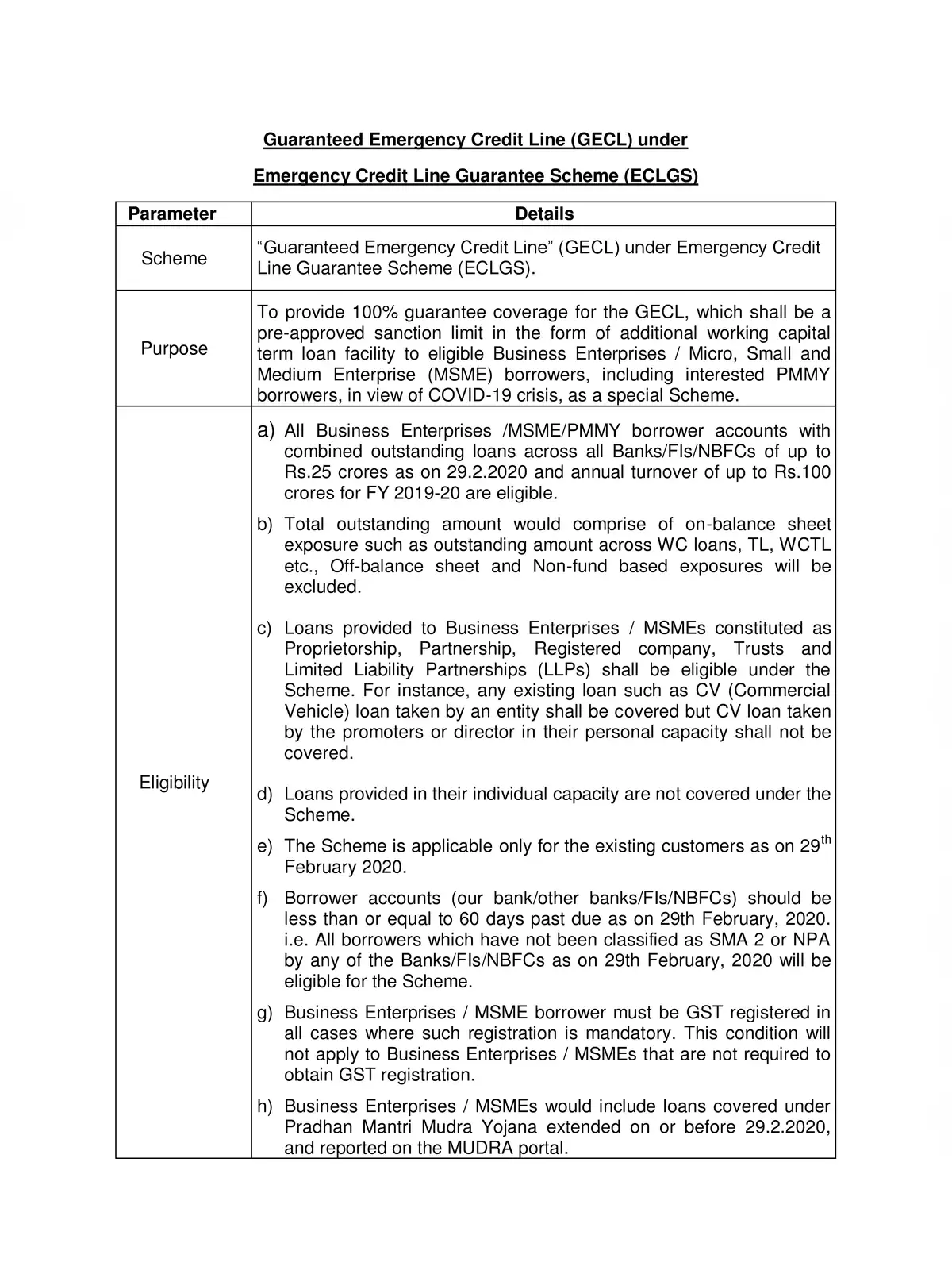

Emergency Credit Line Guarantee Scheme (ECLGS) - Summary

To support businesses impacted by the COVID-19 crisis, the Emergency Credit Line Guarantee Scheme (ECLGS) offers a unique and effective solution. This scheme provides 100% guarantee coverage for the Guaranteed Emergency Credit Line (GECL), which serves as a pre-approved sanction limit, giving additional working capital term loan facilities to eligible Business Enterprises and Micro, Small, and Medium Enterprises (MSMEs), including those interested in the Pradhan Mantri Mudra Yojana (PMMY).

Eligibility for ECLGS

Several criteria determine which borrowers can benefit from this scheme. Here are the key eligibility requirements:

- All Business Enterprises, MSMEs, and PMMY borrower accounts with total outstanding loans of up to Rs.25 crores as of 29th February 2020, and an annual turnover reaching up to Rs.100 crores for FY 2019-20, are eligible.

- The total outstanding amount includes on-balance sheet exposure, which covers outstanding amounts from working capital loans, term loans, and WCTL. However, off-balance sheet and non-fund based exposures are not included.

- Loans granted to Business Enterprises and MSMEs structured as Proprietorships, Partnerships, Registered Companies, Trusts, and Limited Liability Partnerships (LLPs) are acceptable under the scheme. For instance, any existing commercial vehicle (CV) loan taken by a business will qualify, but CV loans taken personally by promoters or directors will not.

- Loans granted in an individual’s name are not eligible for assistance under the scheme.

- This scheme applies only to existing customers as of 29th February 2020.

- Borrower accounts with our bank or other banks, FIs, or NBFCs should not be more than 60 days past due as of 29th February 2020. All borrowers must not be classified as SMA 2 or Non-Performing Assets (NPA) by any financial institutions as of that date to qualify.

- Business Enterprises and MSMEs must be GST registered where such registration is required; this condition does not apply to those who are not required to obtain GST registration.

- Loans given under the Pradhan Mantri Mudra Yojana before 29th February 2020 and reported on the MUDRA portal are considered eligible.

For more detailed information on the Emergency Credit Line Guarantee Scheme (ECLGS), you can download the PDF using the link provided below. Make the most of this opportunity to empower your business! 📥