Form 15H SBI - Summary

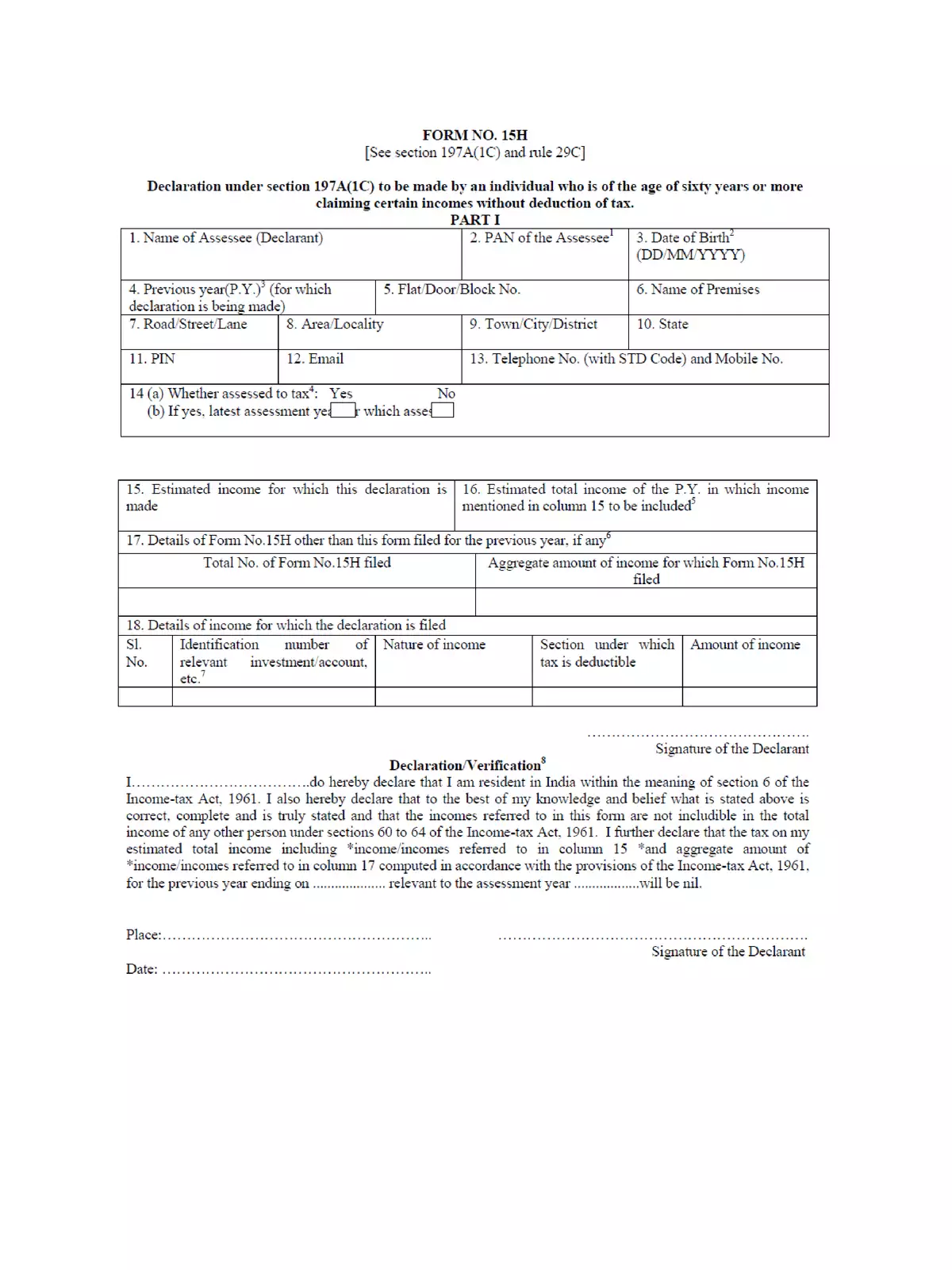

Form 15H is a helpful self-declaration form that allows senior citizens to either request zero TDS deduction or a lower deduction on the interest income earned from their fixed deposits. By submitting this declaration to their bank, they can enjoy greater financial benefits from their savings.

Why Submit Form 15H?

Form 15G or 15H must be presented by fixed deposit holders at the beginning of each financial year to their respective financial institutions, such as banks. This is essential to avoid TDS (Tax Deducted at Source) on the interest income generated from these deposits.

Taxpayers can submit Form 15G and Form 15H starting in the first week of July 2021. For the period from 1st April 2021 to 30th June 2021, the Form 15G and 15H submitted for the FY 2021-22 will serve as valid proof for non-deduction of TDS.

How to Download Form 15H

Download the Form 15H in PDF format using the link provided below or an alternative link. You can easily click on the link for a hassle-free download of the PDF.✨