have already filed Form 15G anytime during the financial year, then the details of the previous declaration along with an aggregate amount of income need to be mentioned in the present declaration.

Field (19) Details of income for which the declaration is filed: Last part of section 1 asks you to fill investment details for which you are filing the declaration. You need to provide the investment account number (term deposit/ life insurance policy number/ employee code etc)

Once you are done with filling the entire fields, cross-check all the details meticulously to ensure there is no error.

Download the Form 15H For PF Withdrawal in PDF format using the link given below.