Form 16A (Tax Deduction Certificate) - Summary

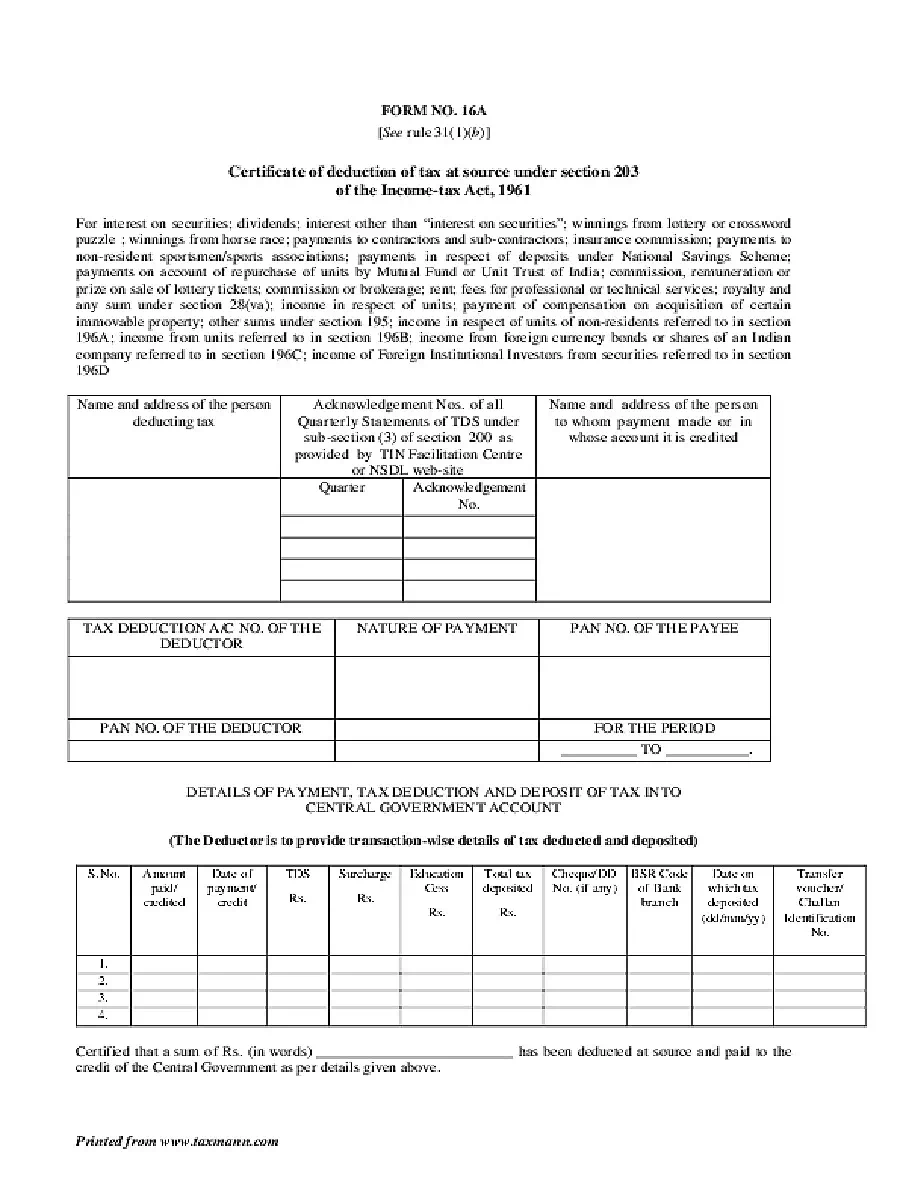

The Form 16A PDF is a vital document that serves as a Tax Deduction Certificate, confirming the amount of TDS (Tax Deducted at Source), the types of payments made, and the TDS payments submitted to the Income Tax Department. This certificate is specifically issued for non-salary payments, such as TDS on professional fees, rent, and bank interest.

Understanding Form 16A

Form 16A is crucial for both individuals and businesses as it acts as official proof of tax deduction. It details the TDS/TCS (Tax Collected at Source) for various transactions between the deductor and the deductee. Issuing these certificates to taxpayers is mandatory and helps maintain transparency in tax transactions.

Importance of Form 16A for Tax Filers

Taxpayers must keep Form 16A safe when filing their income tax returns. This document shows how much tax has been deducted and deposited on their behalf, which simplifies tax calculation and makes the filing process easier.

If you’re looking to download a Form 16A PDF, you can find it below. Remember to save it for your records and future reference!