GST Audit Check List For Audit - Summary

Everything You Need to Know About GST Audit Check List

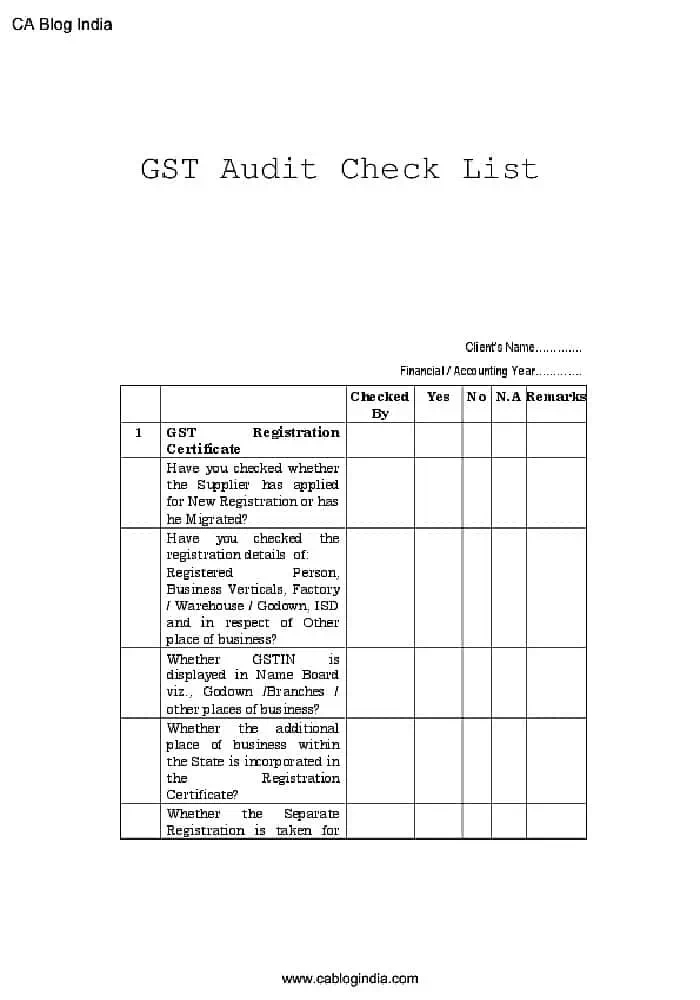

GST Audit Check List For Audit includes important areas that every business owner should pay attention to. The GST Audit Check list covers the following points:

– **GST Registration Certificate**: It is essential to have the correct registration. This ensures that your business is officially recognized under the GST system.

– **Invoicing Documentation**: Proper and accurate invoicing is crucial. It helps in validating all transactions and ensures compliance with the GST regulations.

– **Goods Sent to Job Work**: Keep a record of all goods that are sent for job work. This is important for tracking the movement of goods and ensuring the correct invoicing.

– **Supply**: Any supply of goods or services must be documented thoroughly. It is important to understand what constitutes a supply under GST.

– **Time of Supply**: Knowing the time when the supply occurs is critical for accurate GST calculation. This impacts the tax period and reporting.

– **Input Tax Credit**: Ensure that you are aware of the input tax credit that you are eligible for, as this will help in reducing your tax liability.

– **Classifications**: Understand the classifications of your goods and services. Proper classification can affect the rate of GST applicable.

– **Input Tax Service Distributor**: If you are a service distributor, you need to ensure that the input tax credits are distributed correctly.

– **Returns**: Filing timely and accurate GST returns is mandatory. Keep track of all returns filed and ensure they match your records.

– **GST Collections and Payment Verification**: Regularly verify all GST collections and payments. This helps in maintaining proper records and compliance.

– **Reverse Charge**: Understand the concept of reverse charge and maintain proper records for transactions where reverse charge applies.

– **Value of Supply**: Document the value of supply accurately as it determines the GST liability.

– **Place of Supply**: Knowing the place of supply is essential for determining the correct GST applicable.

– **Refund**: Ensure you are aware of the procedures for obtaining refunds under GST, if applicable.

– **Inward Supply**: Keep a detailed record of all inward supplies. This is important for compliance and input tax credits.

– **Maintenance of Books of Accounts**: Properly maintain your books of accounts. This will support your financial reporting and GST compliance.

– **Other General Points**: Be aware of any other general compliance points that may apply to your business.

Importance of the GST Audit Check List

The GST Audit Check List helps businesses to stay organized and compliant with GST regulations. It is a valuable tool for ensuring that all aspects of GST are covered during an audit. By following this checklist, businesses can avoid potential issues and penalties.

To download the GST Audit Check List For Audit PDF, click the link below and ensure your business is ready for a smooth audit process. Remember, being prepared is the key to successful compliance!