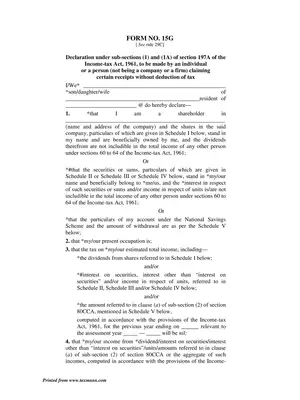

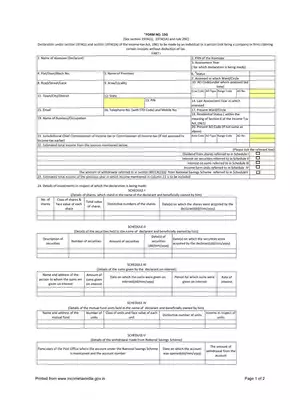

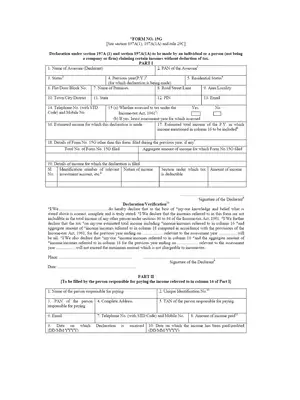

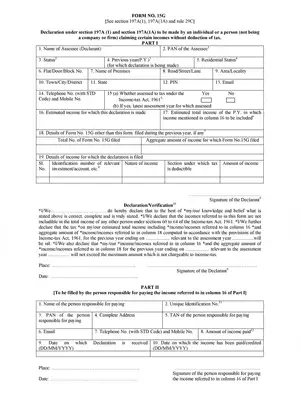

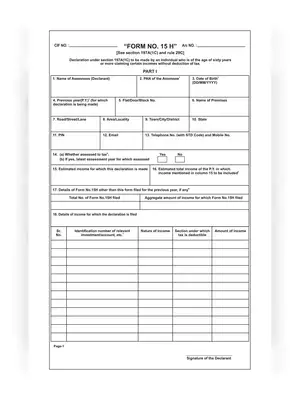

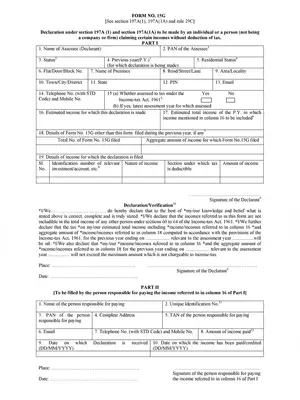

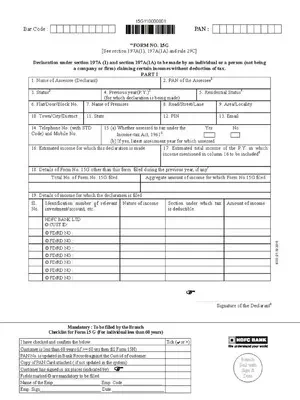

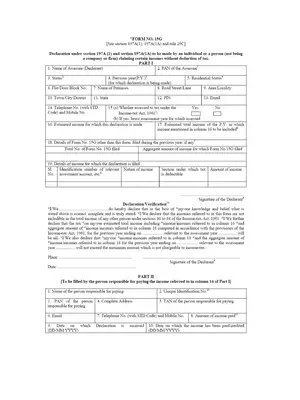

Form 15G

Form 15G is a declaration that can be filled out by bank fixed deposit holders (individuals less than 60 years of age and HUF) to ensure that no TDS (tax deduction at source) is deducted from their interest income for the fiscal.

TDS will be deducted at the rate of 10 per cent provided PAN is submitted. However, in case Form 15G or 15H is submitted by the member, then TDS is not deducted. These forms are to declare that their income would not be taxable after receiving payment of their PF accumulations from retirement fund body EPFO.

Download here all the Bank Form 15G in PDF format using the link given below.