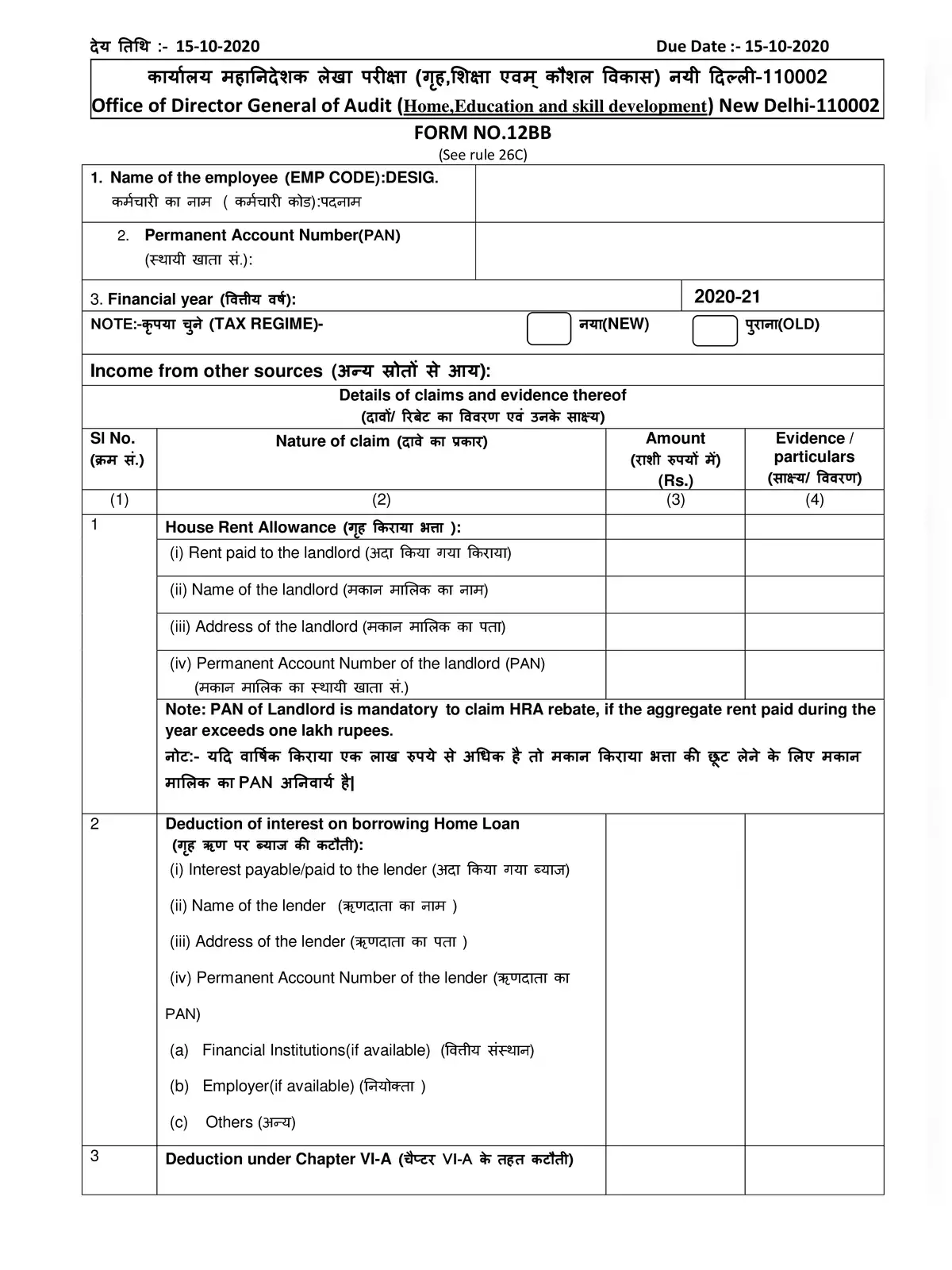

Income Tax Assessment Form 2020-21 - Summary

Income Tax Assessment Proforma for the financial year 2020-21 which may be distributed among the concerned staff members working under your control and duly filled Proforma a/w saving proof (for Old Regime) and any other income etc.(for Old/New Regime) may be submitted to undersigned up to 10-01-2021 positively failing which it shall be presumed that concerned the staff has no saving as well as any other income to declare.

Steps to e-file your income tax return

Step 1: Go to the official website of Income Tax Department of India – incometaxindiaefiling.gov.in and register yourself.

Step 2: Login with your user ID (PAN), password, date of birth, and enter the captcha code as displayed on the page.

Step 3: Click on the e-File tab and press on the ‘Income Tax Return’ link.

Step 4: Select the ITR form and the assessment year for which you want to file return.

Step 5: Press on Prepare and Submit Online.

Step 6: Click on Continue.

Step 7: Key in all the information and keep saving at the same time. Also, fill all the information about investment, health and insurance.

Step 8: A verification page will appear on your screen.

Step 9: Tap on Preview and submit to file your ITR.

You can download the Income Tax Assessment Form 2020-21 in PDF format using the link given below.