West Bengal Professional Tax Slab Rate - Summary

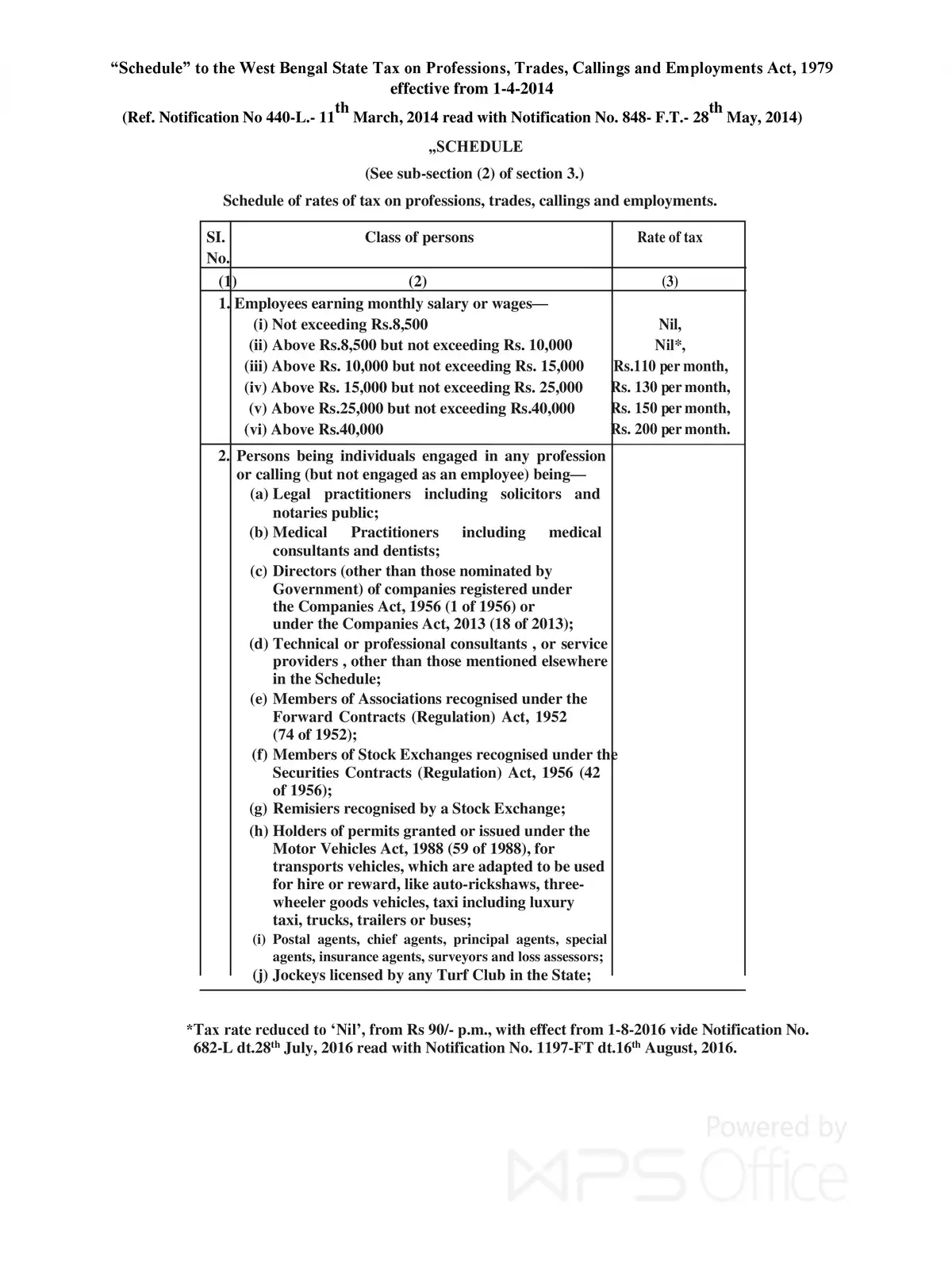

Understanding the West Bengal Professional Tax Slab Rate is essential for everyone who earns a salary or has a monthly income. Professional Tax calculation is based on predetermined slabs, which means the amount you pay is linked to your earnings. Usually, this tax is around Rs 200 a month, and the maximum amount payable in a year is Rs 2,500. Learning about this tax can help you plan your finances better.

What is Professional Tax?

Professional Tax is a tax imposed by the state government on individuals who earn an income through profession, trade, or employment. The amount you pay can vary depending on your income level and is determined by specific slabs set by the government.

Why is Professional Tax Important?

Paying Professional Tax is important because it is a legal requirement. It helps the government provide various services to the public, such as infrastructure development and social welfare programs. Being aware of the slab rates can also assist you in calculating how much you need to set aside from your salary each month.

For more detailed information on the specific slabs and rates, you can download our comprehensive PDF guide. Don’t miss out on understanding your obligations related to Professional Tax!

Additionally, always keep an eye on any updates from the government, as these rates can change. Staying informed can help you avoid surprises when it comes time to pay this tax.