Form 16 Download - Summary

Form 16 is an important document in India, designed for salaried professionals, as per Section 203 of the Income-Tax Act 1961. It is also known as a “salary certificate” and contains complete details about the salary received by employees from their employers in a specific financial year. Additionally, it shows the amount of income tax that has been deducted from the employee’s salary by the employer.

Understanding Form 16: Key Sections to Know

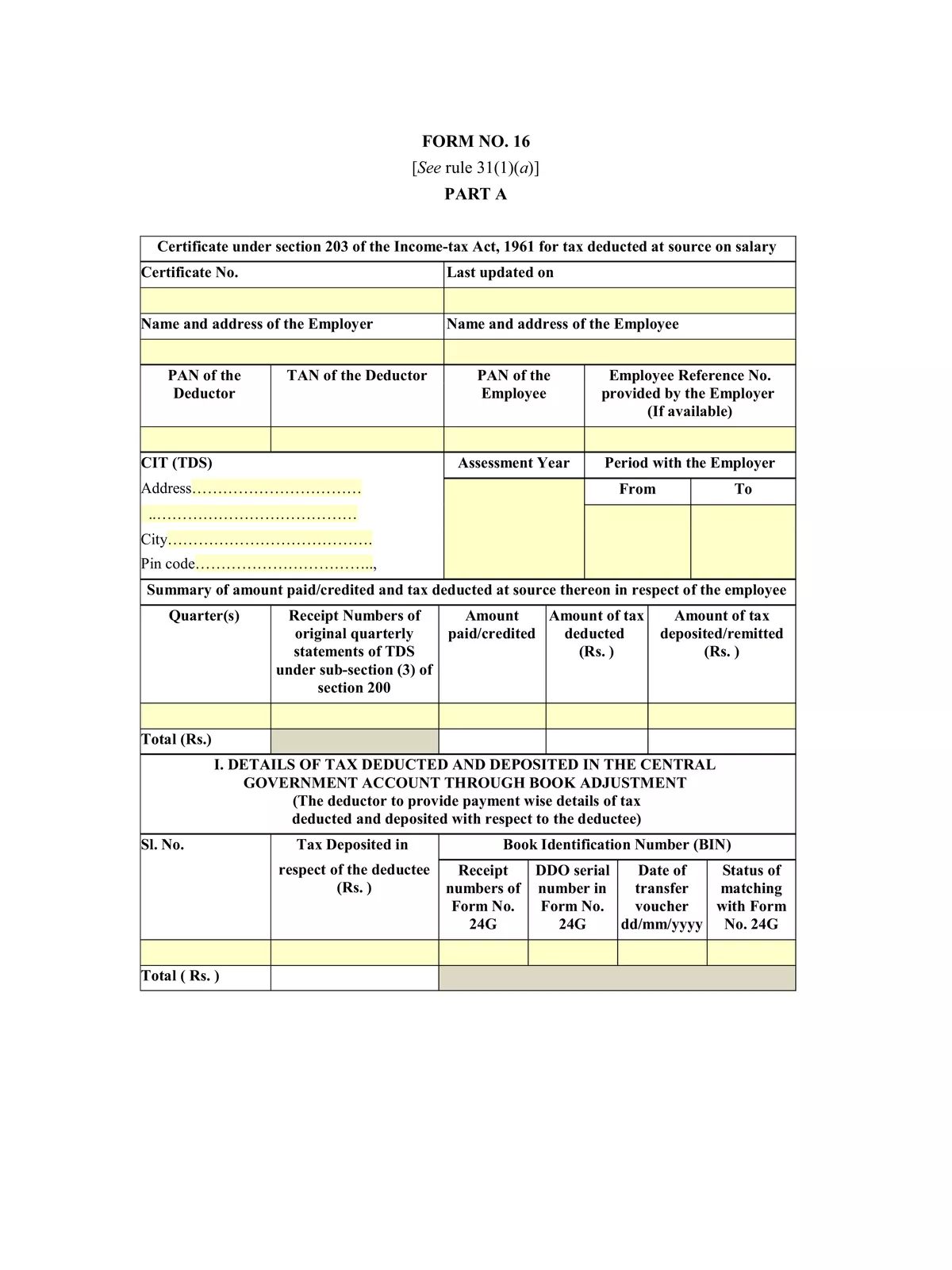

Details to be Mentioned in Form 16 A

- Personal information of both the employer and employee, including names, addresses, PAN numbers, and employer TAN details.

- The Assessment Year (AY)

- The time period during which the employee was employed with the employer in the relevant Financial Year

- Summary of the total salary paid

- Date on which tax was deducted from the salary

- Date when tax was deposited into the government account

- Summary of tax that was deducted and deposited quarterly with the Income Tax Department

