Income Tax Return Due Date Extension Notification 24 October 2020 - Summary

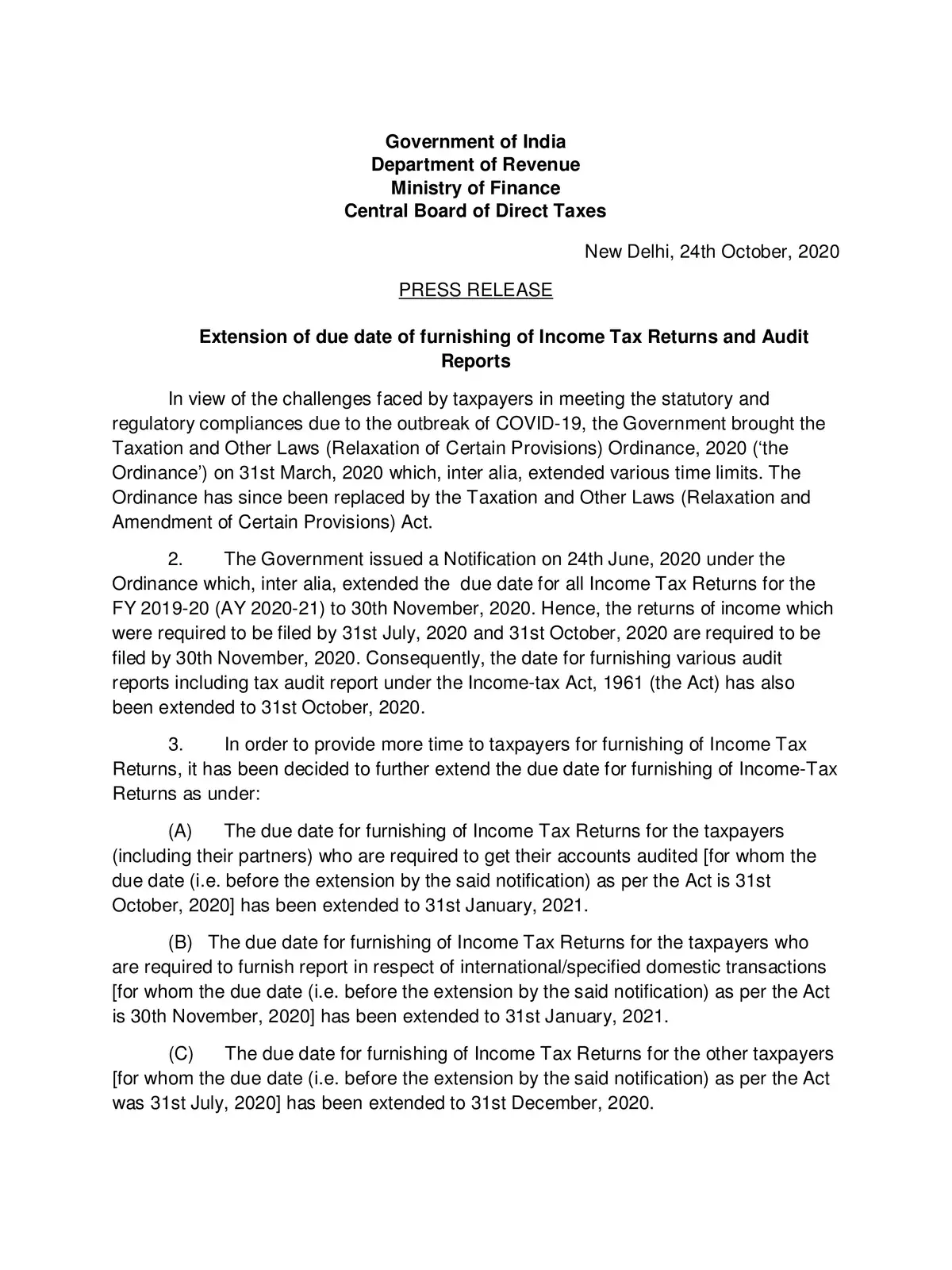

The Government issued a Notification on 24th June 2020 under the Ordinance which, inter alia, extended the due date for all Income Tax Returns for the FY 2019-20 (AY 2020-21) to 30th November 2020. Hence, the returns of income which were required to be filed by 31st July 2020, and 31st October 2020 are required to be filed by 30th November 2020. Consequently, the date for furnishing various audit reports including tax audit reports under the Income-tax Act, 1961 (the Act) has also been extended to 31st October 2020.

- The due date for furnishing of Income Tax Returns for the taxpayers (including their partners) who are required to get their accounts audited [for whom the due date (i.e. before the extension by the said notification) as per the Act is 31st October 2020] has been extended to 31st January 2021.

- The due date for furnishing of Income Tax Returns for the taxpayers who are required to furnish a report in respect of international/specified domestic transactions [for whom the due date (i.e. before the extension by the said notification) as per the Act is 30th November, 2020] has been extended to 31st January, 2021

- The due date for furnishing of Income Tax Returns for the other taxpayers [for whom the due date (i.e. before the extension by the said notification) as per the Act was 31st July, 2020] has been extended to 31st December, 2020.

For more details download the Income Tax Return Due Date Extension Notification 24 October 2020 in PDF format using the link given below.