Form No 3BA Report Under Section 36(1)(xi) - Summary

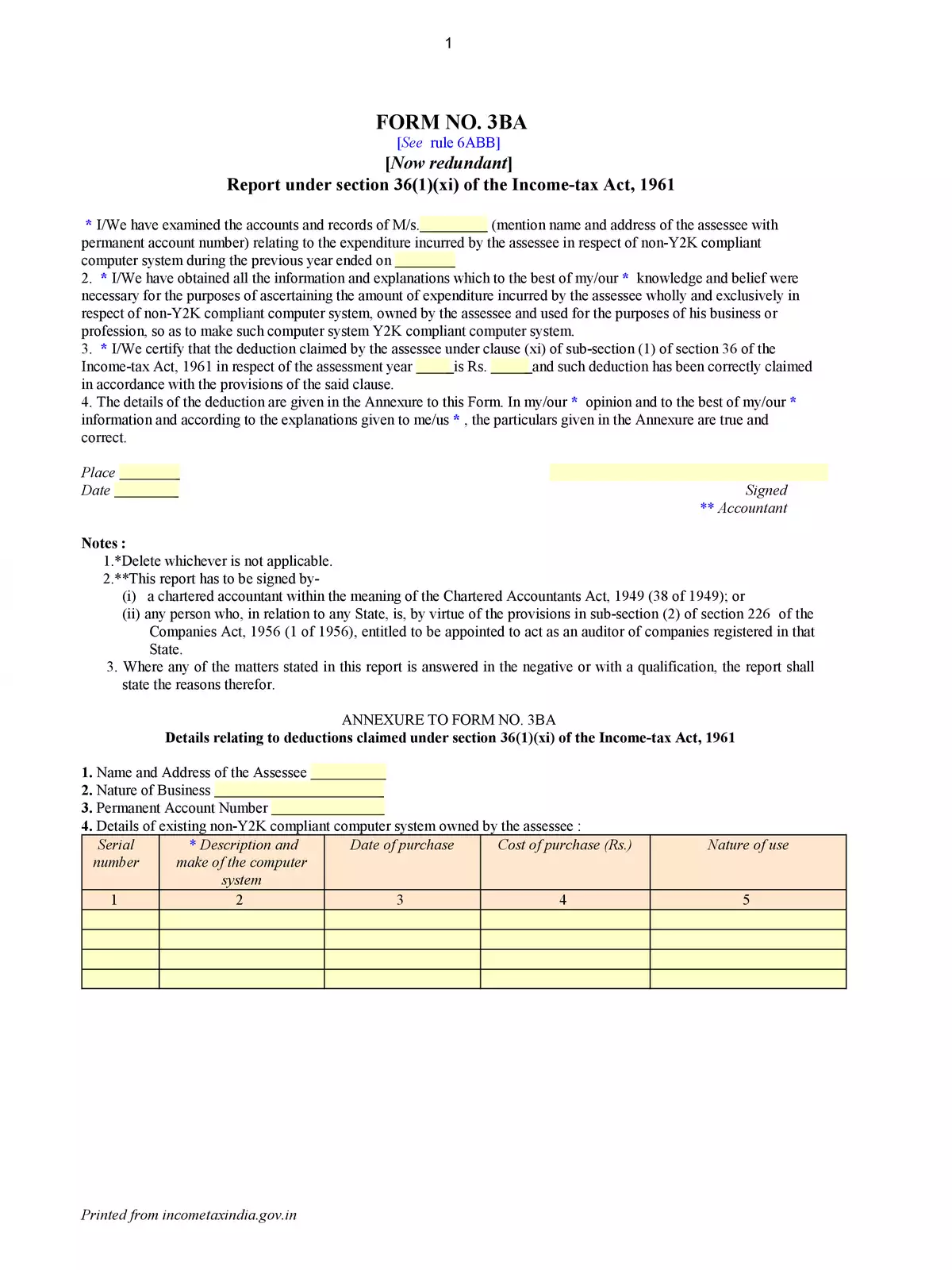

The Form No 3BA Report Under Section 36(1)(xi) is vital for knowing which expenses you can claim as tax deductions on the income you earn through business and profession. Section 36 of the Income Tax Act details the various expenses that are deductible, helping both individuals and businesses optimize their tax liabilities. This guide offers key information regarding the deductions allowed under section 36(1)(xi) of the Income-tax Act, 1961, as reported by the assessee.

What You Need to Know About Section 36(1)(xi)

Section 36(1)(xi) specifies certain allowable expenses that can have a big effect on your total tax calculation. By using this form, taxpayers can correctly report these deductions, which ensures they are following the rules set by the Income Tax Act.

Why Form No 3BA is Important

This form is not just another paper you fill out; it is key for anyone wanting to handle their business finances wisely. If you submit incomplete or incorrect information, it can cause problems when filing your taxes, making it essential to complete the Form No 3BA accurately.

If you’re seeking more detailed insights about tax deductions and saving strategies, don’t hesitate to download the PDF linked below. It is filled with useful information to assist you in managing your financial duties.

With a good understanding and the right approach, handling your income tax deductions under section 36(1)(xi) can be much simpler. So, be sure to download the necessary information for a hassle-free tax experience. 📄