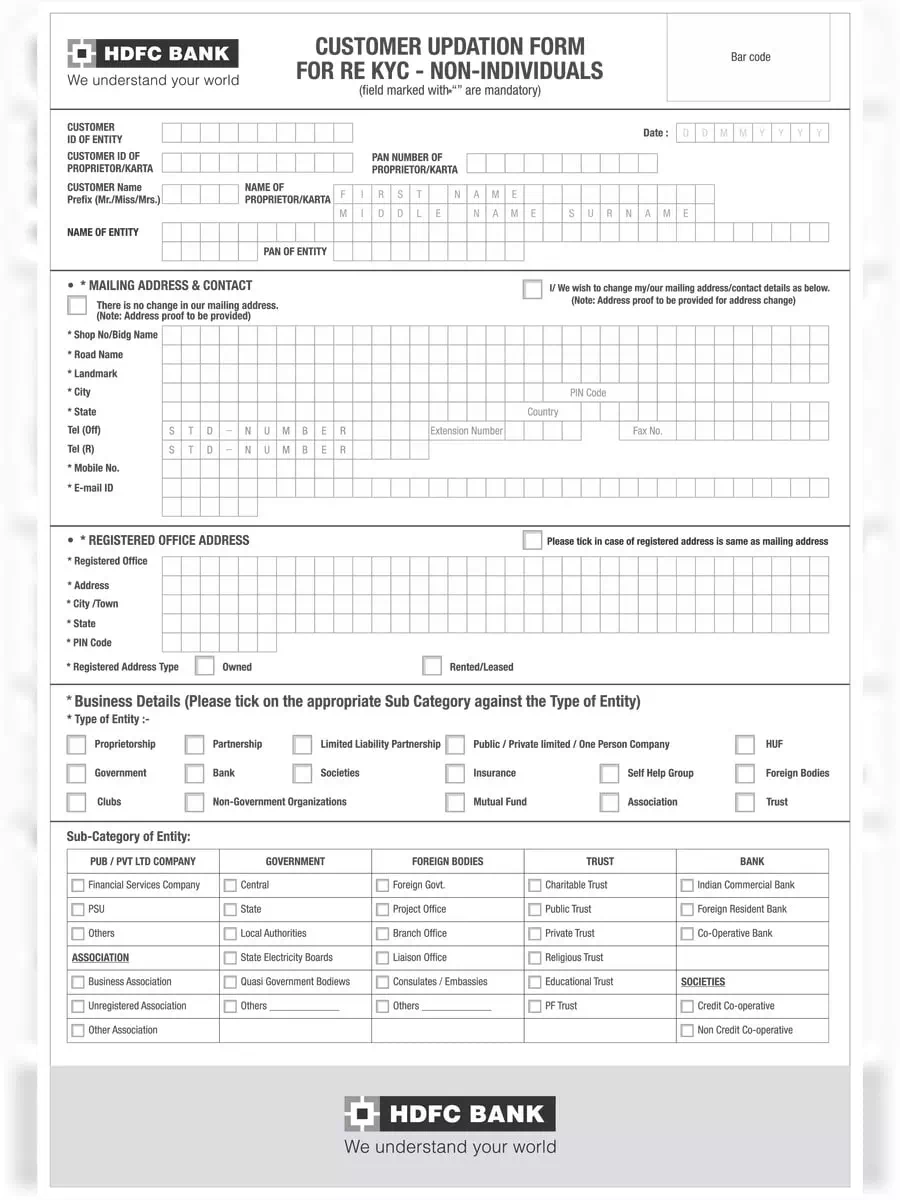

HDFC Bank Re-KYC Form for Non-Individuals - Summary

KYC stands for “Know Your Customer” Generally an identity proof with photograph and an address proof are the two basic mandatory KYC documents that are required to establish one’s identity at the time of opening of savings bank account, fixed deposit, mutual fund, insurance, etc.

It is a process by which banks obtain information about the identity and address of the customers. This process helps to ensure that banks’ services are not misused. The KYC procedure is to be completed by the banks while opening accounts and also periodically update the same

You can download the HDFC Bank Re-KYC Form for Non-Individuals in PDF format online from the link given below.