Form 16 (Part A) - Summary

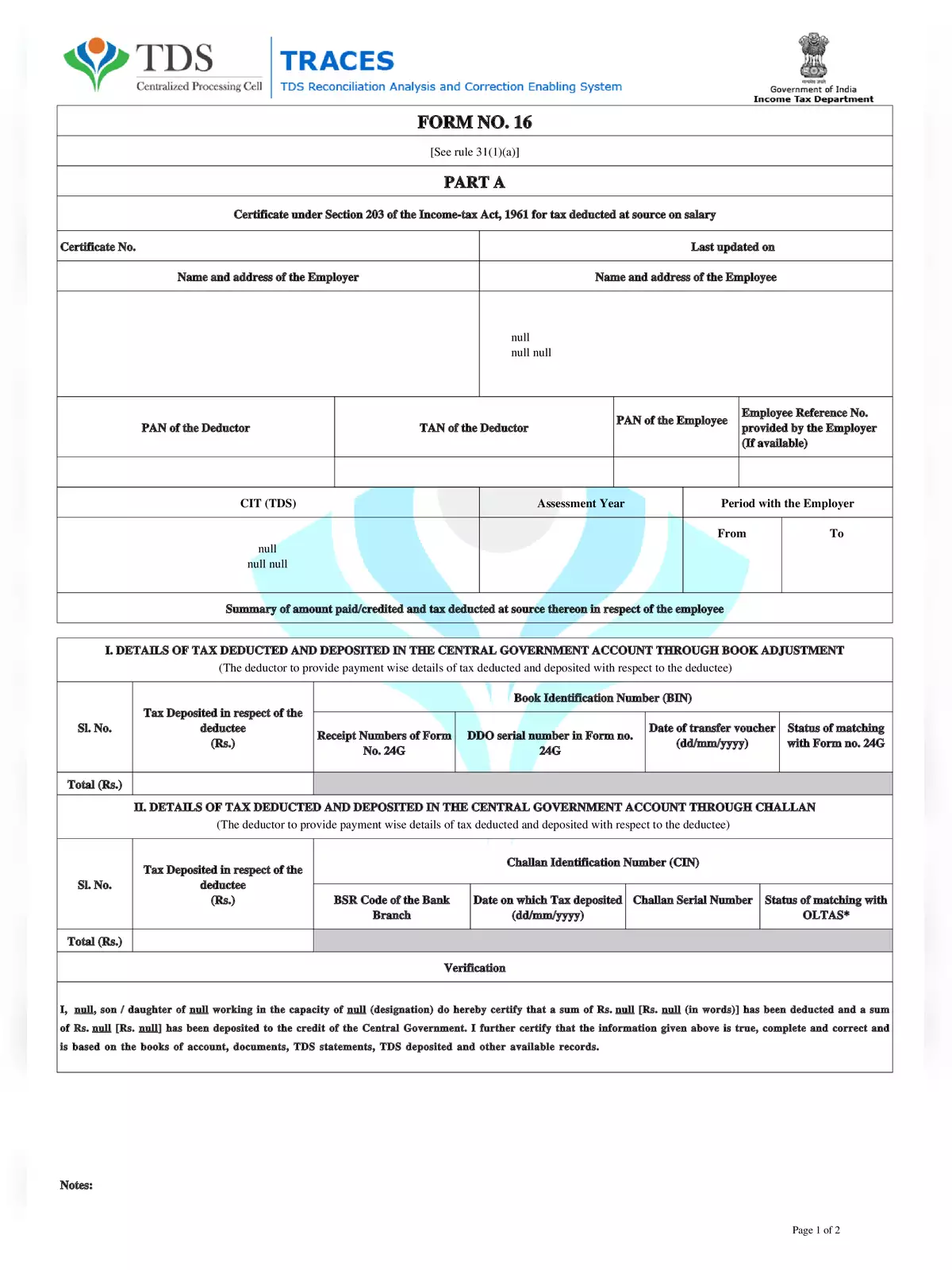

Form 16 (Part A)

Form 16 is an important Income Tax form that companies use to provide salaried employees with details about the tax deducted from their salaries. In simple words, Form 16 is a certificate given by your employer. It shows how much salary you have earned during the year and the amount of Tax Deducted at Source (TDS) that has been deducted.

According to the rules set by the Finance Ministry of the Indian Government, all salaried individuals who are in the taxable income bracket can receive Form 16. This means that if your total income exceeds ₹2.5 lakh, you need to pay tax, and you are eligible to receive this important certificate, Form 16.

Download Form 16 (Part A) Online Free

- Name and address of the Employer

- Name and address of the Employee

- PAN of the Deductor

- TAN of the Deductor

- PAN of the Employee

- Employee Reference No. provided by the Employer

- CIT (TDS)

- Assessment Year

- Period with the Employer

- DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH BOOK ADJUSTMENT

- DETAILS OF TAX DEDUCTED AND DEPOSITED IN THE CENTRAL GOVERNMENT ACCOUNT THROUGH CHALLAN

- (Signature of person responsible for deduction of Tax)

You can easily download Form 16 (Part A) in PDF format online from the official website using the link below or an alternative link. This makes it convenient for you to access your Form 16 and keep it for your records.

Also, Check

Form 16 Part B