Form 3CD – Tax Audit Report - Summary

Understanding Form 3CD – Tax Audit Report

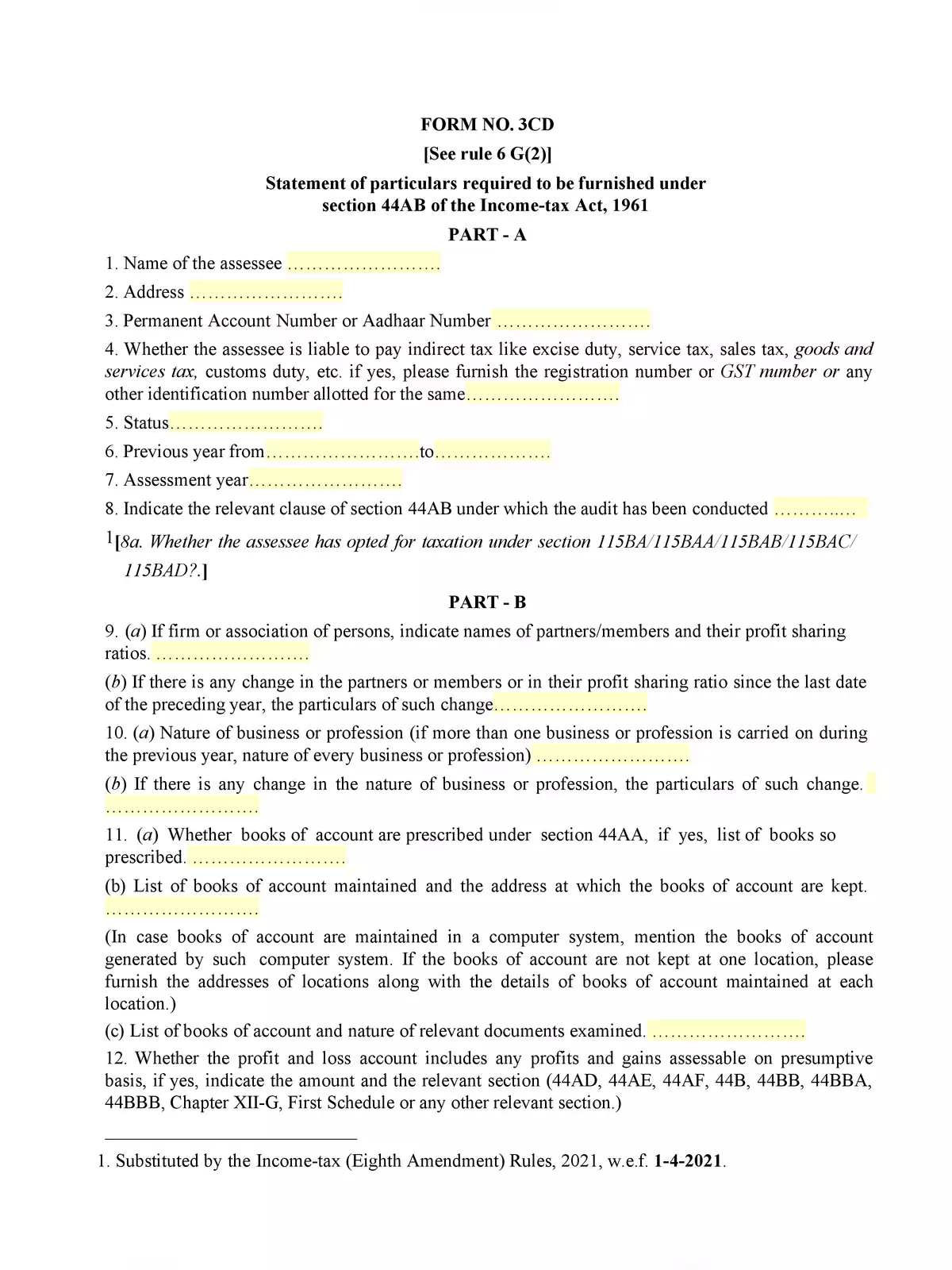

Form 3CD is a key document needed for the tax audit report. This important form contains a total of 44 clauses that require the auditor to report on various significant matters. As a central part of the tax audit process, Form 3CD helps ensure that all compliance requirements are fulfilled, making it essential for both auditors and taxpayers.

What Does Form 3CD Include?

Part B of Form 3CD highlights the details of various compliances under the Income Tax Law. This section is essential as it demands careful documentation and complete disclosure of financial data, which helps in the proper assessment of income and expenses. Understanding how to fill out this form correctly is vital for smooth tax audit operations.

Moreover, accurately completing Form 3CD can protect businesses from potential disputes with tax authorities. By ensuring that all clauses are properly addressed, organizations can show their dedication to compliance and transparency. 🌟

As you go through the tax audit journey, having a well-prepared Form 3CD is crucial. It is advisable to stay updated with the latest amendments and guidelines related to tax audits. 📄

If you want to learn more about the requirements and implications of Form 3CD, consider downloading our comprehensive PDF. This document provides further insights and information about tax audit reports and their importance. 📥

In conclusion, Form 3CD is vital in the tax audit process, helping ensure compliance and making certain that taxpayers meet their legal responsibilities under the Income Tax Act. Keep yourself informed and ensure your audit procedures are effective and well-organized.