Bank of Baroda KYC Documents List - Summary

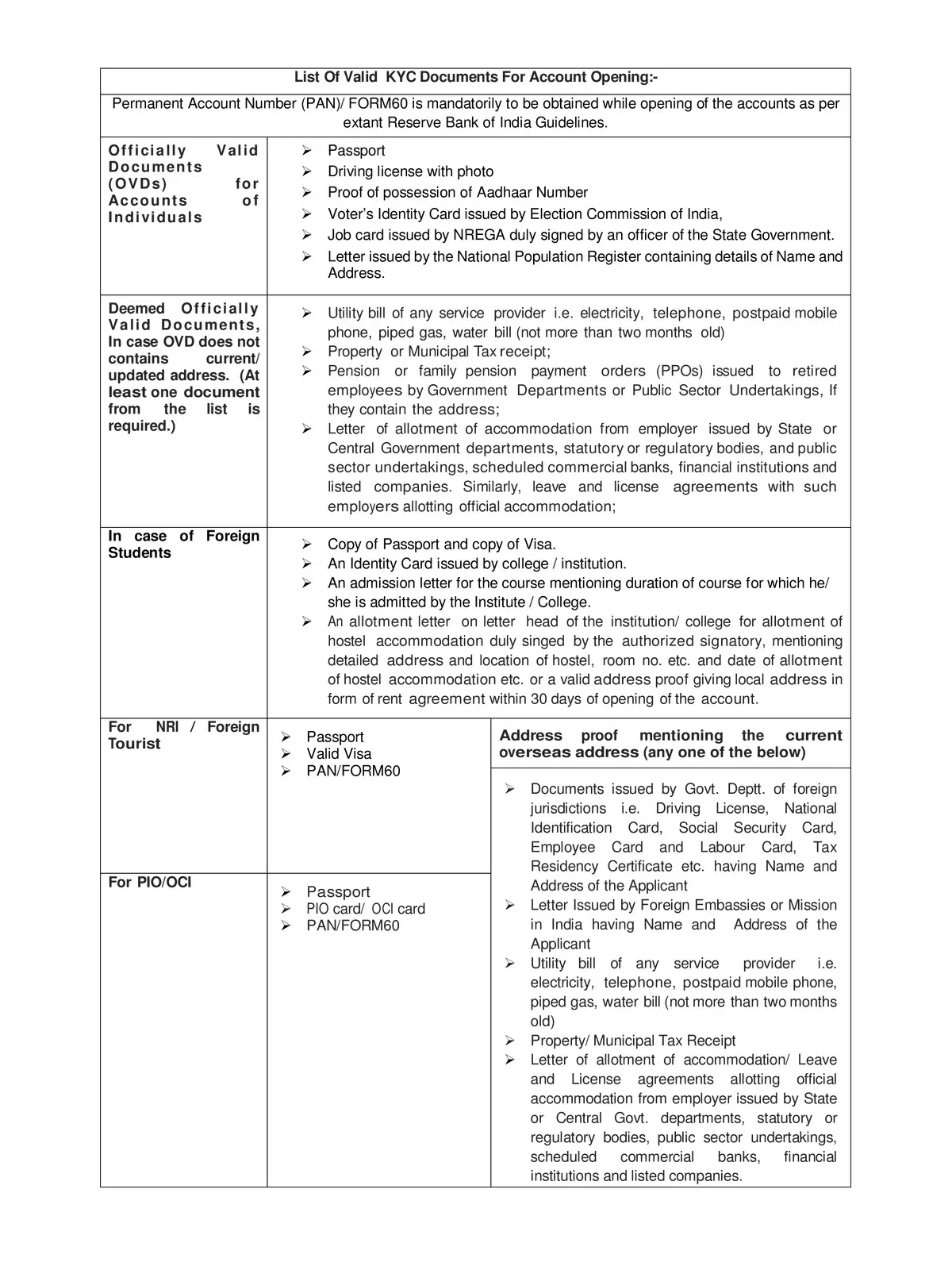

KYC documents are essential not only for account opening but also for various banking services. Applicants can refer to this documents list to understand what kinds of documents are needed for opening an account.

Understanding KYC Documents

KYC stands for “Know Your Customer,” and it is a process that banks like Bank of Baroda use to verify the identity of their customers. This helps in ensuring the safety and security of banking transactions. Knowing the KYC requirements is crucial for customers who want to have smooth banking experiences.

Essential Documents for KYC

Typically, the KYC documents list may include:

– Identity proof (Aadhaar card, passport, voter ID, etc.)

– Address proof (utility bills, bank statements, etc.)

– Recent photographs

These documents are vital for setting up and maintaining your bank account securely. Being prepared with these KYC documents will help you avoid any delays in your banking processes.

Download the Bank of Baroda KYC Documents List in PDF format using the link given or the alternative link for more details. 📥