Form 10BD of Income Tax Act - Summary

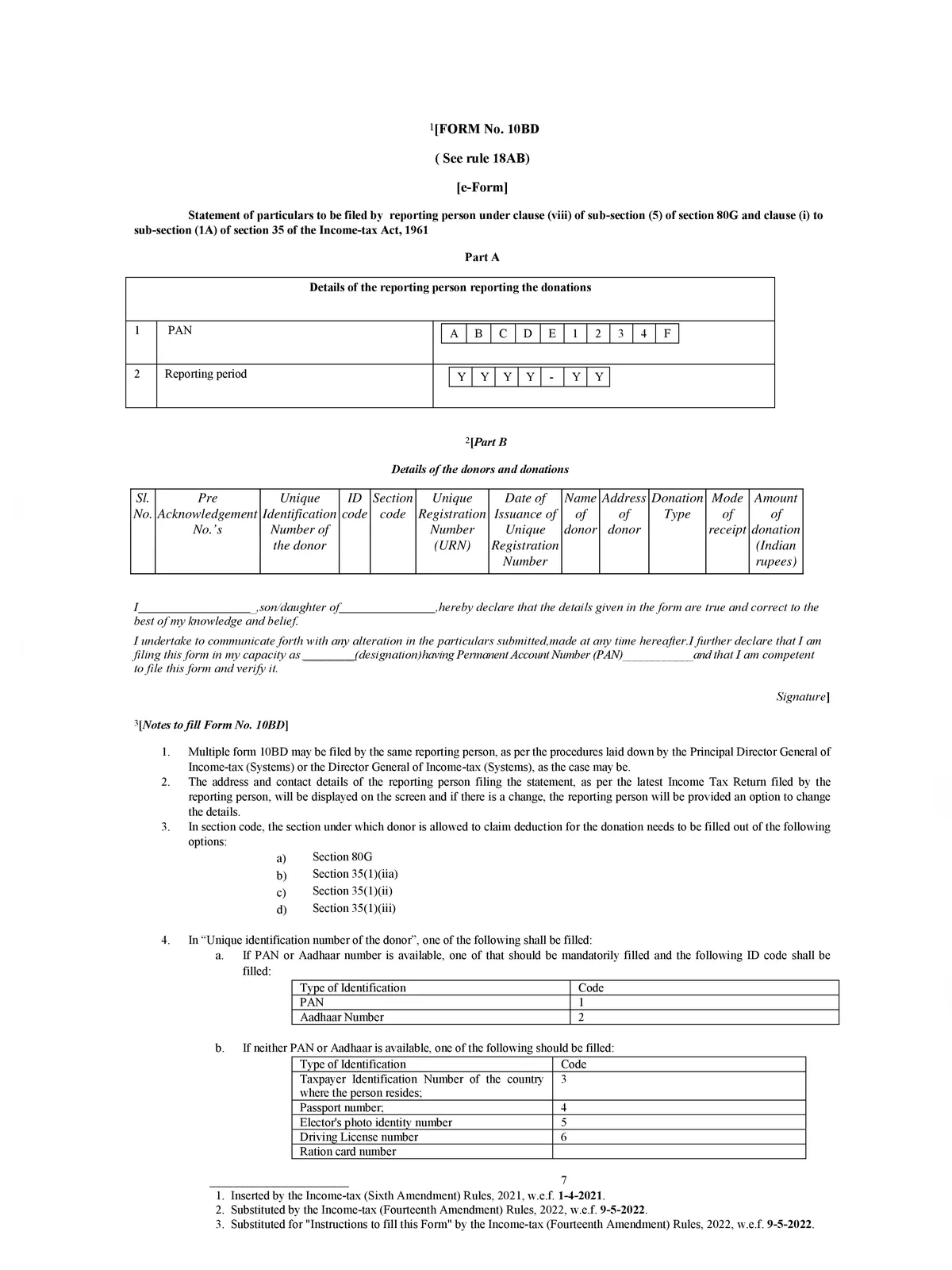

Form 10BD of the Income Tax Act is a crucial document that must be filed electronically through the Income Tax Department’s e-portal. This form should be signed with the digital signature of the person authorized to sign the Income Tax Return (ITR) for the trust. Additionally, you can verify Form 10BD using an Electronic Verification Code (EVC). It’s essential to note that this form is also necessary for research institutions, colleges, universities, and other entities mentioned under clause (i) of section 35(1A) of the Income Tax Act.

Understanding Form 10BD of Income Tax Act

The relevant Form 10BD for a financial year should be submitted by the 31st of May of the following financial year. For example, for the financial year 2021-22, the form needs to be filed by 31st May 2022. 📅

Form 10BD of Income Tax Act – Details Required:

- Name of donor.

- Contact address of donor.

- Nature of donation – corpus / specific grant / others.

- Mode of receipt – cash / kind / electronic modes including account payee cheque / draft / others.

- Amount of donation.

- PAN No. / Aadhar No. / Tax Identification No. of the donor (in case of foreign donor).

- Section under which donation was received.

Consequences for Non-filing Form 10BD:

It is mandatory for the reporting entity to file Form 10BD. If you fail to do so, you will incur a fee of Rs. 200/- for each day of delay, as per the newly added section 234G. In addition to this daily fee for not submitting the donation statement in Form 10BD, not filing such a statement may lead to a penalty under section 271K. This penalty cannot be less than Rs. 10,000/- and may go up to Rs. 1,00,000/-.

You can download the Form 10BD of the Income Tax Act PDF using the link given below.