TAN Application Form 2026 - Summary

TAN Application Form is a form used to apply for a Tax Deduction and Collection Account Number (TAN) in India. TAN is a special number given by the Income Tax Department to people or businesses who need to deduct or collect tax while making certain payments. It helps the government keep track of tax collected and paid correctly.

Filling the TAN Application Form is an important step for anyone who handles tax payments, like companies or organizations. The form asks for simple details such as the name, address, and type of business. Once the form is filled and submitted, the Income Tax Department gives a unique TAN number that must be used in all tax-related documents.

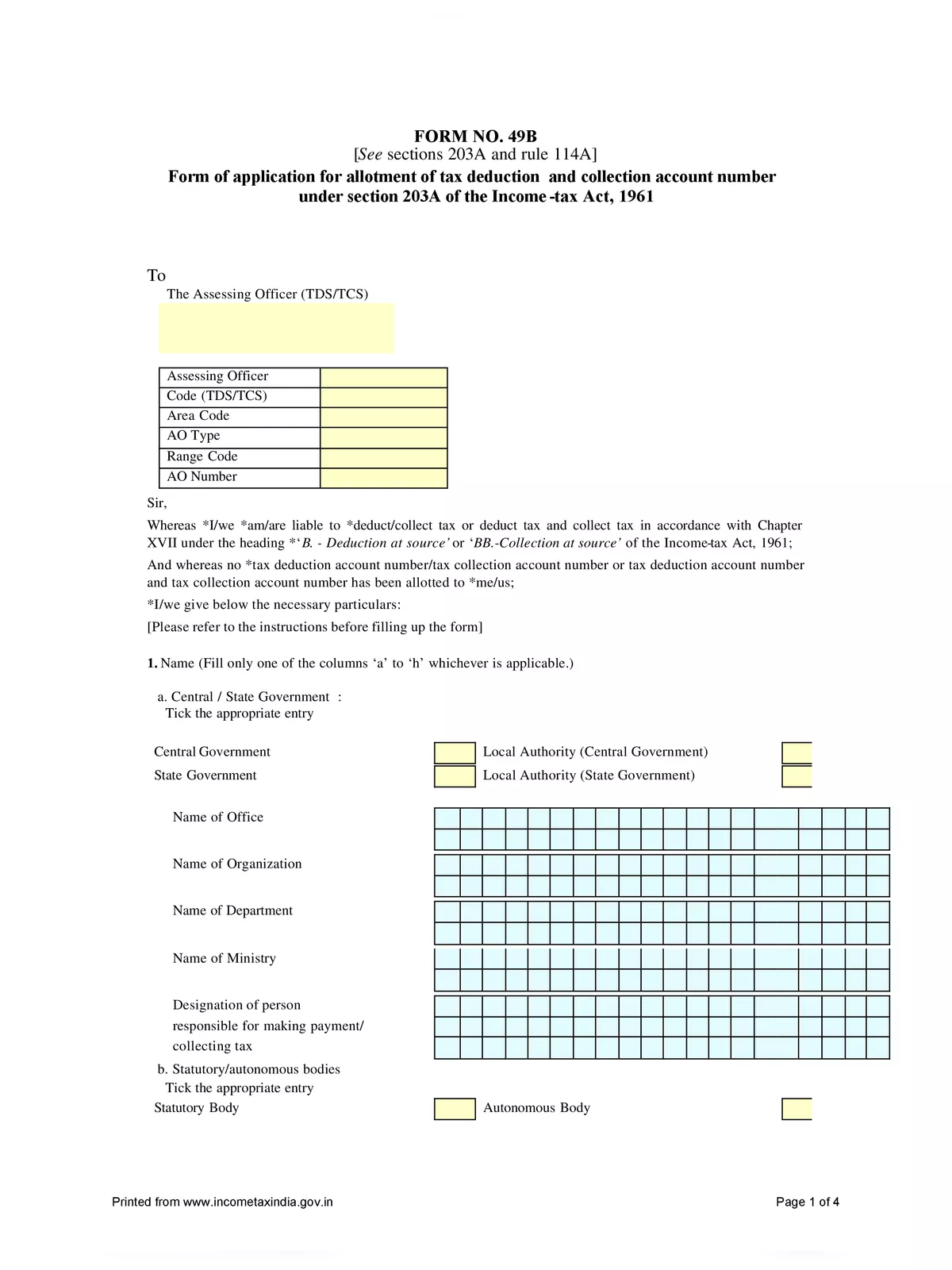

What is Form 49B?

Form 49B, as per section 203A of the Income Tax Act, 1961, is the application form to get a TAN number. All entities that are eligible to deduct TDS on payments must register for a TAN.

TAN Application Form Filling Instructions

- The form must be completed clearly in ENGLISH using BLOCK LETTERS.

- Each box should contain only one character (letter, number, or punctuation), and leave a blank box after each word.

- If you are using a left-hand thumb impression, it must be attested by a Magistrate, Notary Public, or Gazetted Officer with an official seal and stamp.

- Deductors/Collectors need to provide details about the Assessing Officer (TDS/TCS) in the application, which can be found at the Income Tax Office.

- It is necessary for the deductor/collector to fill in the Area Code, AO Type, Range Code, and AO Number. You can find these details at the Income Tax office or TIN Facilitation Centre (TIN-FC).

- Ensure that the form is completely and accurately filled out.

- Filling the ‘Designation of the person responsible for making payment/collecting tax’ field is mandatory when applicable.

- The applicant’s address should only be an Indian address.

TAN Application Form – Apply Online Procedure

- Visit this link and select “Online Application for TAN (Form 49B)” or click here for the link.

- Choose your Category of Deductors from the drop-down menu and click on the “Select Button.”

- Fill in the required details on the form and make sure that all mandatory fields (marked with *) are complete.

- If there are any format errors in your submission, you will see an error message on the screen.

- You will need to correct any errors and resubmit the form.

- If no errors are found, a confirmation screen will display your information.

- If you need to change any data on the confirmation screen, you can select the edit option.

- If all information is correct, choose the confirm option.

- After successful payment of fees (if using a mode other than DD or Cheque), an acknowledgment slip will be created.

- Save and print the acknowledgment, and send it to NSDL with the required documents.

Send your documents to:

NSDL e-Governance Infrastructure Limited,

5th Floor, Mantri Sterling,

Plot No. 341, Survey No. 997/8,

Model Colony,

Near Deep Bungalow Chowk,

Pune – 411016

Make sure to mark the envelope as ‘APPLICATION FOR TAN – Acknowledgment Number’ (e.g. ‘APPLICATION TAN – 88301020000244’).

TAN Application Form – Documents Required

- A passport-sized photograph

- Aadhaar card for address proof

If you are applying on behalf of a partnership firm, please include these additional documents with your application:

- A completed and signed application form

- A passport-sized photograph of the authorized partner

- ID proof for all partners, with copies made on A4 paper

- Address proof for the current office, copied on A4 size paper

- The latest partnership deed

- Bank account statement for the last three months

- Business registration certificate

- KYC details of one partner, including two passport-sized photos, government-issued ID proof, and address proof.

You can download the TAN Application Form PDF using the link provided below for easy access.