GDC Bank 15G and 15H FORM - Summary

Form 15G and Form 15H are crucial documents you can use to avoid TDS deduction on your income, as long as you meet certain conditions. Remember, to submit these forms, having a PAN is required. While Form 15H is specifically meant for senior citizens aged 60 years or older, Form 15G is for everyone else. Both Form 15G and Form 15H are valid for one financial year.

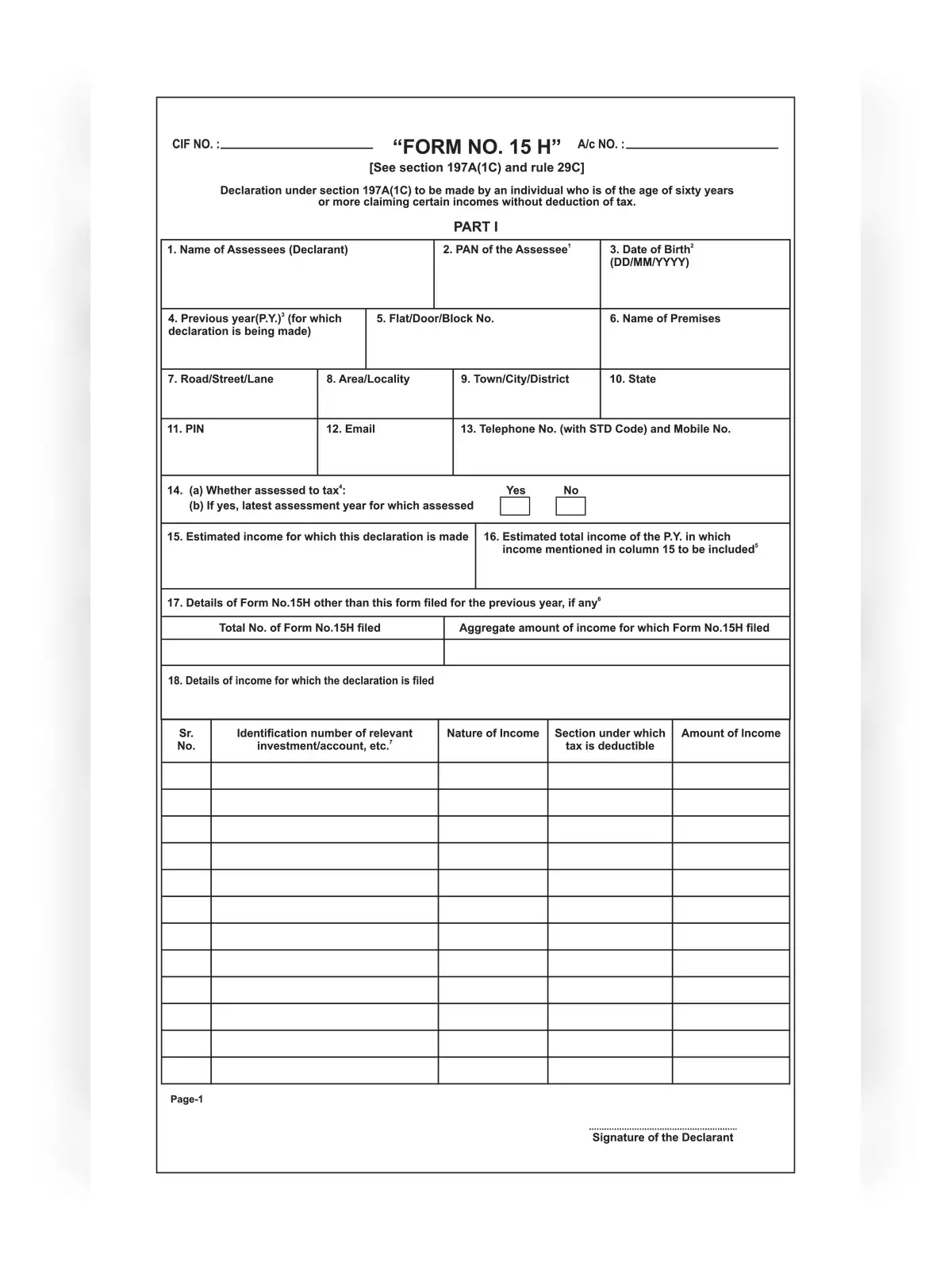

Understanding Form 15G and Form 15H

Form 15G is for anyone eligible who is under sixty during the financial year. On the other hand, Form 15H is intended for eligible senior citizens who are sixty years or older within the same financial year.

It is suggested to submit Form 15G or Form 15H in April each year. If you have fixed deposits or other investments that last more than one year, remember to submit these forms every financial year, ideally during April. Always make sure to submit a new Form 15G or Form 15H for each financial year to manage your income tax deductions properly.

How to Download the Forms

To simplify the process, you can easily download the necessary forms in PDF format from our website. Just click to download the PDF, fill in the details, and ensure smooth handling of your TDS deductions in the coming financial year! 📄