Form 16 - Summary

Form 16 is a document or certificate, issued as per the Section 203 – Income-Tax Act 1961, to a salaried person in India by their respective employers. This Form issued by the employer to their employee once in a year. Also, referred to as a “salary certificate”, it contains the entire details regarding the salary given by the organization or employer to the employee in a particular financial year and the income tax that has been removed from the salary of the individual by the payer.

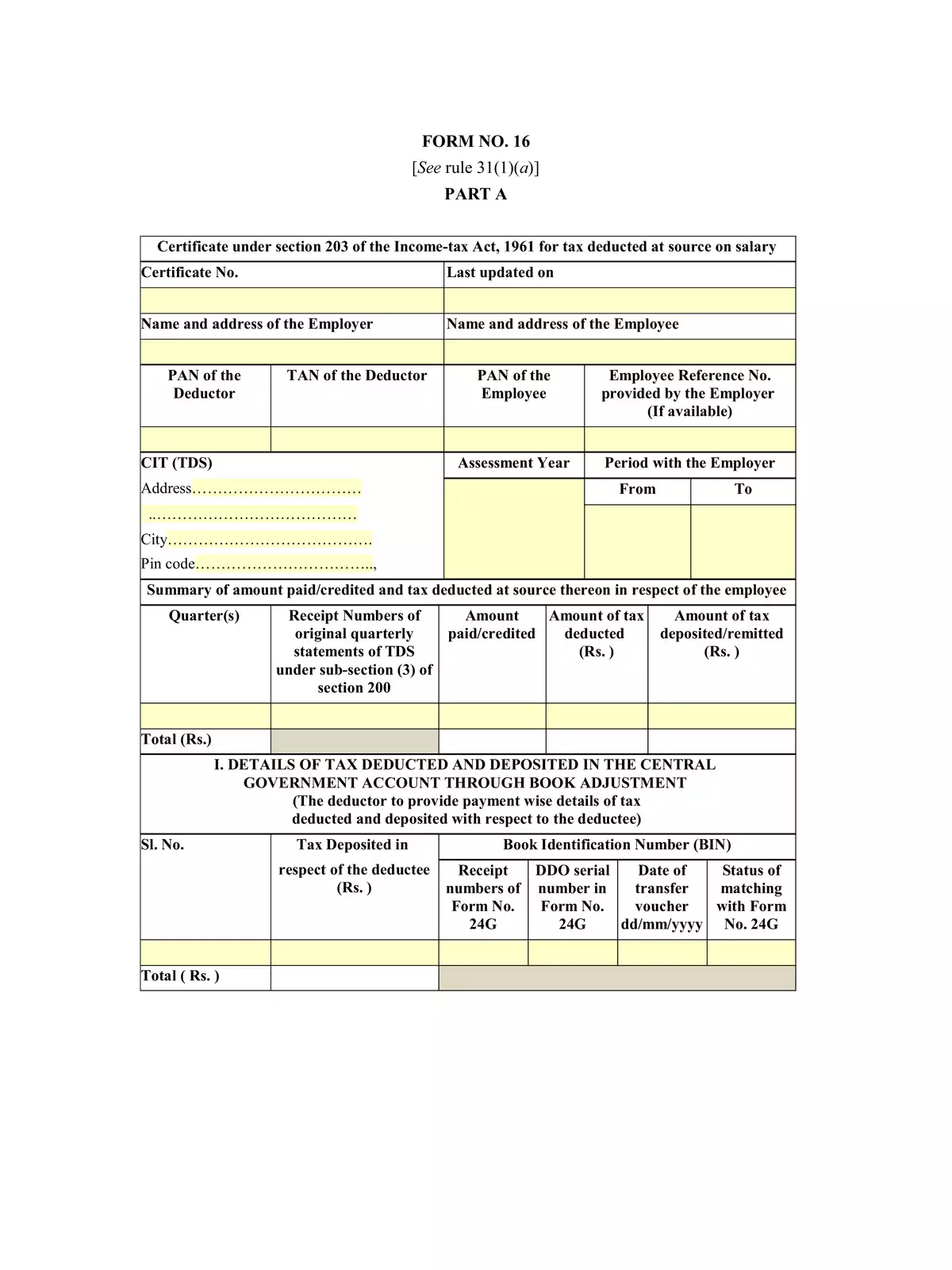

Form 16 Contains two Parts

- Part A :- Part A gives the summary of tax collected by the organization or employer from the salary income, on the employee’s behalf and deposited in the government’s account. It is a certification duly signed by the employer that they have deducted the TDS from the employee’s salary and deposited it with the income tax department.

- Part B:-Part B is a consolidated statement covering details regarding salary paid, any other income as disclosed by the employee to his/her organization, amount of tax paid and tax due, if any. It represents the information in a comprehensive and orderly manner stating the income earned by the employee along with the exemptions and deductions applicable thereon, in the prescribed format. Employee details such as name and PAN are mentioned even in Part B.

Details to be Mention in Form 16

- Personal information of the employer as well as the employee. Particulars such as the individual and employer’s name, address details, PAN details of both and employer’s TAN details. (TAN refers to the number assigned to an account responsible for the deduction and collection of tax).

- The Assessment Year (AY)

- The time period for which the individual was employed with the employer in the concerned Financial Year

- Summary of the salary paid

- Date of tax deduction from the salary

- Date of tax deposit in the account of government

- Summary of tax deducted & deposited quarterly with the Income Tax Department

- Acknowledgment Number of the TDS Payment

You can download the Form 16 in PDF format using the link given below.