Section 194N Income Tax Act

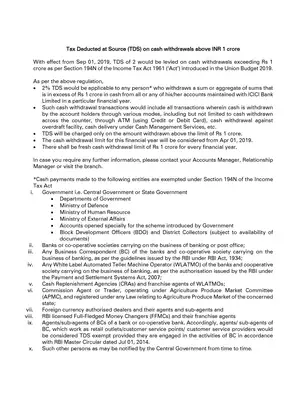

Download the Section 194N Income Tax Act in PDF format. A TDS of 2% is deducted by the bank or financial institution if the total amount of cash withdrawal during the financial year exceeds a specified threshold limit. The threshold limit for individuals and HUFs is ₹1 crore (10 million Indian Rupees). However, for Non-Residents and foreign companies, the threshold limit is ₹20 lakhs (2 million Indian Rupees).

The TDS amount is deducted by the bank at the time of making the cash payment to the account holder. For example, if an individual withdraws ₹1.5 crore during the financial year, the bank will deduct TDS at the rate of 2% on the amount exceeding ₹1 crore, i.e., on ₹50 lakhs.

Section 194N Income Tax Act Download

Q1 The amended section 194N of Income tax Act, 1961provides for TDS obligation on cash withdrawals. Which institutions are covered under scheme of this section which has to deduct TDS on certain cash withdrawals?

The following persons have to deduct TDS on certain cash withdrawals made by a person holding one or more accounts with them:

I) a bank (banking co. to which Banking Regulation Act, 1949 applies);

ii) a co-operative bank;

iii) a post office.

Q2 From which date will the new Section 194N come into force?

The new Section 194N has been substituted for the earlier st section in IT Act, 1961 with effect from 1 July, 2020. (Earlier section came into effect from 01-09-2019).

Q3 What is the point at which TDS will be deducted by a Bank, Co-operative Bank or a Post Office on a cash withdrawal from the account?

The TDS will be deducted by the Bank, Co-operative Bank or Post Office, when the cash withdrawal by a person from his account/accounts during a previous year is an amount or aggregate of amounts which exceeds Rs 20 lakhs or

Rs 1 crore as the case may be. (Depending upon whether the person has filed the ITR u/s 139(1) or not, explained below)

Q4 What is the rate of deduction of TDS from such cash withdrawals and on what sum?

The TDS would be deducted by a Bank, Co-operative Bank or Post Office @2% or @5% ( as the case may be) on a sum of cash withdrawal being the amount or the aggregate of amounts exceeding Rs 20 Lakhs or 1 crore ( as the case may be) during a previous year.

Q5 How the conditions of TDS deduction from cash withdrawals as given in answer to Q4 above would vary, depending on filing or non-filing of ITR in earlier years by the recipient of cash?

In case the recipient receiving the money on cash withdrawal has not filed the income tax return for all of the three

assessment years relevant to three previous years, immediately preceding the previous year when the withdrawal is being made, and time limit for filing return u/s 139(1) has expired, then the TDS is to be deducted during the

previous yeara-

a) @ 2% of the sum where amount or aggregate of amount being paid in cash exceeds Rs 20 lakh but does not exceed Rs 1 crore; or

b) @5% of the sum where amount or aggregate of amounts being paid in cash exceeds Rs 1 crore.

Q6 What are the exceptions to the provisions of section 194N?

The provisions of Section 194N would not apply to any payment made to

i) The Government;

ii) Banking company or Co-op Society engaged in carrying on the business of banking or a post office;

iii) Any business correspondent of a Banking company or Coop Society engaged in carrying on the business of banking;

iv) Any white label automated teller machine operator of a banking company or a co-operative society engaged in the

business of banking;

v) Any other persons as notified by the government in consultation with RBI;

Q7 Any notification/s issued by government w r t exemption till date?

Yes, the following notifications have been issued by the Central Government in consultation with RBI:

i. Notification 68 of 2019 dated 18.09.2019: Cash Replenishment Agencies (CRAs) and franchise agents of White Label Automated Teller Machine Operators (WLATMOs);

ii. Notification 70 of 2019 dated 20.09.2019: Commission agent or trader operating under Agriculture Produce market Committee (APMC) and registered under any law relating to Agriculture Produce Market of the concerned State;

iii. Notification 80 of 2019 dated 15.10.2019: the authorized dealer and its franchise agent and sub-agent and Full Fledged Money Changer (FFMC) licensed by the Reserve Bank of India and its franchise agent; Circular No 14 of 2020 clarified that the above notifications issued under clause (v) of Section 194N prior to its amendment shall be deemed to be issued under fourth proviso to Section 194N as amended by Finance Act 2020.

Download the Section 194N Income Tax Act in PDF format using the link given below.