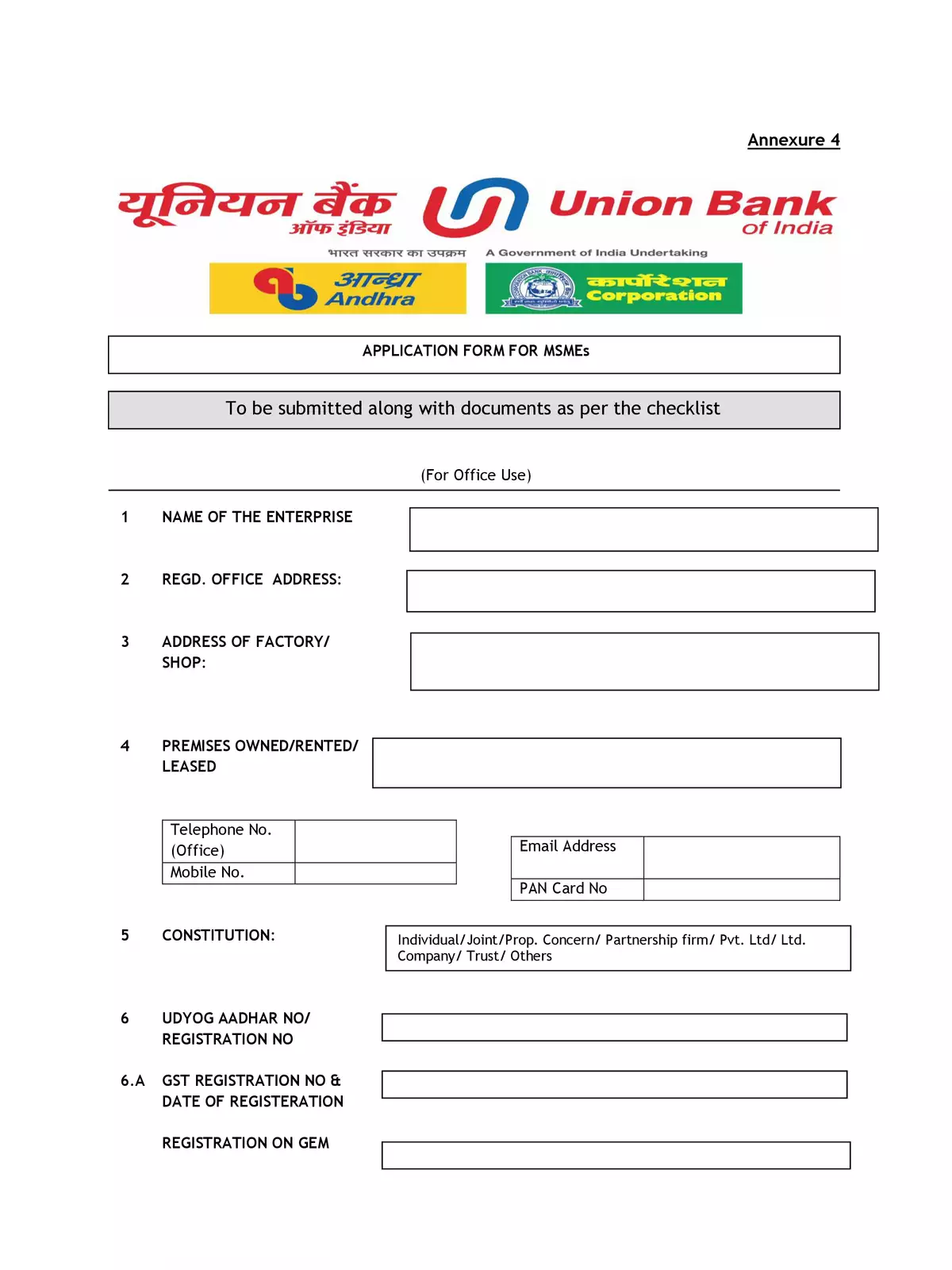

MSME Application Form for UBI Loan - Summary

MSME loans from Union Bank of India (UBI) provide crucial financial help to Micro, Small and Medium Enterprises across India. These UBI MSME loans support small business owners, startups, and women entrepreneurs in growing their businesses with flexible repayment options. You can get your MSME Application Form for UBI Loan quickly in PDF format and download it without any hassle!

Important Government Schemes for MSME Growth

The government has introduced many schemes to boost the MSME sector. One key initiative is the Aatma Nirbhar Bharat Abhiyan / Self Reliant Bharat 2020 Scheme, launched by Prime Minister Shri Narendra Modi. This scheme encourages MSMEs to become more self-dependent and expand their reach in the market.

MSME Loan Checklist for Loans up to Rs. 2 Crore

- Proof of Identity – Voter’s ID card, Passport, Driving License, PAN card, or signature ID from your current banker (for proprietors, partners, or company directors).

- Proof of Residence – Recent telephone or electricity bills, property tax receipt, passport, or voter ID card of the applicant.

- Proof of Business Address.

- The applicant should not be a defaulter in any bank or financial institution.

- Last 3 years’ balance sheets with Income Tax / GST returns (for loans above Rs. 2 lakhs). If audited balance sheets are unavailable for loans up to Rs. 25 lakhs, unaudited statements are acceptable as per bank norms.

- Memorandum and Articles of Association for companies, or Partnership Deed for partners.

- Assets and liabilities statement of promoters/ guarantors with latest income tax returns.

- Rent agreement if the business premises are rented, and clearance certificate from pollution control board if needed.

- MSME/SSI Registration, if applicable.

- Projected balance sheets for next two years for working capital limits and for the full loan tenure in case of term loans (for loans above Rs. 2 lakhs).

- Sanction letters from existing bankers/financial institutions, if the loan is for takeover of advances, with complete terms and conditions.

- Photocopies of lease deeds or title deeds of all properties offered as primary or collateral security.

- Account status from existing bankers confirming the asset is standard (for takeovers).

- Copy of GST returns, if applicable.

- Audited balance sheets are mandatory for loan limits of Rs. 25 lakhs and above.

If you want to apply for a UBI MSME loan, you can fill out the application form either online or offline. Download the Union Bank of India MSME Loan Application Form in PDF for free with the link available below and start your journey to grow your business easily. 📄