Bank of Baroda 15G Form - Summary

Form 15G is an essential declaration for individuals under 60 years old and Hindu Undivided Families (HUF) holding bank fixed deposits. By using the Bank of Baroda 15G form, you can ensure that no TDS (tax deduction at source) is deducted from your interest income for the financial year.

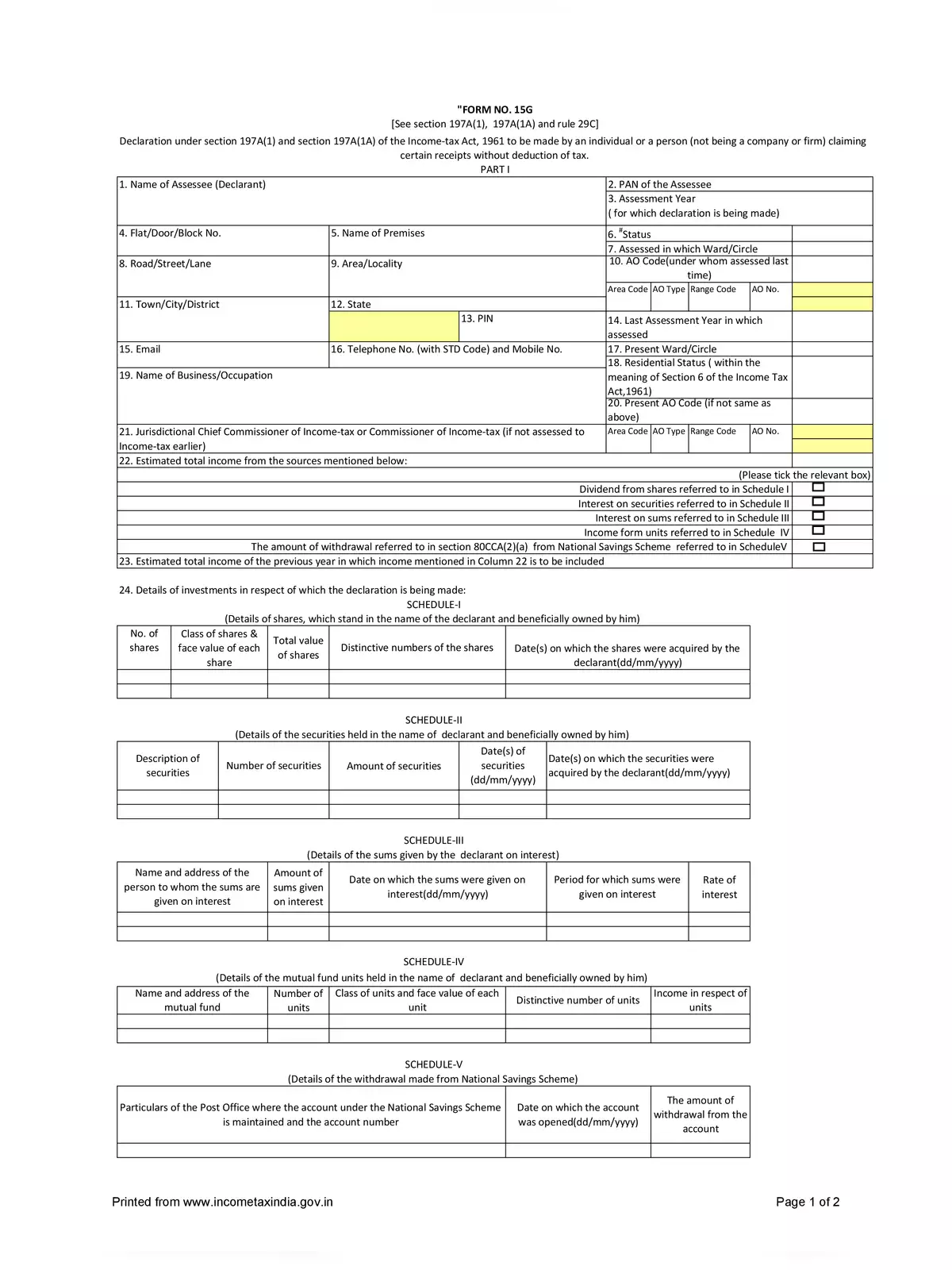

What is Form 15G?

Form 15G is a self-declaration form that allows individuals to express that their total income is below the taxable limit, ensuring that no TDS should be deducted from it. People can also use Form 15H, which is similar but designed for senior citizens.

Essential Fields for Bank of Baroda 15G Form

To correctly fill out the Bank of Baroda 15G form, you’ll need to provide the following important details:

- Name of Assessee (Declarant)

- PAN of the Assessee

- Assessment Year (for which declaration is being made)

- Flat/Door/Block No.

- Name of Premises

- Status

- Assessed in which Ward/Circle

- Road/Street/Lane

- Area/Locality

- AO Code (under whom assessed last time)

- Town/City/District

- State

- PIN

- Last Assessment Year in which assessed

- Name of Business/Occupation

- Telephone No. (with STD Code) and Mobile No

- Present Ward/Circle

- Present AO Code (if not same as above)

- Residential Status (as per Section 6 of the Income Tax Act, 1961)

- Jurisdictional Chief Commissioner of Income‐tax or Commissioner of Income‐tax (if not assessed to Income‐tax earlier)

- Estimated total income from the sources mentioned

- Estimated total income of the previous year in which income mentioned in Column 22 is to be included

- Details of investments for which the declaration is being made

- Signature of the Declarant

You can easily download the Bank of Baroda 15G Form in PDF format from the link provided below. Make sure to complete the form and submit it to avoid any TDS deductions. 🌟