- Acknowledgment Number of the TDS Payment

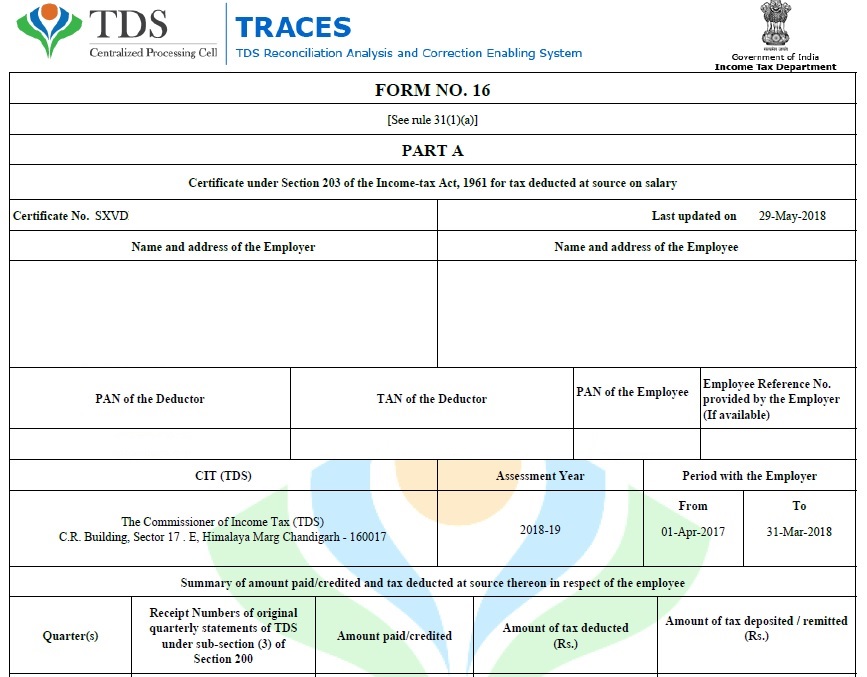

Form 16 Part A

Form 16 Part A

This part is generated and can be downloaded through the TRACES portal of the Income Tax Department. It includes important information such as the Bank’s BSR code for payment processing and challan numbers for future reference. Every page of Part A needs to be signed, either digitally or manually, by the person who deducts the tax.

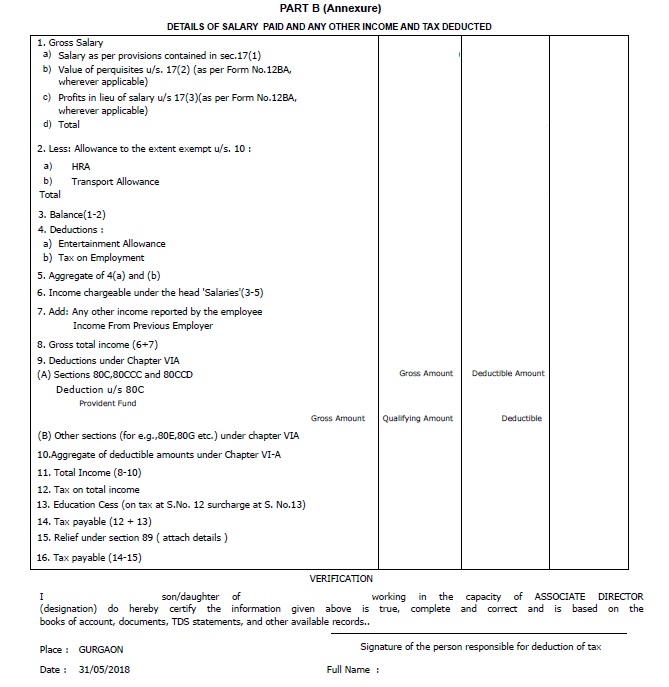

Details to be Mentioned in Form 16 B

Part B is a comprehensive statement that includes details about the salary paid, any other income disclosed by the employee to the employer, tax paid, and any tax due. Employee details such as name and PAN are also recorded in Part B.

Form 16 Part B

Form 16 Part B

It contains the following information:

- Total Salary Received: Breakdown of salary into various components like House Rent Allowance, Leave Travel Allowance, Gratuity, and more.

- Exemptions Allowed: As stated in Sec (10) of the Income Tax Act, 1961, allowances for Conveyance, House Rent (HRA), Children’s education, and medical expenses, among others, are noted here.

- Gross Income: The total income received from the employer plus any other income declared by the employee is recorded. Employees must share details of additional income during investment proof submission.

- Deductions From Salary: Includes contributions under Section 80 C / 80 CCC / 80 CCD such as Public Provident Fund, Life Insurance policies, and other tax-saving instruments.

- Other deductions under sections like 80D (for health insurance), 80E (education loan interest), and 80G (donations) are also provided. Employees need to submit supporting documents for these deductions.

- Net Taxable Salary: After deducting all applicable deductions from gross income, the taxable income is calculated. The tax liability is based on this amount.

- Education Cess and surcharges, if applicable

- Rebate under Section 87, if eligible

- Relief under Section 89, if applicable

- Total tax payable on income

- Tax deducted along with the remaining tax due or any refund applicable

How to Download Form 16/16A Online

Form 16/16A is the certificate that shows tax deducted at source. It is provided to employees by their employers once tax has been deducted. These certificates detail TDS / TCS for different transactions between deductors and deductees. Issuing these certificates is mandatory for taxpayers.

Follow these steps to download:

- Deductor logs in to TRACES. – Online Login Link

- Go to the Downloads tab.

- Select Form 16/16A.

- Enter the required details and click on ‘Go’.

Now you can easily download Form 16 as a PDF to keep a record of your salary and tax deductions! 😊